HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information including the latest Amex Platinum offer.

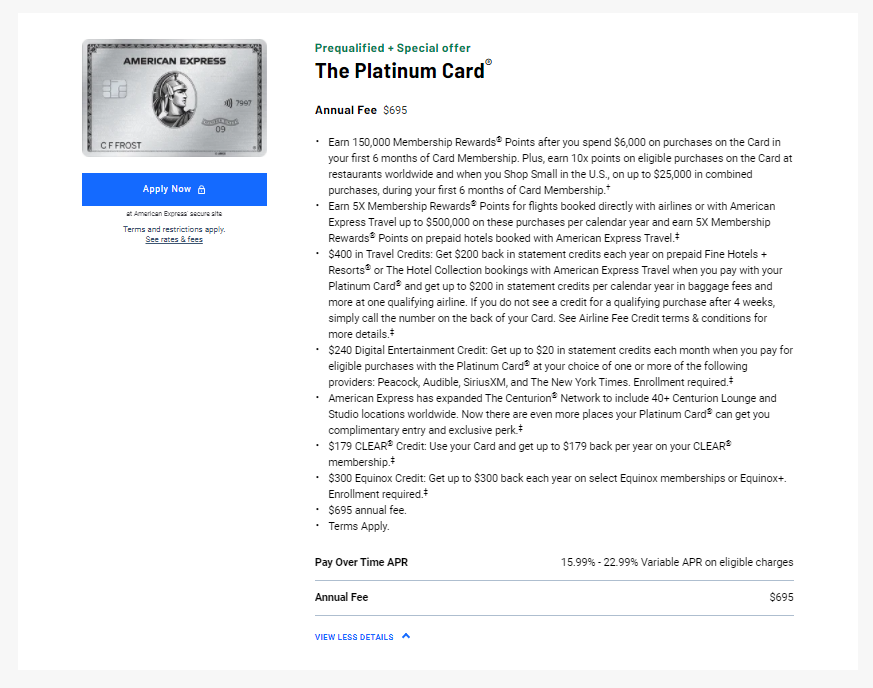

The Platinum Card® from American Express has long been one of the best premium travel rewards cards out there, thanks to a long list of benefits, a strong earning rate on flight purchases and a solid welcome bonus. Thanks to a wholesale revamp earlier this year, the card now has even more perks. While they come at a much higher cost, it is also offering one of the highest welcome bonuses it has ever posted right now.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner’s guide.

Currently, the Amex Platinum Card is offering a 100,000-point welcome bonus after you spend $6,000 on purchases in the first six months of card membership. Not only that, but you’ll also earn 10x on eligible purchases made at restaurants worldwide and when you “Shop Small” in the U.S., on up to $25,000 in combined spending during the first six months of card membership.

Official application link: The Platinum Card from American Express

Note that you could potentially be targeted for a 125,000-point or 150,000-point welcome bonus by using the CardMatch Tool. These offers are subject to change at any time.

TPG values Amex Membership Rewards points at 2 cents each — among the most valuable rewards currencies — making the bonus points from this welcome offer worth $2,000. You could also redeem these points for 1 cent each toward flights booked through Amex Travel.

However, TPG places a higher value on these points if you transfer them to a selection of loyalty programs — including Avianca Lifemiles, Hilton Honors, Etihad Guest and Singapore Airlines KrisFlyer — and the various redemptions they offer.

In addition to an elevated welcome bonus, Amex has added a slew of enticing benefits, from up to $300 in annual Equinox statement credits and an annual statement credit of up to $179 for your Clear membership. Enrollment is required for select benefits.

Unfortunately, along with these improvements came a hike to the card’s annual fee, which is now $695 (see rates and fees) — one of the highest annual fees for consumer cards out there. However, the welcome offer takes some of the sting out of the annual fee, not including all the other benefits you’ll receive with this card.

So let’s review this latest Amex Platinum offer and analyze if it’s worth applying for.

(Photo by Ryan Patterson for The Points Guy) mex Platinum benefits overview

The Amex Platinum now has a $695 annual fee, which may trigger some sticker shock. But when you dive into its mile-long list of benefits, there’s the potential to recoup that value:

5 points per dollar on flights booked directly with the airline or through Amex Travel on up to $500,000 in purchases per calendar year.5 points per dollar on prepaid hotels booked with Amex Travel.1 point per dollar on other purchases.Up to $200 annual hotel credit, in the form of a statement credit on prepaid Amex Fine Hotels and Resorts or The Hotel Collection bookings with Amex Travel when you pay with your Amex Platinum.*Up to $240 annual digital entertainment credit, in the form of $20 in monthly statement credits when you pay for eligible purchases with the Amex Platinum at eligible partners.*Up to $300 annual Equinox credit, in the form of $25 in monthly statement credits on select Equinox memberships or Equinox+ app.*Up to $179 annual Clear credit for your Clear membership.*Up to $200 annual airline fee credit.*Up to $200 in annual Uber Cash in the form of $15 in Uber credits for dining or rides each month, with an up to $20 bonus in December (for use in the U.S.).*Up to $100 in credits at Saks each calendar year (up to $50 for January to June and up to $50 for July to December).*Airline lounge access — including Centurion Lounge access, Priority Pass Select lounge access (excluding restaurant lounges), and Delta Sky Club access when you’re flying same-day Delta flights — through the American Express Global Lounge Collection.*Up to $100 application fee credit for Global Entry every four years or TSA PreCheck every 4.5 years.Gold status with Hilton Honors and Marriott Bonvoy.*Elite-like benefits when you book a stay through Amex’s Fine Hotels & Resorts program or Amex’s Hotel Collection.*Up to a $155 statement credit that covers the cost of a monthly Walmart+ membership when paying with the Amex Platinum.Up to a $300 statement credit toward a SoulCycle at-home bike (an Equinox+ membership is required to purchase a SoulCycle at-home bike).*Access to the Platinum Card Concierge.*Access to the American Express International Airline Program.*Travel protections when you use your card, including trip delay insurance, trip cancellation and interruption insurance, car rental loss and damage insurance and baggage insurance.Premium Global Assist hotline that may provide many services when you’re away from home, including emergency medical transportation assistance.*Shopping protections when you use your card, including extended warranty protection, purchase protection and return protection.*Multiple options for redeeming points, including transferring to hotel and airline partners, booking travel through Amex Travel and Pay With Points.Complimentary additional Gold Cards, or you can add up to three Platinum Card authorized users for $175 per year (see rates and fees).No foreign transaction fees (see rates and fees).*Enrollment required for select benefits.

That’s the one of most exhaustive lists of perks available among premium travel rewards cards. From the annual credits alone, you’re looking at more than $1,800 in value. So, if you can put many of these to use, the Amex Platinum could be worth a place in your wallet — even with that $695 annual fee.

The reason you might want to apply right now is that many of this card’s statement credits reset at the end of the calendar year. For example, cardmembers get up to $200 in statement credits per calendar year toward incidental charges with a U.S. airline that they designate. If you opened the card now, you could put some of these charges on it — such as seat assignments, checked bag fees or a lounge membership for holiday travel (or really any travel you can book before the end of the year) and then enjoy up to another $200 in credits in 2022. That’s a potential $400 in value right from the start.

The same is true with the card’s $200 annual hotel credit for Amex Fine Hotels + Resorts and The Hotel Collection bookings. You could use your new card to make a reservation now, even if it’s for later in 2022, and enjoy up to $200 in credits, then make another booking in 2022 and enjoy the same benefit all over again.

In short, right now represents a brief period of time before the end of 2021 where you could essentially take advantage of many of this card’s yearly statement credits twice in short order.

Related: Amex Platinum Card review

Is this offer worth it?

Early in the year, the Amex Platinum’s public offer was 75,000 Membership Rewards points after you spent $5,000 in the first six months. So, this latest welcome offer is an improvement.

Plus, the ability to earn 10 points per dollar on restaurants worldwide and when you “Shop Small” in the U.S. is fantastic, giving a 20% return according to TPG valuations.

(Photo by VGstockstudio/Shutterstock)

One of the primary drawbacks to the Amex Platinum is that you only earn bonus points on select travel expenses after the initial welcome period.

Keep in mind that you could be targeted for an even bigger welcome bonus through the CardMatch tool. Right now, some new cardholders are being targeted for a 125,000- or 150,000-point welcome offer.

Offer retrieved on November 4, 2021. (See rates and fees.) (Screenshot courtesy of CardMatch)

Those who apply through CardMatch for those elevated offers will still earn 10 points per dollar at restaurants worldwide and when you Shop Small in the U.S., on up to $25,000 in combined spending within the first six months, so it’s certainly worth checking to see if you are eligible. (CardMatch offers are targeted and subject to change at any time.)

Bottom line

The Amex Platinum is one of the best travel cards on the market. As travel ramps back up, applying for the card now could help pay for upgraded experiences on your trips down the road. And since Amex only allows you to earn one welcome bonus per lifetime on each card, it’s imperative to choose wisely when to apply.

Especially if you are targeted for the 125,000- or 150,000-point CardMatch offer, now is an excellent time to apply for the card to rake in a large bonus while earning on common everyday spending categories that generally don’t earn bonus rewards with the card.

Official application link: The Platinum Card® from American Express with a 100,000-point bonus, or check out the CardMatch tool to see if you are targeted for a bonus of up to 150,000 points.Additional reporting by Chris Dong, Stella Shon, Katie Genter and Eric Rosen.

Featured photo by Ryan Patterson for The Points Guy.

For rates and fees of the Amex Platinum Card, click here.

Title: Here’s how you can earn up to 100,000 points on the revamped Amex Platinum

Sourced From: thepointsguy.com/news/amex-platinum-current-offer/

Published Date: Tue, 21 Dec 2021 19:59:05 +0000

No comments:

Post a Comment