HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Are you debating between a trip to Hawaii or somewhere in the Caribbean?

That’s not a bad problem to have, but it’s just the type of problem TPG likes to help you solve. Both destinations have fantastic, balmy weather year-round, palm trees and fragrant tropical flowers, white- or black-sand beaches, forests filled with hiking trails, plenty of offshore activities and a ton of ways to get there and stay with miles and points.

Of course, right now, coronavirus safety precautions have temporarily changed travel to Hawaii and the Caribbean.

Americans can currently visit Hawaii, and fully-vaccinated travelers no longer need to get pre-tested or quarantine upon arrival. (Though if you aren’t vaccinated, you will need a pre-arrival test or be subjected to a 10-day quarantine upon arrival.)

Entry stipulations in the Caribbean vary by island nation. For example, the Bahamas requires all tourists over the age of two to present a negative COVID-19 test taken within five days. Meanwhile, Turks and Caicos requires all visitors 16 and older to submit proof of full vaccination before arrival.

Related: When will international travel return? A country-by-country guide to coronavirus recovery

Rules are still changing regularly, so if you’re planning to visit the Caribbean or Hawaii, look into current entry mandates before booking travel.

But, the real question is, should you go to the Caribbean or Hawaii? Let’s break it down.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

In This Post

Best times to visit

We say there’s no universally bad time to visit either destination. But here are the best times to visit Hawaii and best times to visit the Caribbean.

If you’re worried about crowds in either location, avoid peak dates when lots of families travel near holidays, such as Thanksgiving, Christmas and spring break.

Tropical cyclones can hit the Hawaiian Islands, and many islands in the Caribbean are subject to hurricanes. In both cases, storm season starts in early June and ends at the end of November. In the Caribbean, peak hurricane months are August to October. If you’re traveling to the Caribbean from June to August and worried about a hurricane, pick an island — such as Barbados or Trinidad — that’s outside of the traditional hurricane-prone zone.

If you’re interested in whale watching, visiting Hawaii between the months of November and May is your best chance for catching a glimpse of the humpbacks. In the Caribbean, you’ll have a better chance of seeing humpbacks (and dolphins) from mid-January to mid-March.

The Ritz-Carlton, Grand Cayman. (Photo courtesy of the hotel)

Getting to the islands

Depending on what part of the U.S. you call home, it could be easier to get to either the Caribbean or Hawaii. And when we say “easier,” we mean a combination of factors, including the distance and duration of the flight; if you have to connect somewhere before arriving at your final destination; and the cost of the flight in either cash, points or miles.

