HOSTED BY: 1 AIR TRAVEL

Editor’s note: This story has been updated with new information.

It’s that time of year again.

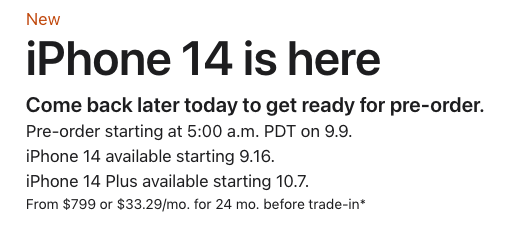

Apple’s latest smartphone family, the iPhone 14 group, has officially been unveiled, and the new models will start hitting store shelves on Sept. 16.

Pre-orders for the iPhone 14 begin on Friday, Sept. 9, just two days after the company’s “Far Out” special event, where the tech giant unveiled its latest products, including the latest iPhones; Apple Watch Series 8, SE and Ultra; and next-generation AirPods Pro.

For a recap, be sure to check out the 11 travel must-haves with Apple’s latest devices.

From satellite connectivity to crash detection to “Find My” support for the AirPods Pro charging case, the latest devices should appeal to many consumers, especially those who are always on the road, including myself and our flight review team.

If you are contemplating an upgrade, you’ll definitely want to maximize your purchase by using the right credit card (more on that below).

In the meantime, there are four new iPhones you might be considering:

iPhone 14, starting at $799.iPhone 14 Plus, starting at $899.iPhone 14 Pro, starting at $999.iPhone 14 Pro Max, starting at $1,099.Preorders and in-store purchases

Three of the four iPhones will be available for purchase on Sept. 16, but you can preorder your device directly through Apple as of 8 a.m. EDT on Friday, Sept. 9. Preordering gives you a better chance of receiving your device on launch day.

Note that the iPhone 14 Plus doesn’t launch until Oct. 7.

APPLE

Beginning on Sept. 16, you’ll be able to make your purchase at an Apple Store, through your carrier of choice (AT&T, Verizon or T-Mobile) or through third-party vendors such as Best Buy and Walmart.

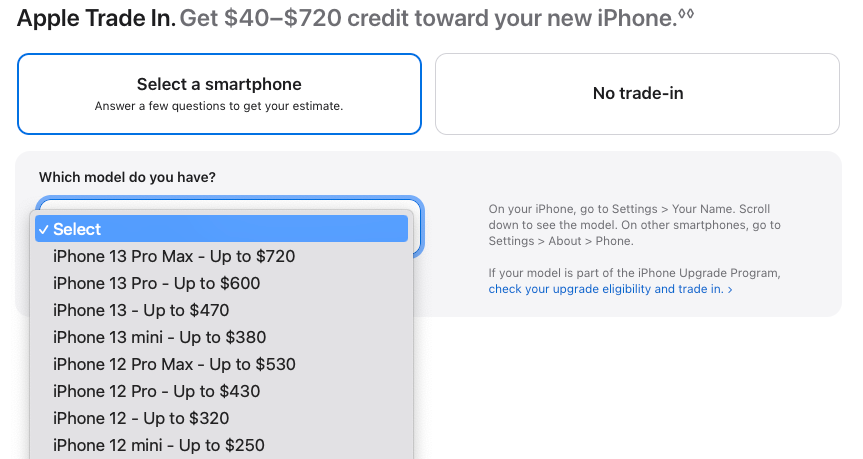

Trade-in options

The new iPhones certainly aren’t cheap, but they can be far more affordable if you’re willing to trade in your current phone. Credits range from $40 for the iPhone 7 (2016) to as much as $720 if you hand over last year’s iPhone 13 Pro Max.

APPLE

You’ll need to make your purchase directly through Apple to take advantage of that particular offer, though many third-party sellers have similar promotions available.

Shopping portal bonuses

Typically, iPhones aren’t eligible for shopping portal bonuses shortly after launch, though that’s something to look for if you decide to make your purchase at a later date. It can also make sense to use a shopping portal aggregator like CashBack Monitor to easily identify the largest return.

BRITISHAIRWAYS.COM

For example, British Airways, which is currently offering 2 Avios per $1 spent on Apple purchases, specifically lists the following exclusion: “Unless you are notified otherwise, no rewards are given on new products when launched.”

Which cards to use

A number of Apple enthusiasts will almost certainly end up making their purchase with the Apple Card — it’s not the worst option since you’ll be able to take advantage of an interest-free monthly installments plan and earn 3% back if you purchase directly through Apple. But it’s not necessarily your best pick, either.

Historically, I’ve made my Apple purchases with The Platinum Card® from American Express. Though you’ll earn just 1 Membership Rewards point per dollar spent, worth 2 cents each according to TPG’s valuations, the card’s included purchase protection is a great insurance policy if I end up breaking or losing my iPhone.

Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Plus, as you’ll see below, Amex recently added ongoing cell phone protection to the Platinum card, making this card my top pick for iPhone purchases.

