HOSTED BY: 1 AIR TRAVEL

Editor’s note: This post has been updated with new information.

Without question, The Business Platinum Card® from American Express is a card you’ll want if you own a business. It combines everything we love from the consumer version (The Platinum Card® from American Express), with some higher earning rates and a better welcome offer of 120,000 bonus points — worth a sky-high $2,400, according to TPG’s valuations.

New to The Points Guy? Sign up for our daily newsletter and join our community for small-business owners.

In this guide, we’ll walk through how business owners can maximize their earning potential with strategies that can help you earn thousands of points each year on the Amex Business Platinum.

Official application link: The Amex Business Platinum, with a welcome offer of 120,000 bonus points after you spend $15,000 in the first three months of card membership.

(Photo by Wyatt Smith/The Points Guy)

In This Post

Overview of the Amex Business Platinum benefits

Before we begin, let’s quickly go over the standout benefits of the Amex Business Platinum. There’s currently a $595 annual fee that will increase to $695 if you application is received on or after Jan. 13, 2022 (see rates and fees).

Earning rate: Earn 5 Membership Rewards points per dollar on flights and prepaid hotels through Amex Travel. Earn 1.5 Membership Rewards points per dollar on eligible purchases of $5,000 or greater and on U.S. purchases at construction material and hardware suppliers, electronic goods retailers, software and cloud system providers and shipping providers — on up to $2 million in purchases per calendar year (then 1 point per dollar thereafter). Earn 1 Membership Rewards point per dollar on all other eligible purchases.Pay With Points rebate: When you redeem your points for airfare via Amex Pay With Points for business- or first-class tickets on any airline, or any class on your selected qualifying airline through Amex Travel, you’ll get a 35% points rebate back to your account — using fewer points and getting more bang for your buck — up to 500,000 points back per calendar year.Lounge access: Get access to the American Express Global Lounge Collection, including Centurion, Priority Pass, Delta Sky Club (when flying same-day Delta) lounges and more.*Annual statement credits: Get up to a $400 Dell technologies credit ($200 from January to June and $200 from July to December), up to a $360 Indeed credit, up to a $200 airline fee credit for incidental charges from the airline of your choice, $179 Clear membership credit, up to a $150 Adobe credit and up to a $120 U.S. wireless telephone services credit (broken down to $10 per month).*Global Entry/TSA Precheck reimbursement: Every four years (or 4.5 years for TSA Precheck) get reimbursed up to $100 for your application to either Global Entry or TSA PreCheck, which will speed up your experience in the airport.Hotel elite status: Get automatic Gold status on both Hilton Honors and Marriott Bonvoy for room upgrades (upon availability), bonus points on stays and more.*Car rental elite status: Get Avis Preferred, Hertz Gold Plus Rewards, and National Emerald Club Executive status for car upgrades (upon availability), discounts and more.*Amex Fine Hotels + Resorts program: When you book a hotel through the Amex FHR program, you’ll get elite-like perks such as daily breakfast for two, room upgrades and early check-in (upon availability), guaranteed 4 p.m. check-out, $100 amenity credit and more.Business Platinum Concierge: For everything from dining arrangements and travel plans to finding tickets to a concert, you can call up the Business Platinum Concierge for assistance.Travel protections: When booking travel with your card, you’re getting baggage insurance, travel accident insurance and access to the Global Assist Hotline in case something goes wrong on your trip.Cellphone protection: Pay your monthly cellphone bill with your card and get up to $800 per claim (with a $50 deductible) with a limit of two claims in a 12-month period. This will come in handy if your phone breaks or even if your screen is shattered.*Enrollment required for select benefits, terms apply.

With the Amex Business Platinum, you can think of the card as an incredible resource for all things travel-related. You’ll earn bonus points when you pay cash for your flights, travel statement credits to improve your overall experience, airport lounge access worldwide and so much more.

Also, remember that the card has your back when things go awry, whether with travel or your cellphone — making the Amex Business Platinum a form of insurance and a way to ensure peace of mind, which we all need more of in this day and age.

While there are so many fantastic benefits to discuss, we’ll focus on how you can earn more points each year with your Amex Business Platinum for the things we love the most at TPG, like award travel.

Related: Is the Amex Business Platinum worth the annual fee?

Strategies for maximizing the Amex Business Platinum

(Photo by Wyatt Smith/The Points Guy)

Let’s nail down how to maximize the earning potential on this card. There’s a spending minimum of $15,000 in the first three months of account opening to nab the welcome offer. Beyond this, how can you strategize your earning on this card?