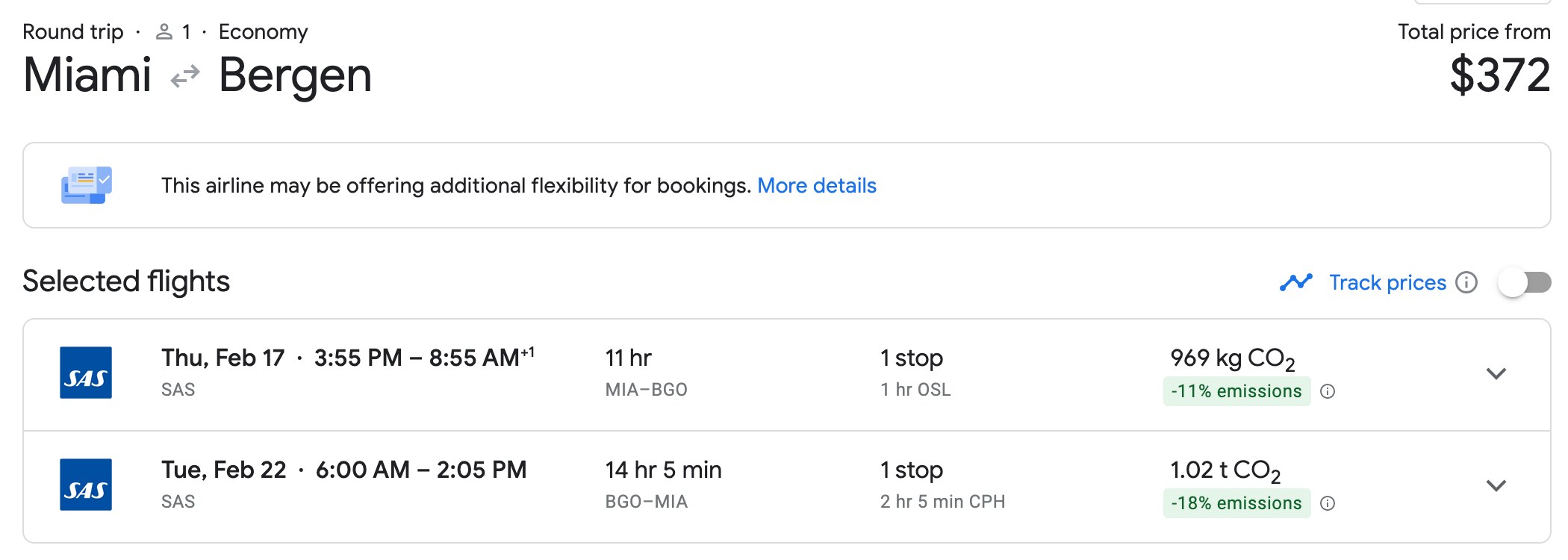

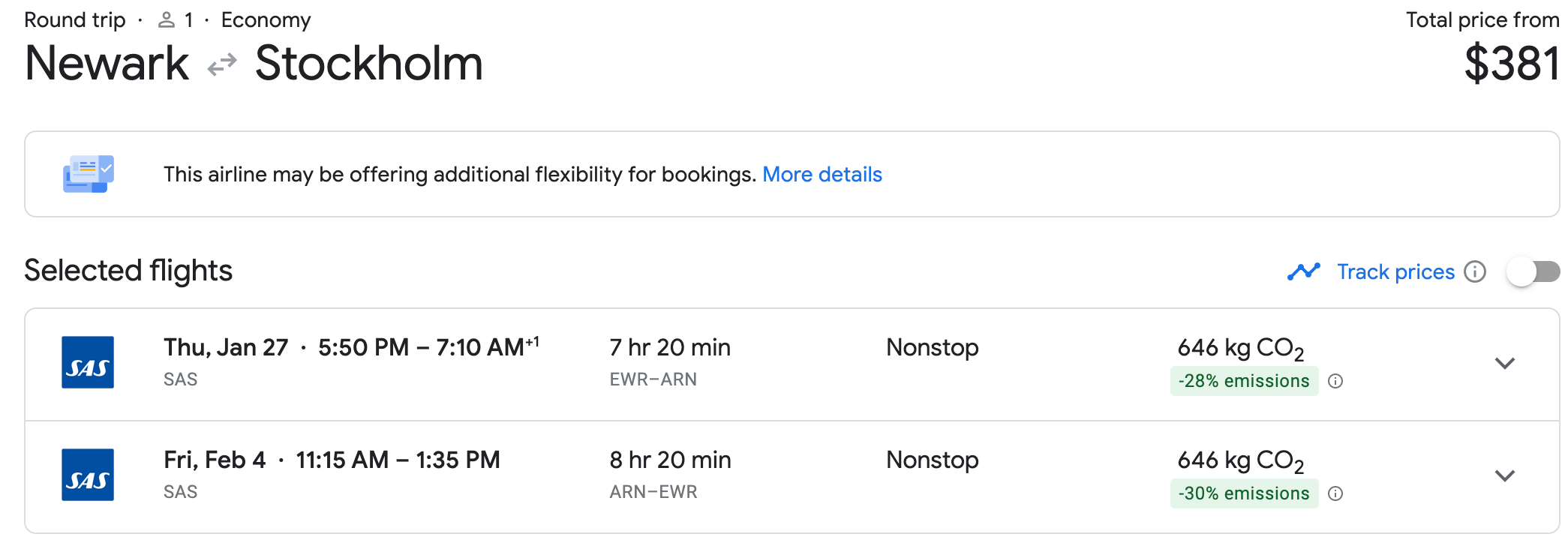

Flying from the East Coast and Midwest

If you live on the East Coast, the Caribbean is much closer than Hawaii. Flights from hubs such as the New York City area, Chicago, Charlotte, Miami and others are plentiful — especially to major islands.

