HOSTED BY: 1 AIR TRAVEL

Since I’m striving to requalify for American Airlines Executive Platinum status under the new Loyalty Points scheme, I’ve started paying a lot more attention to programs like SimplyMiles, Citi Merchant Offers and the AAdvantage shopping portal.

By paying closer attention to offers, I’ve recently been able to stack rewards — including earning Loyalty Points toward American Airlines elite status — on various purchases I planned to make anyway. In just the last few months, I’ve triple dipped (or better) on rewards when making purchases with Uber, Uber Eats, Allbirds, Viator and Simply Blooms.

I wrote about earning Loyalty Points on Uber purchases, but haven’t covered most of the other stacking offers since they seemed of limited interest. But, when I noticed I’d be earning rewards five different ways on a Hotels.com booking I made for next summer, I thought this stack would be worth sharing. Here’s what you need to know.

In This Post

Stacking rewards on a Hotels.com booking

LITTLECLIE/GETTY IMAGES

Next summer, I’m helping run a league at the RoboCup international robot soccer competition in Bordeaux, France. The competition days are usually long and tiring, so I wanted to book lodging within walking distance of the venue.

None of my preferred hotel loyalty programs offer any hotels near the Parc des Expositions de Bordeaux (the site of RoboCup 2023), so I booked an independent hotel through Hotels.com. My eight-night prepaid but fully refundable stay costs $738 ($717 before taxes and fees). But, I should earn as follows based on how I booked and the card I used to pay:

2,325 AAdvantage base miles and Loyalty Points through SimplyMiles (worth $41 based on TPG’s valuations).$50 back through Citi Merchant Offers.3,584 Citi ThankYou points from using my credit card to make the purchase (worth $65 based on TPG’s valuations).1,434 Membership Rewards points by clicking through Rakuten before making my purchase (worth $29 based on TPG’s valuations).Eight stamps toward a reward night through Hotels.com Rewards (which I value at about $72).Based on these five earning methods, I should earn about $257 worth of rewards and cash back on my $738 stay. In the following sections, I’ll discuss each earning method in detail.

Related: How robot soccer got me into points and miles

Earning through SimplyMiles

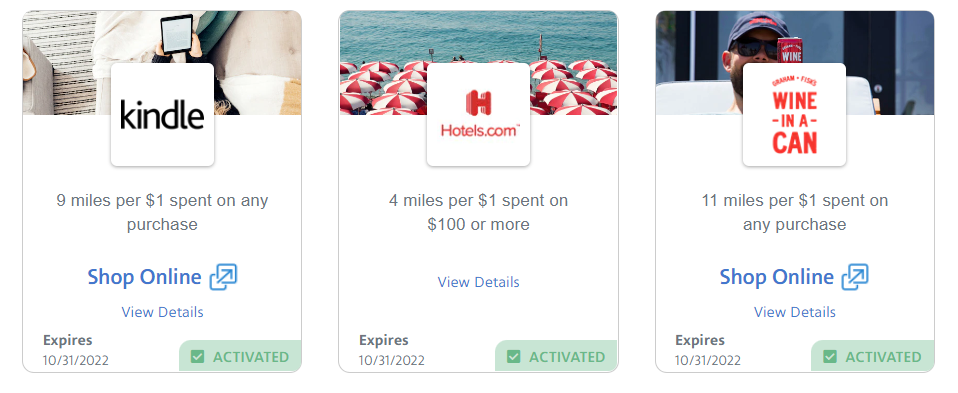

To participate in SimplyMiles, you must be an AAdvantage member, reside in the U.S. and hold a valid Mastercard. However, even if you have a SimplyMiles account, you may not be targeted for this offer.

If you are targeted for this Hotels.com offer through SimplyMiles, you can earn 4 miles per dollar when spending $100 or more through Oct. 31 with Hotels.com. To earn the bonus miles, you must use a Mastercard linked to your SimplyMiles account to pay for your Hotels.com purchase.

SIMPLYMILES.COM

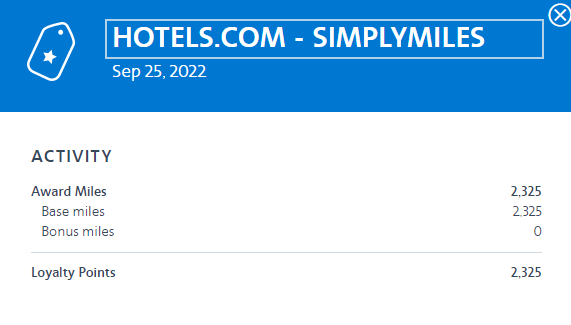

You can use this offer up to three times. The amount you can earn through this offer is capped at 6,975 miles, but you can’t earn more than 2,325 miles per booking.

AA.COM

As such, you’ll reach the earning cap on a stay costing $582 or more before taxes and fees. Based on TPG’s valuation of AAdvantage miles at 1.77 cents each, 2,325 miles are worth about $41.

Related: Winc: Ordering wine is helping me earn airline elite status, but is it worth it?

Earning through Citi Merchant Offers

If you have a Citi credit card, you likely have access to Citi Merchant Offers for your card. For example, my Citi Premier® Card, American Airlines AAdvantage MileUp℠ Card, Citi Prestige® Card (no longer available to new applicants), Citi Dividend card (no longer available to new applicants) and AT&T Access Card from Citi all have access to Citi Merchant Offers.

