HOSTED BY: 1 AIR TRAVEL

Editor’s note: This post has been updated with new information.By the time you’re well into your tenure as an award traveler, your wallet is likely split into two groups. You have everyday cards, such as the Chase Sapphire Reserve, that you swipe frequently to take advantage of their generous bonus categories, and you probably have other cards you rarely use. So there are two questions: Should you cancel cards that you no longer use; and what will it do to your credit score?

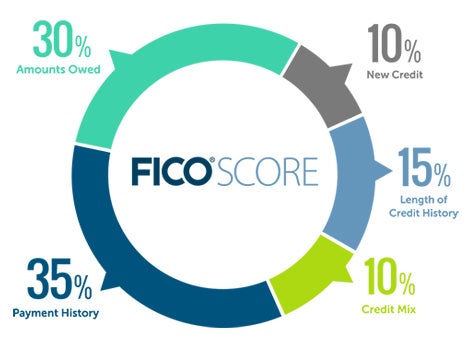

Opening or closing a credit card is not something you should do lightly, and cardholders are spot-on for thinking about the consequences of this decision. There are a few things you will want to consider. The first involves one of the most important aspects of your credit score: the amount you owe compared to the amount of credit you have (frequently referred to as your credit utilization rate). This is all about how much of your overall available credit you are using, and it makes up 30% of your FICO score. If the cards that you don’t use very often make up a large portion of your current credit, closing any of them could have a massive impact on your score.

(Photo courtesy of FICO)

As an example, let’s say you currently have combined credit lines of $100,000 across all of your card accounts. At any given time, you might have an average of $5,000 worth of balances among these cards even if you do pay them in full each month. That gives you a utilization rate of 5% ($5,000 ÷ $100,000). If two cards have $5,000 credit lines, the impact of closing both of them isn’t too significant — $5,000 ÷ $90,000 = 5.56%. However, if each card has credit lines of $30,000, the impact is much more significant. You would still have the same balances ($5,000), but would now have that spread over just $40,000 of available credit. Your utilization thus jumps from 5% to 12.5%. That’s not a danger zone for issuers, but it could impact your score.

Related: 8 biggest factors that impact your credit score

Beyond the credit score, you also need to look at the cards’ annual fees to ensure the out-of-pocket costs are more than offset by earning rates and benefits. For example, The Amex EveryDay® Preferred Credit Card from American Express has a $95 annual fee, and while you might be able to recoup that cost by taking advantage of one or two Amex Offers each year, it generally doesn’t make sense to pay a fee on a card that you don’t use. The exception would be a card such as The Platinum Card® from American Express, as the benefits alone make it worthwhile for many.

Related: Amex EveryDay vs. Amex EveryDay Preferred: Which should be in your wallet?

One option that many EveryDay Preferred cardholders utilize is to downgrade their cards to the no-annual-fee Amex EveryDay® Credit Card from American Express, which would preserve your account history and credit lines while saving $95 a year. If you already have the no-annual-fee version, you may have luck downgrading to another card such as the Blue Cash Everyday® Card from American Express (see rates and fees).

The information for the Amex EveryDay Preferred Card, Amex EveryDay Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

A similar strategy applies to those who have the Chase Sapphire Reserve or Chase Sapphire Preferred Card. While both cards offer compelling value propositions for many travelers, you may want to downgrade to the no-annual-fee Chase Freedom Unlimited. This could also be a good option if you have the Sapphire Preferred and are ready to get the Sapphire Reserve, as Chase no longer allows you to hold both (and requires you to go at least 48 months between earning sign-up bonuses).

Related: Chase Sapphire showdown: Sapphire Preferred vs. Sapphire Reserve

Once you’ve downgraded, it usually makes sense to keep your cards open. If it costs you nothing to hold a no-annual-fee card, and it can help strengthen your credit score, then it’s a no-brainer. However, TPG strongly encourages you to put a small charge on the card every six months or so to keep the issuer from closing the account due to inactivity. If you’re serious about racking up as many points and miles as possible, no-annual-fee cards should play a role in your strategy, as you can keep them open forever to keep your credit score nice and strong.

(Photo by Olleg/Shutterstock)

Despite all of this, there are a few instances when you may want to consider closing cards you don’t use (to make way for new ones, of course). Some issuers limit the number of cards they’ll give you at any one time, such as Capital One, which only allows you to have two personal Capital One cards. On the other hand, Amex has language on its application pages for its cards, including the following related to welcome offers:

“Welcome offer not available to applicants who have or have had this Card or the Premier Rewards Gold Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.”

While there’s no way to know for sure, closing credit cards around the one-year mark may flag an Amex account and cause you to be denied future welcome bonuses.

For full details, check out our Ultimate Guide to Credit Card Application Restrictions.

Bottom Line

While it’s easy to evaluate which welcome bonuses are worth pursuing, it can be harder to decide which cards belong in your wallet year after year. Benefits and transfer partners change, and the strategy you initially used might no longer make sense. You should avoid paying annual fees on a card you don’t use, but other than that, it helps your credit score to keep existing accounts open as long as possible.

Featured photo by Stella/Getty Images

For rates and fees of the Blue Cash Everyday, click here.

Title: Should I cancel my credit cards if I don’t use them anymore?

Sourced From: thepointsguy.com/news/cancel-credit-cards-not-using/

Published Date: Sun, 06 Feb 2022 17:59:39 +0000

No comments:

Post a Comment