Prices can vary from reasonable to expensive, depending on when and where you travel. (Just try booking a flight to say, Aruba, during spring break. The fares can be brutal.)

If you keep up with airline deals, you can luck out and find cheap fares to the Caribbean. For example, we found flights to St. Croix from a number of East Coast cities for under $100 round-trip in August.

Want to see the latest flight deals as soon as they’re published? Follow The Points Guy on Facebook and Twitter, and subscribe to text message alerts from our deals feed, @tpg_alerts.

If you want to go to Hawaii from the East Coast, you may need need to book connecting flights. There are some nonstop flights, such as Hawaiian Airlines from Boston (BOS) and New York-JFK, and United from Newark (EWR) and Washington Dulles (DUL), but connecting on the West Coast or similar is pretty common.

Related: Why you should fly Hawaiian Airlines to Hawaii

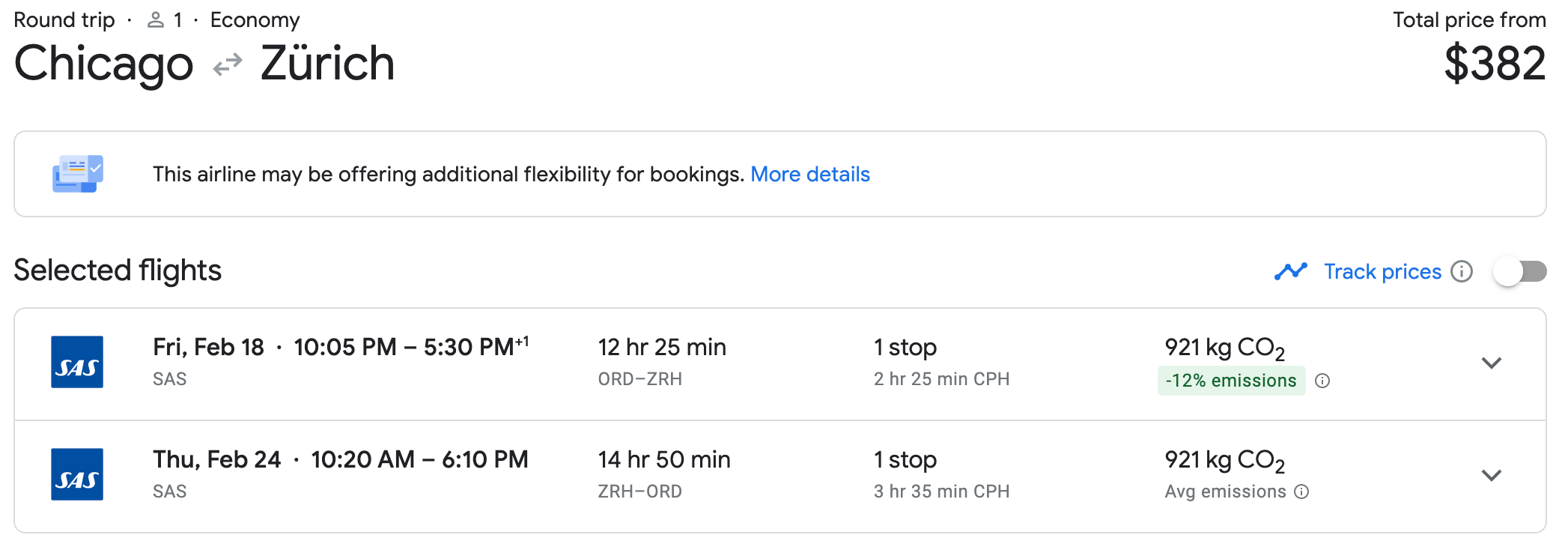

Do you have an address in the middle of the country? If so, there are also some excellent routes that can get you to the Caribbean islands fairly quickly, again through airline hubs such as Dallas, Houston, Chicago and others. There are also nonstop flights to Hawaii from many of those same hub cities. This means travelers in the middle may have flight possibilities in both directions.