For starters, we know that the Amex Business Platinum likely won’t be the only rewards card that you have in your wallet. Chances are you also have personal credit cards that help you earn points and miles on personal purchases, whether that’s dining, groceries or gas.

However, when it comes to business travel and significant business expenses, the Amex Business Platinum is king. Here are some examples that demonstrate why.

Use your Amex Business Platinum to pay for flights

The Amex Business Platinum is the perfect card to use to purchase any flights since you’ll earn 5x on flights booked through Amex Travel. Based on our valuations of Membership Rewards points, that’s a 10% return.

Unlike the personal version of this card, which comes with a $500,000 annual cap on this earning rate, there’s no limit to how many points you can earn on flights with the Amex Business Platinum. So if your company spends a lot on air travel, you can earn 5 points per dollar on as many flights as you need to purchase.

If you wish, you can also redeem your Membership Rewards points for flights through the Pay With Points rebate at a rate of 1 cent each.

Use your Amex Business Platinum to pay for hotels

Likewise, the card offers a stellar return of 5x on prepaid hotels booked through Amex Travel. This is also a 10% return based on our valuations, and the flexibility to book various hotel brands and earn this terrific rewards rate is a huge selling point of the card.

Use your Amex Business Platinum to pay for big purchases and work expenses

Amex recently added new bonus categories to incentivize businesses with high operating expenses. You’ll earn 1.5 points per dollar for purchases of $5,000 or more (like before), but also on select business categories, including:

U.S. electronic goods retailers.U.S. software.U.S. cloud service providers.U.S. construction materials and hardware supplies.U.S. shipping providers.Cumulatively, you’ll earn this 1.5x rate on up to $2 million in purchases per calendar year. Therefore, be sure to use your Amex Business Platinum to benefit from this 1.5x earning rate, which is a solid 3% return based on our valuations.

Use your Amex Business Platinum for your monthly cellphone bill

Cardholders will get up to $10 off U.S. wireless cellphone services per month, for up to $120 per calendar year, so you’ll want to pay your monthly cellphone bill with your Amex Business Platinum.

Don’t forget that the Amex Business Platinum is one of the few cards that provides cellphone protection. When you pay your monthly cellphone bill with your card, you qualify for up to $800 per claim (with a $50 deductible) with a limit of two claims in a 12-month period.

