HOSTED BY: 1 AIR TRAVEL

Editor’s note: This guide has been updated with the latest information.There is one common question we get from TPG readers who are cruise enthusiasts: How can I maximize earning and redemptions on cruises?

The truth is, the options are pretty limited. Most cruise line cobranded credit cards don’t offer decent value, leaving it up to travelers to get creative with the flexible-points currencies or fixed-value cards already in their wallets.

Today, we’ll take a look at the best ways to earn and redeem points for cruises, including which credit cards are best for cruises.

(Image courtesy of American Cruise Lines)

Want more credit card news and advice from TPG? Sign up for our daily newsletter.

In This Post

Earning points and miles on cruises

As mentioned above, cobranded cruise line credit cards are generally not a good option. For example, the Royal Caribbean® Visa Signature® Card offers a sign-up bonus of 10,000 bonus points (worth $100 in onboard credit) after you make a qualifying transaction within 90 days of account opening.

The information for the Royal Caribbean Visa Signature Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you’re a regular TPG reader, you know that you can do much, much better than that.

Best credit cards for booking cruises

Your best bet for earning points on cruise bookings is a credit card with a broadly defined bonus category for travel spending or a fixed-value card that offsets travel spending (more on that later).

That said, here are the cards with some of the best travel bonus categories for cruises and their earning values, based on TPG’s monthly valuations:

CardEarning rate on cruisesWhat the points are worthPercent returnChase Sapphire Preferred Card5 Ultimate Rewards points per dollar if booked with Chase Travel (2 points per dollar otherwise).2 cents per point.10% (or 4%).Chase Sapphire Reserve3 Ultimate Rewards points per dollar (after using your $300 annual travel credit).2 cents per point.6%.American Express® Green Card3 Membership Rewards points per dollar.2 cents per point.6%.Capital One Venture X Rewards Credit Card2 Capital One miles per dollar.1.85 cents per point.3.7%.Capital One Venture Rewards Credit Card2 Capital One miles per dollar.1.85 cents per point.3.7%.Bank of America® Premium Rewards® credit card2 points per dollar (up to 3.5 points per dollar with Bank of America’s Preferred Rewards).1 cent per point.2% (up to 3.5%).The information for the Amex Green card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Other than the Premium Rewards card, the other cards earn valuable, transferable rewards that can be put toward your next vacation. Bank of America’s option earns points that can be redeemed in numerous ways, always at 1 cent per point in value. The cards on this list provide travel protections that can also help you in case things go wrong during your trip.

However, if you’re loyal to a specific airline, it may make sense to use another card to maximize your earnings — especially depending on where you book.

Best websites for booking cruises

Besides the question of which card to use, the next question is which website or portal to use for booking your cruises. Here, you have a number of options.

irline-specific cruise sitesAmerican Airlines, Delta and United each offer their own cruise-booking websites (operated by third-party travel agencies) that give you the potential to earn tens of thousands of bonus miles.

If you go to United’s cruise-booking site, for example, you can see the current offers to earn up to 7 miles per dollar, depending on what type of cabin you book and whether you pay with a United credit card (such as the United Explorer Card).

(Screenshot from cruises.united.com)

United Premier elites can even enjoy bonus offers on select cruises, such as free dinner, wine or spa credits.