But things still aren’t equal. From Houston, Honolulu is about eight hours away by air, while a flight to Jamaica lasts about half as long, assuming you’re booking nonstop flights.

Just a few of the nonstop flights from Chicago O’Hare to Montego Bay, Jamaica. (Image courtesy of Kayak.com)

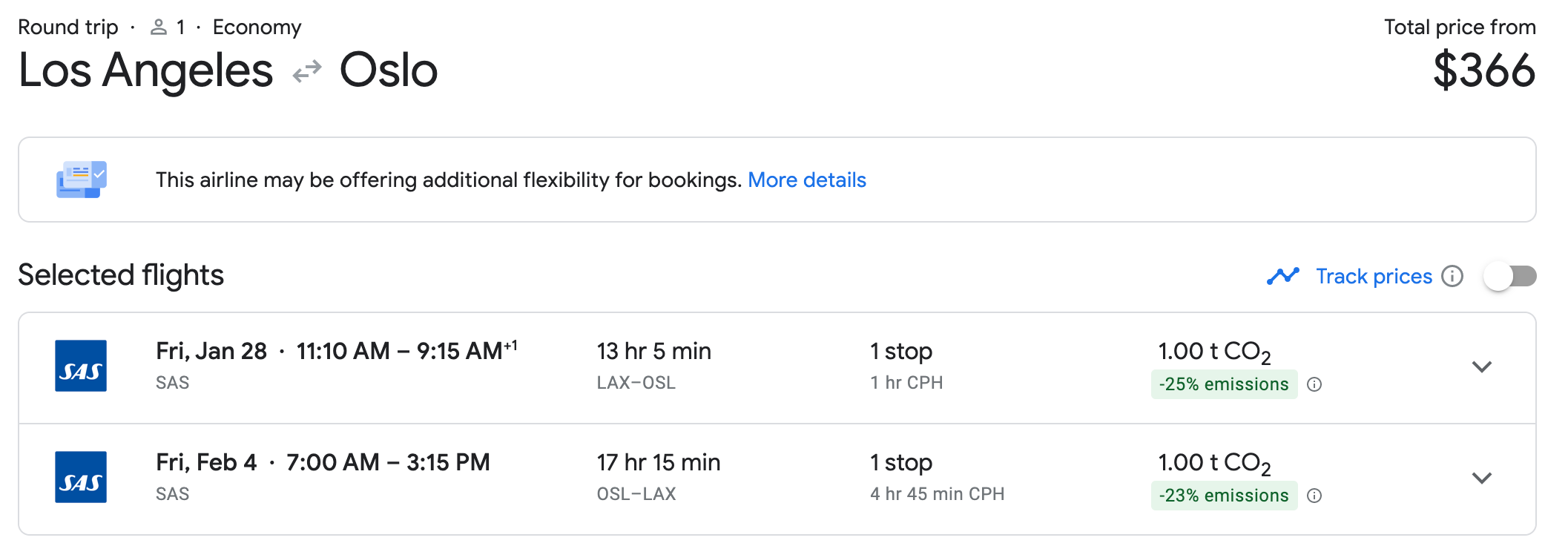

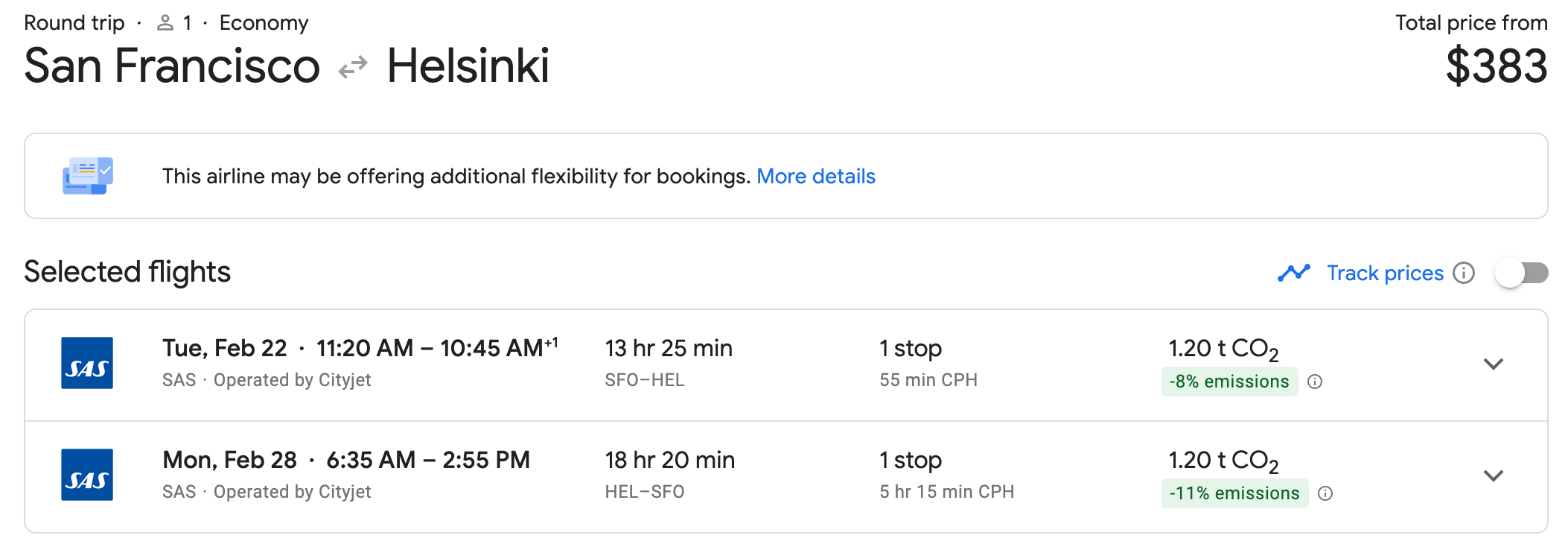

Flying from the West Coast

If you live on the West Coast, Hawaii can be an easier and even more cost-effective destination than the Caribbean. The nonstop flight time from San Francisco to Honolulu is just about five hours. Add around 30 minutes if you leave from Los Angeles instead.

If you were to take Hawaiian Airlines’ nonstop flight from Boston to Honolulu, you’re looking at spending nine hours and 40 minutes inflight. A Bostonian could watch two additional full-length movies to kill the extra time it takes to get to Hawaii.

There are great fare sales to the Hawaiian Islands from the West Coast from a number of airlines, including a recent deal alert for round-trip flights to the islands for under $200. Alaskan Airlines had another deal back in September that could get you to Hawaii for less than $100, and Southwest was offering 40% off Hawaii fares for early 2022 travel during the first week of October.

Southwest’s route map to Hawaii. (Image courtesy of Southwest)

