HOSTED BY: 1 AIR TRAVEL

UpdateSome offers mentioned below are no longer available. View the current offers here

If you’re someone who frequently dines out or travels with groups of friends, you know all too well the headache that comes with offering to put the bill on your card.

Sure, you earn the rewards, but you also volunteer to take the responsibility of splitting the bill and then sending the payment requests out to everyone else. It’s up to you to keep track of who hasn’t paid and when they do, remember to transfer the money from whatever app you’ve used to your bank so you can pay off your bill.

When you’re dealing with a large group and multiple expenses to split, the mental cost of getting those extra reward points can skyrocket quickly.

What is Amex Send & Split?

Like a group payment superhero, American Express made our lives easier in 2019 when they launched their “Send & Split” feature, a way to split purchases with contacts through the app using Venmo or PayPal.

This feature, available to all U.S. Basic Consumer cardholders, helps do some of the legwork of splitting the bill while letting you keep all of the associated Amex Membership Rewards. You can split both pending and posted Amex transactions with up to 20 contacts.

Since the initial release, American Express has tweaked the feature to make it even easier to use. This week, they announced another exciting update: Now you can choose multiple charges to split at the same time, simplifying the process for multi-venue events and group trips.

Here’s what you need to know before your next group outing.

How to use Amex Send & Split

Enroll

In order to split payments, you must be enrolled in the feature and connect it to your Venmo or PayPal account.

To enroll, you’ll need to download and log in to the Amex App. Tap “Send & Split: Venmo/PayPal” and follow the prompts to link your Venmo or PayPal account.

Choose “Split It” in the app

After enrolling and making a purchase, open the app. Under the transaction, you should see the option to “Split It.”

AMERICANEXPRESS.COM

Choose your payment app and amount

After you select “Split It,” you’ll need to choose whether to use PayPal or Venmo. Here, we opted to go with Venmo:

AMERICANEXPRESS.COM

Then, you’ll be asked to add contacts. You can manually input an email or phone number, or you can hit the “+” sign to choose a contact from your phone.