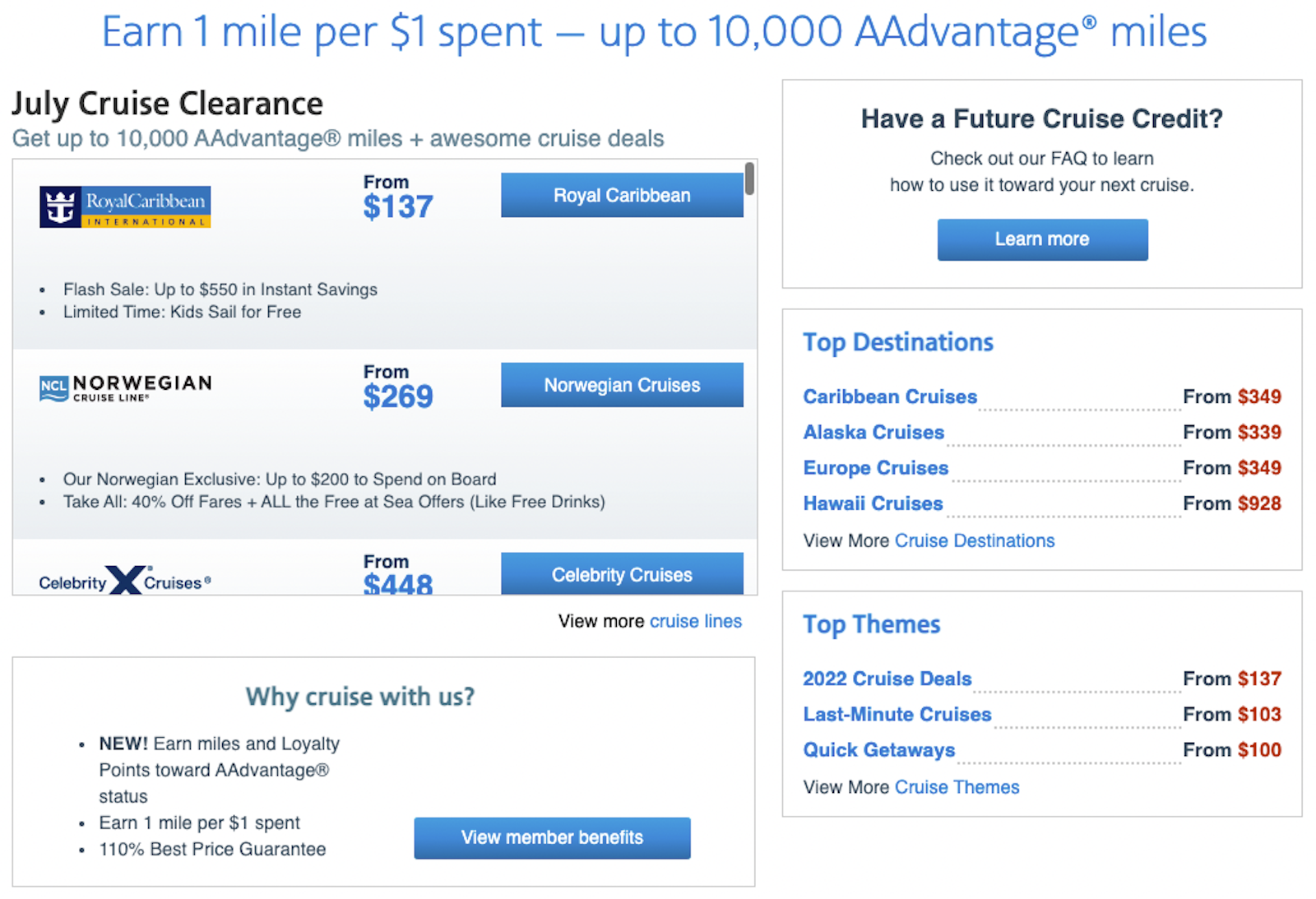

American’s cruise site has similar offers, allowing you to earn at least 1 AAdvantage mile per dollar spent or even more if you pay with an American Airlines AAdvantage credit card like the Citi® / AAdvantage® Executive World Elite Mastercard®. You’ll also earn Loyalty Points on these bookings, which can help you earn American Airlines AAdvantage elite status.

(Screenshot from bookaacruises.com)