Southwest and Alaska Airlines routes to Hawaii are a boon to West Coast travelers. It’s important to monitor fares from both airlines since they offer great deals from their West Coast gateways. And both airlines offer buy-one-get-one fares.

If you’re a Southwest traveler, you’re probably already aware of its Companion Pass that lets a companion travel with you for just the cost of the ticket’s taxes. You can get a free companion fare (other than the cost of taxes) whether you paid cash or points for your ticket. That’s an incredible value — especially if you’re flying to Hawaii.

Should you want to use Southwest points to get to Hawaii (or the Caribbean) those points count toward earning a Companion Pass. The following Southwest credit cards are offering up to 100,000 bonus points (50,000 points after you spend $2,000 on purchases in the first three months of account opening, plus an additional 50,000 after you spend $12,000 in the first 12 months from account opening):

Southwest Rapid Rewards Premier Credit CardSouthwest Rapid Rewards Priority Credit CardSouthwest Rapid Rewards Plus Credit Card

Alaska Airlines offers a once-a-year companion certificate to anyone who holds the Alaska Airlines Visa Signature® credit card. You get the certificate on your card’s anniversary. It’s valid on all Alaska Airlines flights with no blackout dates. You pay $99 for the fare (plus as little as $22 for the taxes and fees). Again, a truly cost-effective way to secure round-trip flights to Alaska’s Hawaiian gateways, including Honolulu (HNL), Maui (OGG), Kona (KOA) and Lihue (LIH).