AMERICANEXPRESS.COM

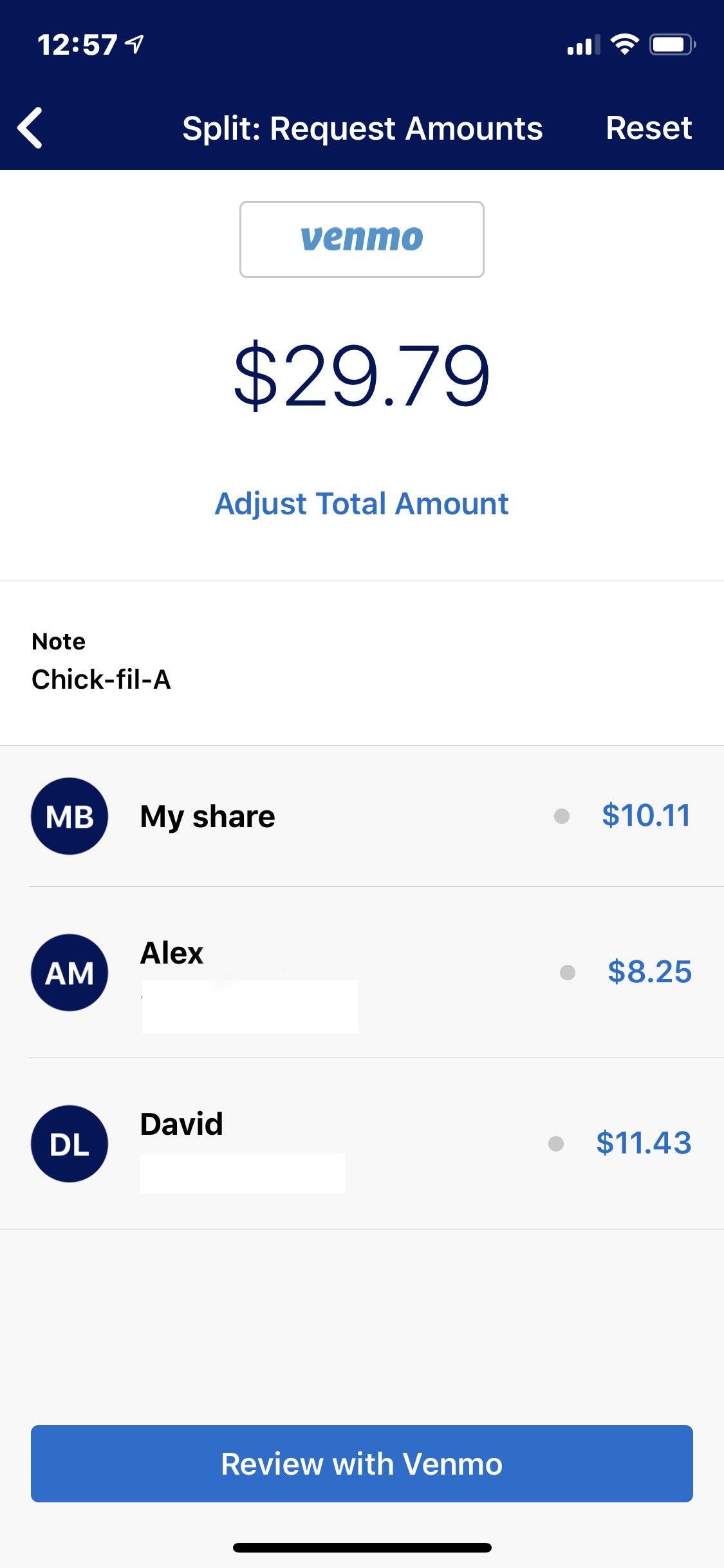

Amex automatically splits the bill equally between all contacts added, but you can also go in and manually change what each person will pay. Because posted transactions aren’t itemized, you will have to do that math on your own to decide who pays what.

Another helpful feature is the ability to adjust the total amount to account for a tip or other fees that may not be included in the transaction amount posted to your Amex account. You can input a custom amount, or you can choose one of four percentage-based adjustments (which would be great for adding tips to a grand total).

AMERICANEXPRESS.COM

Once you’ve set up the correct total and split the payment how you want among contacts, Amex will send the request to Venmo/PayPal to review and complete the request. After you’ve completed that step, you’ll be sent back to the Amex app for the confirmation page.