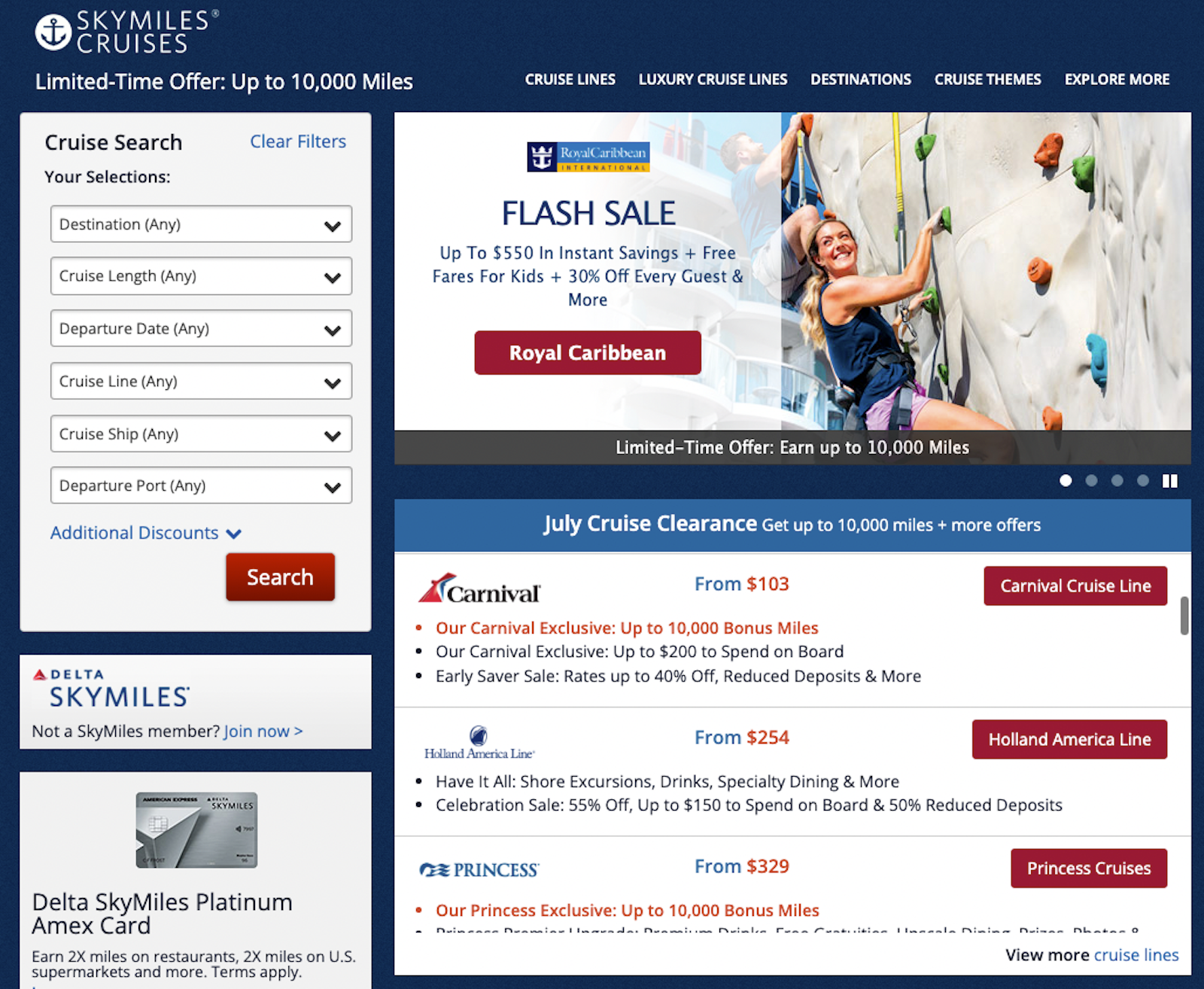

Delta’s SkyMiles Cruises site is structured slightly differently. As you can see from the chart below, offers can vary. Some bookings will provide discounts, free sailings for children or bonus miles — or a combination of the above. Offers will vary based on the cabin type and length of your cruise.

(Screenshot from skymilescruises.com)

Readers in the TPG Lounge correctly pointed out that you won’t earn 2 miles per dollar for booking these cruises with a cobranded airline credit card. Instead, your entire bonus from the cruise booking will likely appear as a lump sum on your frequent flyer account, not on your credit card statement.

In addition, each airline cruise portal also offers individual promotions for specific cruise lines and departure dates that can potentially let you earn up to 100,000 miles (or several hundred dollars in onboard credit). These promotions can give you a huge return on your booking in addition to the credit card points you’ll earn, but always make sure you compare prices and check TPG’s monthly valuations to make sure the offer you’re booking — in terms of money and miles — is the best one you can get.

merican Express Cruise Privileges ProgramIf you have The Platinum Card® from American Express, you can also enjoy special benefits when booking through the American Express Cruise Privileges Program. You’ll receive an onboard credit of up to $300 per room booked, 1 extra Membership Rewards point per dollar spent and additional amenities depending on the cruise line.

Amex cardholders should also watch for Amex Offers that can save additional money on select cruise bookings, though they often require you to book through a specific channel.

(Screenshot from americanexpress.com)

How to find the best deal on cruises

Considering how expensive cruises can be, you might also consider forgoing the bonus miles from airline portals (yes, I did just say that) and looking for the largest cash discount or onboard credit possible when booking. Warehouse clubs such as Sam’s Club and Costco frequently offer package deals and even large cash-back or onboard credit incentives for members.

Related: The 5 best Visa cards for Costco purchases

Another great trick is to book your next cruise even as you’re taking one, as many cruise lines offer reduced rates and enhanced offers to current passengers to entice you to return. In many cases, you don’t even need to know exactly what sailing you want — you can simply put down a placeholder that’s valid for a set period of time.

And don’t worry if you usually work with a travel agent. Any cruise booking made onboard can be “transferred” to your preferred agent, so you won’t miss out on any added perks the agency usually offers in exchange for your business.

Cruise Compete can be an easy resource for getting competitive quotes (including onboard credits) from a variety of travel companies all in one location. You can then make an informed decision about the best course of action for booking, factoring in points, price and perks.

Redeeming points for cruises

Booking a cruise using points and miles can be limited, but it’s generally split into two categories: fixed-value eraser credit cards and cards that allow you to pay with points.