Related: The best ways to get to Hawaii using points and miles

Island-hopping

If you want to visit more than one island on your tropical vacation, it’s generally easier to do that in Hawaii. There’s a network of interisland flights that are affordable on cash or points. In the Caribbean, unless there’s ferry service from one island to another — as is the case between St. Thomas and St. John — it can be expensive and inconvenient to fly between them. If you’re looking for an itinerary like that, research British Airways’ fifth-freedom island-hopping routes in the Caribbean that do go between certain islands on certain days, starting at just 4,500 points in each direction.

Related: Island-hopping on Southwest Airlines in Hawaii

Southwest makes it easy to island-hop in Hawaii. (Photo by Summer Hull/The Points Guy)

Island culture

When it comes to the “feel” of the islands and the distinct culture you’ll find on each, there are some significant differences that are perhaps more important than the geographical distances.

The Hawaiian experience

Hawaii was the holy grail of vacation destinations for most U.S. residents even before it became a state in 1959. It’s miles and miles from the mainland — 2,556 miles from Los Angeles, to be exact. Magazines featured photos of fire eaters and beautiful hula dancers.

Maui’s Feast at Lele luau closes with an incredible fire dancer. (Photo by Leonard Hospidor)

Military personnel stationed at Pearl Harbor wrote home about the islands’ secluded beaches, waterfalls, lava flows and tunnels and so much more. They weren’t lying — and the tourists followed.

Just one of the waterfalls you’ll encounter along Maui’s Road to Hana. (Photo by ejs9/The Points Guy)

Those who traveled to the main islands of Oahu, Maui, the Big Island or Kauai returned home to regale their friends with tales of soaring cliffs, snorkeling adventures, whale watching, tropical flowers and volcanoes. Hawaii still holds that mystique.

Kauai’s majestic Na Pali Coast. (Photo by Paul Mounce/Corbis via Getty Images)

The islands have changed and become more commercialized in some areas, but their beauty and ethos have remained. The Spirit of Aloha and Polynesian influences remain strong and are a major reason why people continue to want to visit the Hawaiian Islands. It is, in a word, special.

The Caribbean experience

The island chains that make up the West Indies are located in the Caribbean Sea. They’re wedged between the southernmost tip of Florida to the north, South America to the south and Central America to the west. There are a lot of Caribbean islands, broken up in the following way:

Greater Antilles: Cuba, Hispaniola (Haiti and Dominican Republic), Jamaica and Puerto RicoLesser Antilles: Anguilla, Antigua and Barbuda, Barbados, Dominica, Grenada, Guadeloupe, Martinique, Montserrat, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Virgin Islands (U.S. and British)Lucayan Archipelago: Bahamas and Turks and CaicosSouth American Continental Shelf: Aruba, Bonaire, Curacao, Trinidad and Tobago

In Hawaii, the culture derives mainly from ancestral Hawaiian and Polynesian traditions (though Chinese, Japanese and other cultures have made a significant impression). The Caribbean has even more influences, from the area’s original inhabitants to those brought from Africa against their will in the slave trade. Europeans — from the English to the French to the Dutch to the Spanish — all staked claim to certain islands, and their influence is also still felt in many places.

In the Caribbean, you’ll find historic forts, former sugar cane plantations, rum distilleries and plenty of coffee beans in the mountains of Jamaica.

Fort Louis in Marigot on the French side of St. Martin. (Photo by Sean Pavone/Getty Images)

There are volcanoes there, too, as well as secluded beaches and historic old towns with an unmistakable European flair.

Willemstad, Curacao, shows its Dutch heritage. (Photo by Tim Drivas Photography/Getty Images)

Rooted in its own history, each island has a distinct feel, so lumping them together isn’t fair in many ways.

Related: Little-known Caribbean islands to visit before everyone else

Beaches

The beach is likely a major draw whether you plan to vacation in Hawaii or the Caribbean. You’ll find a range of beach types in both destinations. If you’re a fan of powder-soft white sand and crystal-clear blue water, the Caribbean may have more options.

Grace Bay, Turks and Caicos. (Photo by minimum/Getty Images)

If you’re interested in less conventional beaches, Hawaii has them in pink, green, red and even black sands. Of course, there are also beaches with a more traditional look — for example, the basically perfect Mauna Kea beach on the Big Island.