Ultimately, given the high cost of Apple’s latest smartphones, I’d focus on cards that offer purchase protection and extended-warranty benefits rather than those that offer the greatest return — with one exception, which I’ll dig into below. Other top purchase-protection picks include:

CardMaximum coverage amount Maximum coverage amountCoverage duration (days)Earning rate(s)Annual feeAmerican Express® Gold Card*$10,000 per item (or $500 per event for natural disasters).$50,000 per card per calendar year.90.4 points per dollar at restaurants; 4 points per dollar at U.S. supermarkets (up to $25,000 per calendar year; then 1 point per dollar); 3 points per dollar on directly purchased airline tickets or airfare purchases through amextravel.com; 1 point per dollar on all other purchases. Terms apply.$250 (see rates and fees).Capital One Venture X Rewards Credit Card$10,000 per claim.$50,000 per account.90.10 points per dollar on hotels and rental cars booked through Capital One Travel; 5 points per dollar on flights booked through Capital One Travel; 2 points per dollar on all other purchases.$395.Ink Business Cash Credit Card$10,000 per claim.$50,000 per account.120.5% at office supply stores/telecom (up to $25,000 per account anniversary year, then 1%); 2% at gas stations/restaurants (up to $25,000 per account anniversary year, then 1%); 1% on all other purchases.$0.Blue Cash Everyday® Card from American Express*$1,000 per item (or $500 per event for natural disasters).*$50,000 per card per year.90.3% cash back at U.S. supermarkets, U.S. gas stations and U.S. online retail purchases on up to $6,000 per calendar year in purchases for each category (then 1%), and 1% cash back on other purchases. Terms apply.$0 annual fee (see rates and fees).Chase Freedom Flex$500 per claim.$50,000 per account.120.5% on up to $1,500 in combined purchases in bonus categories each quarter you activate; 3% on dining and drugstore purchases; 1% on all other purchases.$0.*Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Protect your investment

These days, some credit cards don’t only include purchase protection during the first few months after getting your shiny new phone. A number of cards also now offer ongoing cell phone protection, as long as you pay your carrier bill with an eligible card that offers loss and damage protection.

Personally, I’d recommend using either The Platinum Card® from American Express, the Chase Freedom Flex or the Capital One Venture X, all of which offer both purchase protection and cell phone protection benefits.

CardCoverage/Deductible Notable ExclusionsEarn rate on cellphone billAnnual FeeInk Business Preferred Credit CardUp to $1,000 per claim; three claims max per 12-month period with a $100 deductible per claim.Cosmetic damage that doesn’t affect the phone’s ability to function; lost phones.3 Chase Ultimate Rewards points per dollar.*$95.The Platinum Card® from American Express**Up to $800 per claim; two claims max per 12-month period with a $50 deductible.Cosmetic damage that doesn’t affect the phone’s ability to function; lost phones.1 Amex Membership Rewards point per dollar.$695 (see rates and fees).Chase Freedom FlexUp to $800 per claim; max two claims worth $1,000 per 12-month period with a $50 deductible.Cosmetic damage that doesn’t affect the phone’s ability to function; lost phones.1 Chase Ultimate Rewards point per dollar.$0.Capital One Venture XUp to $800 per claim; max two claims and $1,600 per 12-month period with $50 deductible.Cosmetic damage that doesn’t affect the phone’s ability to function; lost phones.2 Capital One miles per dollar.$395.*On the first $150,000 in combined purchases each account anniversary year in the categories of travel, shipping purchases, internet, cable and phone services, and advertising purchases with social media sites and search engines.

**Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Meeting minimum spending

It could make sense to time your large Apple purchase with the opening of a new card. This way, you’d be much closer to meeting the minimum spending requirement to earn a significant sign-up bonus. One of our top picks at the moment is the Chase Sapphire Preferred Card, which is offering 60,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months of account opening.

I’ll run through some other top contenders below, and you can find a full list of top offers here. Just note that not all of these cards include purchase protection and extended-warranty perks, so if you’re looking to prioritize coverage over points, refer to the chart above.

Chase Sapphire Preferred Card: Best starter travel credit card.American Express® Gold Card: Best for dining at restaurants.Capital One Venture X Rewards Credit Card Best premium travel card.Chase Sapphire Reserve: Best for travel credits.Ink Business Preferred Credit Card: Best for small business travel.The Platinum Card® from American Express Best for lounge access.Hilton Honors American Express Aspire Card Best premium hotel card.Delta SkyMiles® Platinum American Express Card: Best for airline rewards.Marriott Bonvoy Boundless Credit Card: Best mid-tier hotel card.Citi® / AAdvantage® Platinum Select® World Elite Mastercard®: Best for American Airlines flyers.For more on this latest round of Apple products, see our story on the 11 reasons why you might want to consider upgrading to Apple’s iPhone 14, AirPods Pro and Watch Series 8.

The information for the Hilton Aspire Amex card and Citi AAdvantage Platinum Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

For rates and fees of the Amex Gold Card, click here.

For rates and fees of the Blue Cash Everyday card, click here.

For rates and fees of the Amex Platinum card, click here

Featured photo courtesy of Apple.

Title: Maximizing points, miles and coverage with Apple’s new iPhone 14

Sourced From: thepointsguy.com/guide/maximize-iphone-purchase/

Published Date: Thu, 08 Sep 2022 10:30:21 +0000

No comments:

Post a Comment