(Photo by John Gribben for The Points Guy)

Some cards allow you to cover travel purchases with the points or miles in your rewards account. Thus, even if you can’t directly book with your points, you can still pay with points or miles afterward to essentially remove purchases from your statement. This includes cards like the Capital One Venture Rewards Credit Card, Capital One Venture X Rewards Credit Card, Bank of America® Premium Rewards® credit card and Barclaycard Arrival Plus® World Elite Mastercard®, among others. The redemption rate on these transactions is 1 cent per point/mile.

Alternatively, cruisers can pay with points through the Citi ThankYou Travel or Chase Ultimate Rewards portals. Although we generally recommend transferring these points to airline and hotel partners to maximize their value, direct redemptions can make sense here, given the limited options for booking cruises with your rewards.

Note that with Chase, you need to call to redeem points for cruises (855-234-2542). Unfortunately, Disney Cruise Line is not an eligible redemption option with Ultimate Rewards at this time. While you can view some cruise information on Citi’s travel site, you also have to call to book using your points (800-842-6596).

The information for the Barclaycard Arrival Plus World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Disney Dream. (Photo by Summer Hull/The Points Guy)

You’ll also be able to take advantage of pay-with-points travel bonuses here, such as the 50% bonus on the Chase Sapphire Reserve that makes your points worth 1.5 cents each toward travel — or the similar 25% bonus on the Chase Sapphire Preferred Card and Ink Business Preferred Credit Card that gives you 1.25 cents per point.

Amex Membership Rewards points can be redeemed through Amex Travel portal for cruises, but this comes at a paltry rate of 0.7 cents per point—that’s less than half of TPG’s average valuation of these points.

United’s cruise portal also gives you the option to redeem your MileagePlus miles for a cruise instead of paying cash, though the rates are less than desirable. This may be viable if you’re sitting on a massive stash of United miles and feeling burned by the carrier’s string of devaluations over the past couple of years. Otherwise, I’d recommend against this route.

Take, for example, a four-night Western Caribbean cruise with Carnival Cruise Line with prices starting at just $119 per person for the sailing. If you were to redeem your miles, you’d need to pay 17,000 miles for the same base cabin, which works out to a redemption rate of 0.7 cents per mile, well below TPG’s valuation of United miles. Unlike some other programs, you can’t even score a higher redemption value by booking a fancier cabin; you’re locked into this low value for all cabins across all cruise lines.

Factor in trip protections

You can (and perhaps should) purchase insurance for your cruise, but using the right credit card for your cruise can at least get you some built-in protections. Certain premium credit cards offer trip protections that apply to cruises since the cruise line is your “common carrier.” These protections work basically the same as they would with airlines.

The Chase Sapphire Reserve, for example, offers trip delay reimbursement, trip cancellation insurance and even emergency medical coverage and medical evacuation coverage if you charge the cruise to that card (or use points from the card to book the cruise).

Related: When to buy travel insurance vs. when to rely on credit card protections

(Photo by John Gribben for The Points Guy)

The Sapphire Reserve card would provide you up to $10,000 per covered trip (with a maximum limit of $20,000 per occurrence) against incidents such as sickness or severe weather.

If you think you’re going to rely on a credit card like the Sapphire Reserve for travel insurance, carefully recheck your card’s benefits and limits against the coverage offered through independent travel insurance providers. And remember: you must pay for at least part — and sometimes all — of the trip with the credit card whose protections you want to enjoy.

In terms of medical evacuation coverage, the Amex Platinum is the top dog. If you’re on a trip of fewer than 90 days and are traveling at least 100 miles from home, this card has your back if you need medical evacuation.* Note that getting COVID-19 will likely not qualify you for coverageA Premium Global Assist (PGA) administrator must coordinate everything for you to avoid any cost, but there is no coverage maximum. Any coverage not coordinated through the Premium Global Assist line (which you can call 24/7 at 1-800-345-2639) may be your financial responsibility.

The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home and can get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Cardmembers are responsible for the costs charged by third-party service providers. For further information: Your complete guide to travel protections on American Express cards.

Related: A guide to travel insurance for cruises

Bottom line

Choosing the best credit card to pay for your cruise is a multilayered process. Are you looking to maximize the dollars spent, access card benefits or use points? Do you need built-in credit card travel protections? Regardless of those factors, the best card to use is typically not a cobranded credit card from a cruise line but a solid, all-around travel rewards credit card.

Additional reporting by Ryan Smith, Stella Shon and Chris Dong.

Featured photo by Norwegian Cruise Line.

Title: Use these credit cards to maximize your next cruise vacation

Sourced From: thepointsguy.com/guide/best-credit-cards-for-cruises/

Published Date: Tue, 19 Jul 2022 16:00:55 +0000

No comments:

Post a Comment