On Maui’s Road to Hana, you’ll find the black-sand beach at Waianapanapa State Park. (Photo by Matt Anderson Photography/Getty Images)

Watching the sunset along Hanalei Bay on Kauai is also something special that everyone should experience at least once in a lifetime.

Things to do

You can hike, sail, dive or snorkel in either destination, though whale watching is definitely better in Hawaii. You can see humpback whales from November through May, with the peak months from January through March. If you’re into wildlife, you can see dolphins, sea turtles and stingrays in both Hawaii and the Caribbean. Surfing is big in Hawaii, but it’s possible to surf in some parts of the Caribbean, too.

Hawaii has its popular cultural show, the luau, that showcases hula dancing, fire twirling and traditional dishes like kalua pig and poi. One of our favorite luaus in Hawaii is the Smith Family Luau on Kauai, which has been a family-run business for decades. After closing during the pandemic, it’s reopened to guests as of May 2021.

Smith Family Luau. (Photo by Summer Hull / The Points Guy)

On the other hand, the Caribbean has a network of rum distilleries that offer tours and tastings.

Island cruises

If you’ve got your heart set on a tropical cruise, your options are much more plentiful — and therefore more affordable — in the Caribbean. In March 2022, for example, there are nearly 90 ships sailing the Caribbean from embarkation ports like San Juan (Puerto Rico); Barbados; Fort-de-France (Martinique); Miami, Fort Lauderdale, Tampa, and Port Canaveral, Florida; New Orleans; Galveston, Texas; and Mobile, Alabama.

During the same period, only six ships call on Hawaiian ports. Your best bet for a seven-night voyage around the Hawaiian Islands is Norwegian Cruise Line’s Pride of America or Uncruise Adventures’ Safari Explorer. So you can technically cruise around either island chain, but it is much easier and more affordable to do in the Caribbean. The Caribbean is also where cruise lines have their private islands, such as Royal Caribbean’s Coco Cay, Disney’s Castaway Cay and the brand-new Ocean Cay from MSC Cruises.

Related: Review of cruising the Caribbean on the Disney Dream

Silversea Silver Spirit in Tortola, British Virgin Islands. (Photo courtesy of Silversea)

Ease of the visit

Travelers often ask if it’s easier to visit Hawaii or the Caribbean. Since Hawaii is a U.S. state, no passport, foreign currency or international cellphone plan is necessary. You can rent a car using your state-issued driver’s license and the rules of the road are the same as they are at home in the Lower 48.

Most of the Caribbean, with the exception of Puerto Rico and the U.S. Virgin Islands, are foreign destinations. You’ll need your passport and may have to exchange currency, though many island vendors will accept U.S. dollars, and some islands do officially use the U.S. dollar. Then, of course, you’ll have to allow time for clearing customs on both the front and back ends of the trip.

Related: Key things to know about Global Entry

A note about safety: Petty crime can happen anywhere, so you should pack your street smarts wherever you go. Car break-ins are common in the Hawaiian Islands and some Caribbean islands have had problems with pushy vendors on public beaches. For those reasons, on some Caribbean islands, such as Jamaica, visitors often stay sequestered at their resort instead of renting a car to explore the island as you likely would in Hawaii. There are a number of Caribbean islands that are on the U.S. Level 2 and 3 travel advisory lists.

Research your Caribbean island choice to get a feel for whether you’d feel comfortable exploring beyond your resort or not. For example, getting around places like Barbados, Aruba, Grand Cayman and Turks and Caicos is the norm and you’re unlikely to encounter safety issues. But that isn’t as true on every island.

ll-inclusive resorts

If you like the idea of an all-inclusive resort where your accommodations, meals and beverages and entertainment are bundled into one price, look to the Caribbean. The islands offer a variety of all-inclusive options; there aren’t any true all-inclusive properties in Hawaii.

Here’s an in-depth look at the all-inclusive beach resorts you can book on points in the Caribbean.