Select your payback option

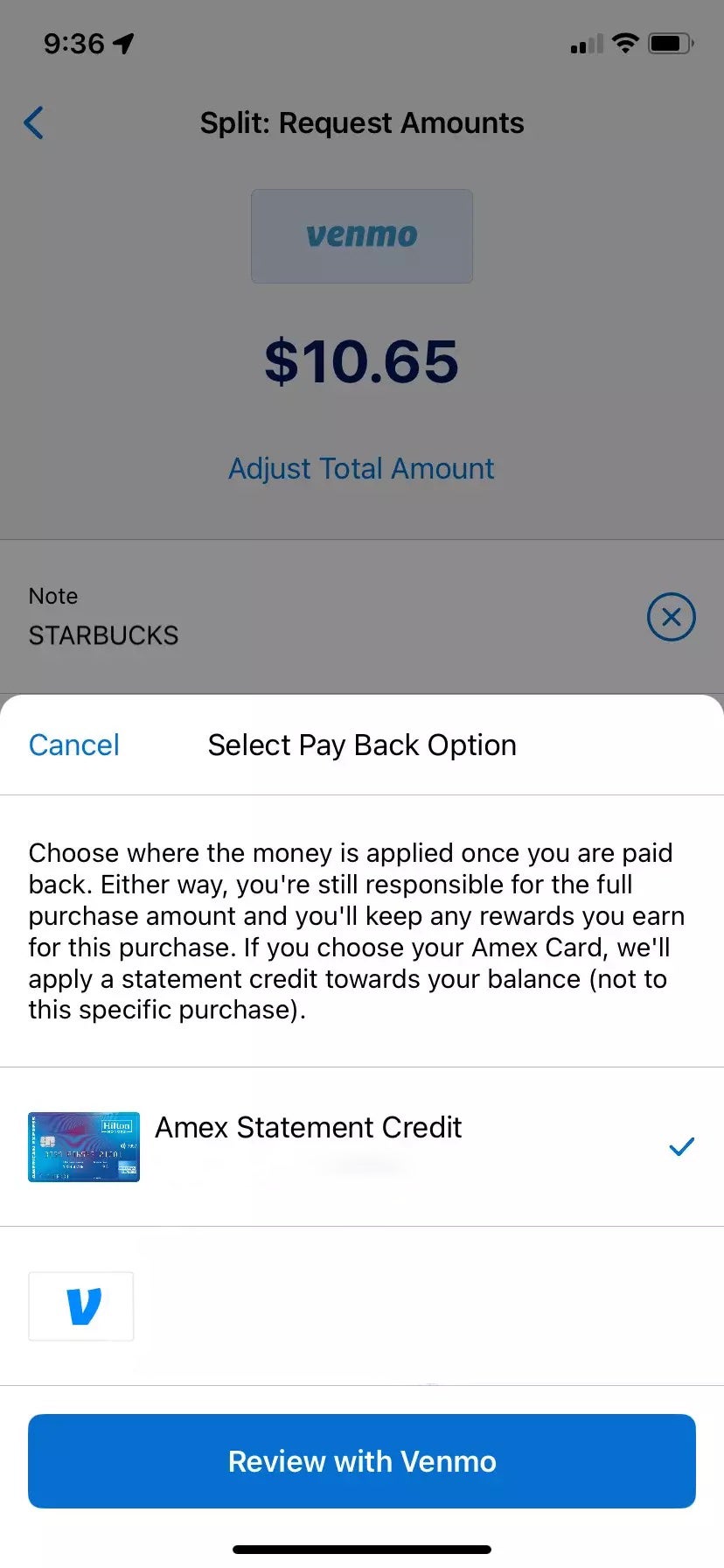

In the original version of the feature, the payment would go directly to your Venmo account, leaving you with the responsibility of moving the money from your Venmo account to your bank account and using it to pay off your card balance.

Now, however, the app will prompt you to select whether you want the money to go to your Venmo account or to directly credit your account.

AMERICANEXPRESS.COM

The contacts you entered receive a Venmo request quickly, and they pay just like a normal Venmo request. However, if you chose the statement credit option, the funds will bypass your Venmo account and go straight to your Amex account as a statement credit.