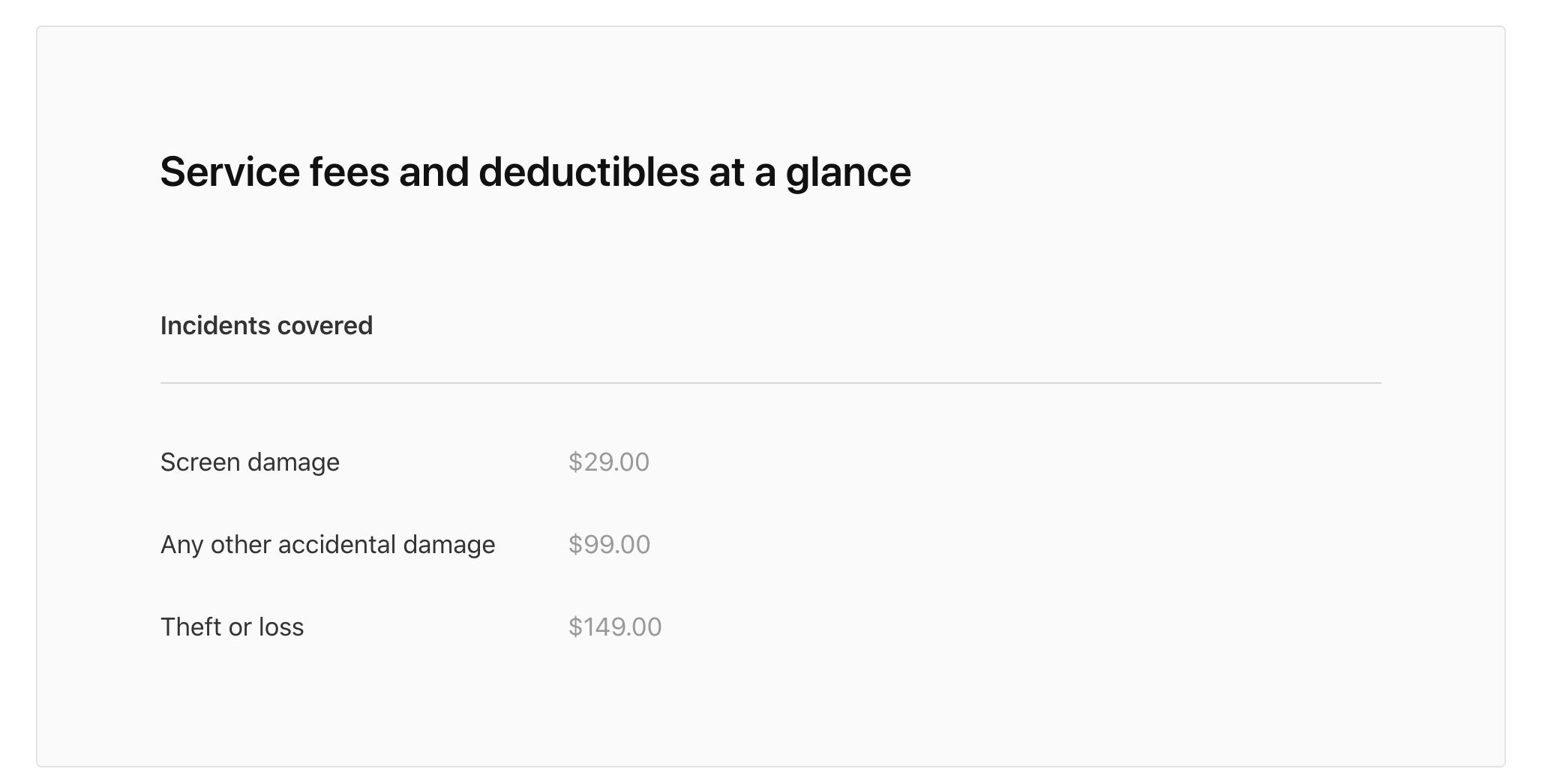

Let’s say you get a new iPhone, and the service provider asks if you want to add Apple Care to your plan, which typically costs $9.99 per month. By declining Apple Care and paying your monthly bill with your Amex Business Platinum, you’ll save about $120 per year alone. Plus, Apple Care’s deductibles are much higher for other accidental damage (besides cracked screens) and theft or loss. Apple Care also has the same limit as the Amex Business Platinum on two claims every 12 months.

Apple Care has varying prices for deductibles. (Screenshot from Apple)

Save your time and money and rely on the cellphone coverage that comes with your Business Platinum — it’s arguably just as good as Apple Care.

When not to use the Amex Business Platinum

While the Amex Business Platinum is a great card for the scenarios above, we know it’s not ideal for all purchases. Here are some situations where the Amex Business Platinum isn’t necessarily the best card to use.

Don’t use your Amex Business Platinum for office supplies

While furnishing your office may be expensive (and can trigger the 1.5x earning rate if the purchase is $5,000 or more), smaller items such as stationery, office chairs or printer ink likely won’t meet this cutoff. You’d be better off using a card with an office store or office supply category bonus.

Don’t use your Amex Business Platinum for company meals

Unless your tab runs $5,000 (or higher), you likely want to avoid using your Amex Business Platinum for meals. Instead, many other rewards cards — both business and personal ones — offer fantastic returns on restaurant purchases that make much more sense than using your Business Platinum.

You can still maximize your points

If you want to keep earning and maximizing the Membership Rewards points, consider applying for the no-annual-fee (see rates and fees) Blue Business® Plus Credit Card from American Express. You’ll earn 2 points per dollar on the first $50,000 spent in purchases each year (then 1x), so if you max that out, you’re looking at an additional 100,000 Membership Rewards points on purchases that your Amex Business Platinum falls short in.

(Photo by John Gribben for The Points Guy)

While it doesn’t have the most sizable welcome offer out there, you’ll still earn an easy 15,000 bonus points after spending $3,000 on the card in the first three months of account opening.

Related: Score rare welcome bonuses on Amex’s no-annual-fee business cards

Bottom line

The Amex Business Platinum won the best business card in the 2020 TPG Awards, and we can expect the card to continue being a crowd-pleaser thanks to its tremendous earning potential and ample statement credits. Now’s the chance to apply for the card while it comes with a 120,000-point welcome bonus.

Related: Full review of the Amex Business Platinum.

Official application link: Amex Business Platinum offering 120,000 points, worth $2,400 according to TPG’s valuations.

For rates and fees of the Amex Business Platinum, click here. For rates and fees of the Blue Business Plus, click here.

Featured photo by Ryan Patterson for The Points Guy.

Title: How to maximize your earning with the Amex Business Platinum

Sourced From: thepointsguy.com/guide/maximizing-amex-business-platinum/

Published Date: Fri, 12 Nov 2021 17:00:31 +0000

No comments:

Post a Comment