Hyatt Ziva all-inclusive in Cancun. (Photo by Zach Griff)

Points hotels

If you’ve got hotel points from the major players like Hilton, Hyatt, Marriott and IHG, you’ll be able to spend them in either Hawaii or the Caribbean. Here are some recent reviews of points hotels in those destinations:

Hawaii points hotel reviews: Westin Moana Surfrider | The Westin Princeville Ocean Resort Villas | Hilton Waikoloa Village | Grand Hyatt Kauai

Caribbean points hotel reviews: Park Hyatt St. Kitts | Westin St. John Resort Villas | Kimpton Seafire Grand Cayman | Scrub Island, Autograph Collection

You’ll find hotels in both the Caribbean and Hawaii on various ends of the award spectrum. Neither group of islands is likely to have many hotels at the lowest award rates, but there are resorts that cross the middle and upper ranges of the award spectrum. You could use a Marriott up to 35,000-point certificate from the Marriott Bonvoy Boundless Credit Card, for example, in both destinations. Think: A free night at the Sheraton Kauai Coconut Beach Resort in Hawaii or the St. Kitts Marriott Resort & The Royal Beach Casino in the Caribbean.

Sheraton Kona Lobby. (Photo by Summer Hull / The Points Guy)

If service is important to you, remember that some Caribbean countries are newer to the tourism industry than others. Generally speaking, areas that have been hosting tourists for decades — or even generations — may have a higher service level of service delivery than the “island time” you may experience in other regions newer to the industry.

Here are some resources for using points and free-night certificates in both destinations:

The best points hotels in the CaribbeanThe best ways to use credit card award-night certificates in Hawaii

Family travel

If you are considering traveling to the Caribbean or Hawaii with a family, you may have unique questions about the destinations and their level of kid-friendliness. The answer on which is best will depend on what you are looking for.

The Caribbean has kid-focused resorts such as the Nickelodeon Resort in Punta Cana and family-friendly, all-inclusive resorts in Jamaica, the Dominican Republic and beyond. For those in the middle and eastern parts of the U.S., the Caribbean is also much easier on kids when it comes to jet lag. From somewhere like New York or Texas, you could reasonably take the kids to the Caribbean for a long weekend, whereas that would probably not be enough time for kids to adjust and enjoy Hawaii.

Related: Best way to fly with kids to Hawaii

Fun in the sun in Punta Cana. (Photo by Summer Hull/The Points Guy)

You can have memorable, relaxing family vacations in either the Caribbean or Hawaii. The Caribbean may have more specifically kid-focused lodging options, but there are plenty of full-service resorts in Hawaii that also cater to kids.

Disney’s Aulani resort on Oahu is one option if you want kid-focused and Hawaii all in one. (You’ll even find an included kid’s club at Aulani.)

Related: How to rent DVC points to stay at Aulani for less

Disney Aulani. (Photo by Summer Hull / The Points Guy)

Even if you pass on Disney’s Aulani, points-friendly resorts in Hawaii such as the Grand Hyatt Kauai offer kids clubs and have water slides, kid-focused activities and more than enough to do. But there’s so much more to Hawaii (and the Caribbean) than the resorts.

Take your kids to explore waterfalls, hike, volcanoes and explore the natural beauty of the islands. If all you want to do is go have a family resort vacation (and there’s nothing at all wrong with that), the Caribbean might have the edge as a family-friendly destination. If you want to get out there to explore and experience a wide range of natural wonders — Hawaii probably takes the pineapple-flavored cake.

To show you what’s possible, here are some fun things to experience with a family on Kauai and the Big Island.

Exploring Volcanos National Park in Hawaii. (Summer Hull/The Points Guy)

Bottom line

If you’re looking for a getaway to a gorgeous tropical locale, you can’t go wrong with either Hawaii or the Caribbean. Sometimes, the best choice comes down to personal preferences, where you’re flying from, how much time you have and flight and hotel availability for your dates.

Featured photo by bjonesmedia/Getty Images.

By: Summer Hull and Andrea M. Rotondo

Title: Hawaii vs. the Caribbean: Which islands should you visit?

Sourced From: thepointsguy.com/guide/hawaii-versus-caribbean-vacation/

Published Date: Thu, 25 Nov 2021 19:00:03 +0000

__________________________________