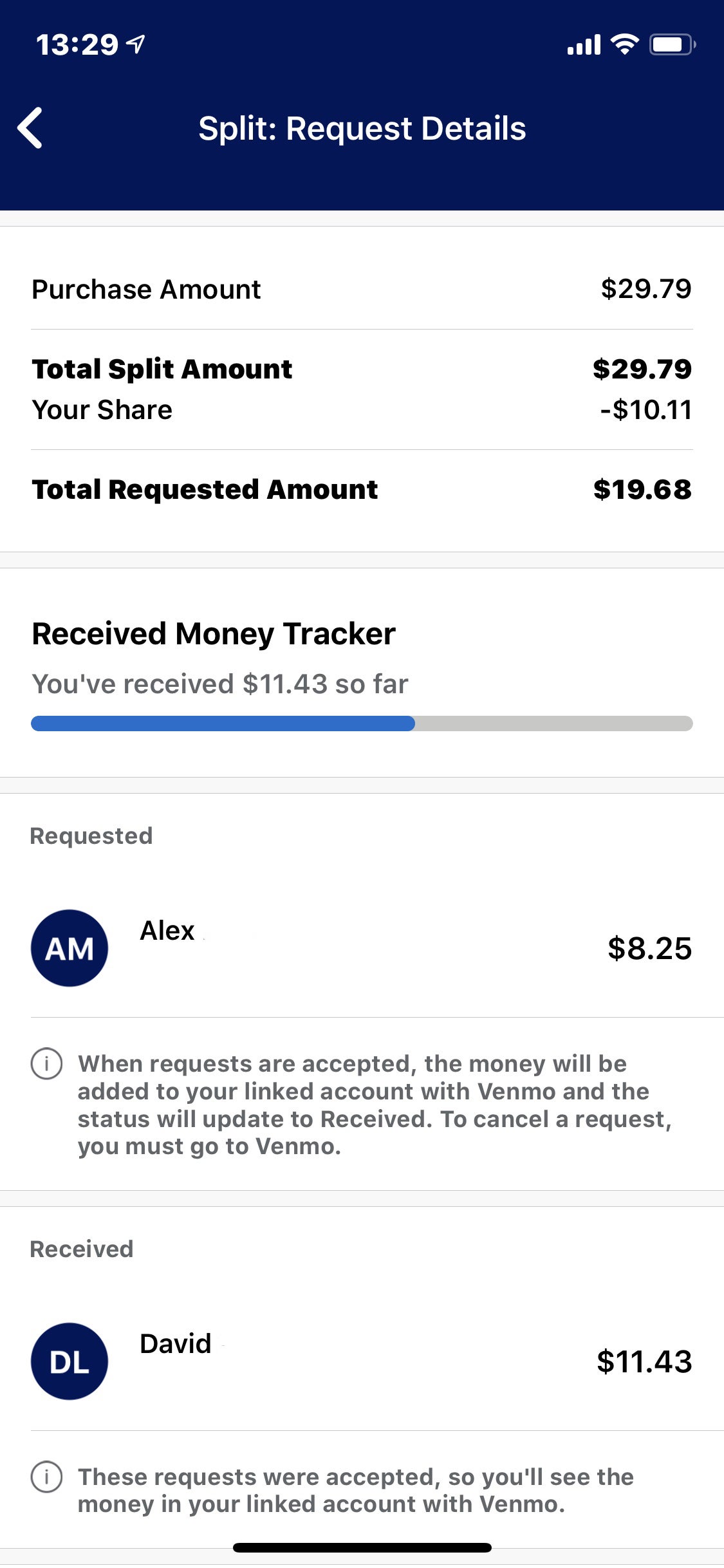

Keep track of who still owes you

Another great element of this feature is that it allows you to keep track of who has paid you in the same place. If you go to the account tab at the bottom of the Amex app screen, there is a “Split Purchases” section you can click to view transactions that you’ve split and their details.

AMERICANEXPRESS.COM

Relax

That’s it. This app feature really does the work for you. You choose which charges you want to split and where you want to send the requests, and then you can just sit back and watch the credits roll into your account.

You still get all the Membership Rewards points for the group purchase but almost none of the headaches that used to accompany it.

How to maximize Amex Send & Split

This feature is available on all personal American Express U.S. Basic Consumer Cards, but you’ll want to be strategic about which card to use based on what you’re charging.

WYATT SMITH/THE POINTS GUY

If you’re dining out with friends, for instance, you may want to put the charge on your American Express® Gold Card (see rates and fees) and earn 4 Membership Rewards points per dollar spent on your group’s charge at restaurants worldwide, plus takeout and delivery in the U.S.

Bottom line

The Amex “Send & Split” feature is great for anyone who ever splits payments with others. It allows you to split a cost, request payment from your friends and keep track of who has paid right in your card app.

You can opt to get the payments sent back to your card account directly, bypassing the several steps this process used to require. Now you can further streamline the process by splitting multiple expenses at once.

With this feature, you won’t think twice before offering to put the bill on your card the next time you’re out with friends.

Additional reporting by Madison Blancaflor.

For rates and fees of the American Express Gold please click here

Title: Amex split pay feature: Useful for sharing costs in big groups

Sourced From: thepointsguy.com/news/amex-split-it-payment-feature/

Published Date: Fri, 07 Oct 2022 13:00:51 +0000

No comments:

Post a Comment