The information for the Citi Prestige, Citi Dividend and AT&T Access Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

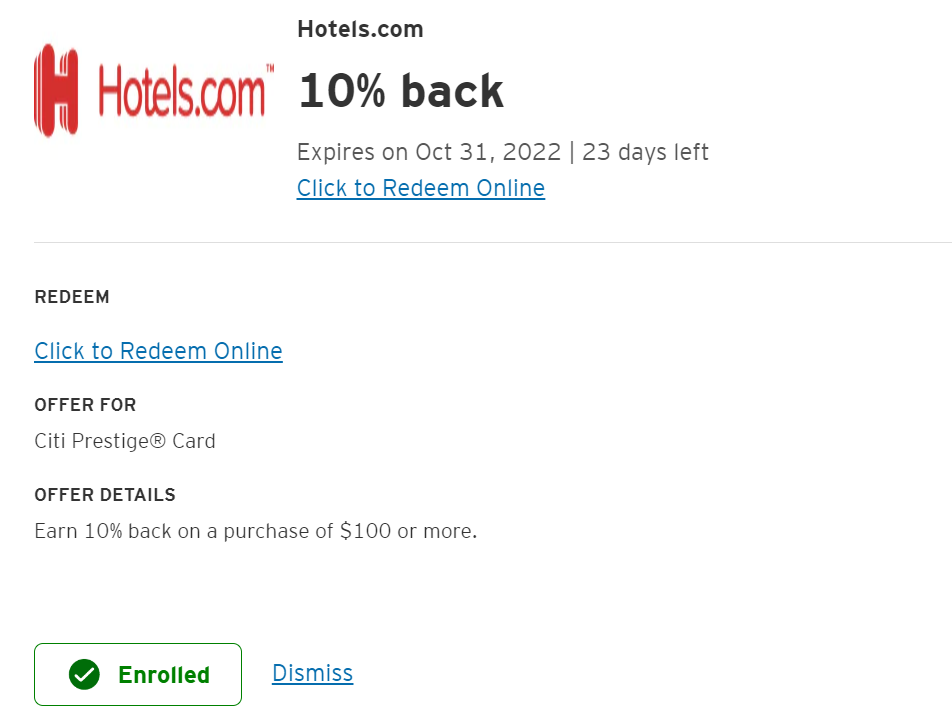

Citi Merchant Offers are targeted by card, so you’ll likely see different offers on each card if you have multiple Citi cards. In my case, I only see the Hotels.com offer that lets me get 10% back in statement credit (up to $50 back) on a purchase of $100 or more through Oct. 31 on my Citi Premier and Citi Prestige cards.

ONLINE.CITI.COM

You must add the offer to the card you plan to use before making a purchase with that card. You can use the offer up to three times per card once you enroll (for up to $150 in total statement credits per card). Your bookings must be made on the Hotels.com website using the “pay online now” option.

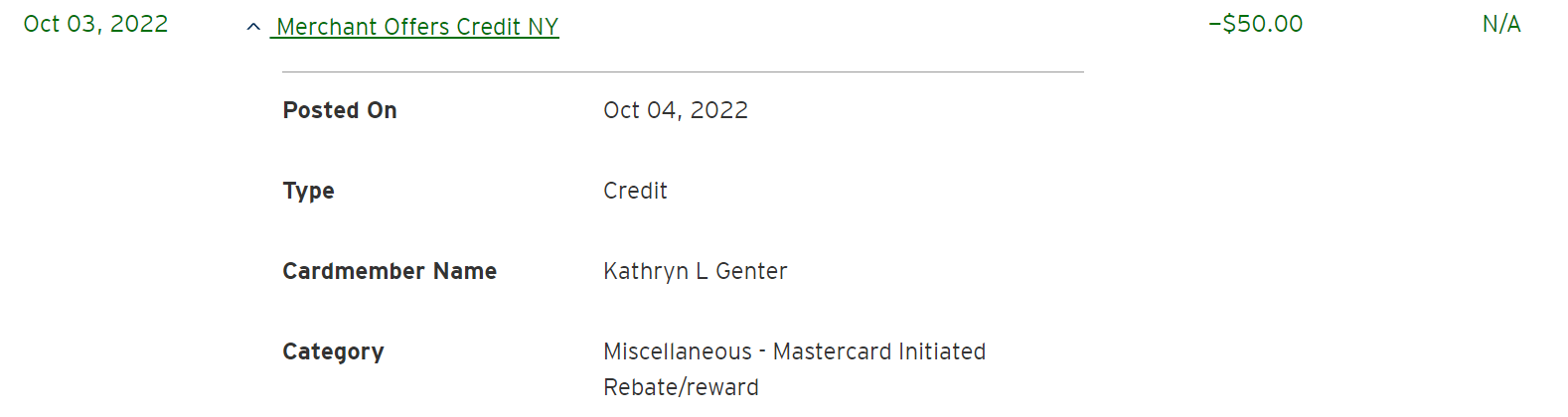

Citi posted my $50 statement credit a little over a week after I booked and paid for my stay through Hotels.com with my Citi Prestige Card.

CITI.COM

Related: How credit card merchant offers can save you hundreds of dollars every year

Earning through your credit card

As long as you use a rewards card, you’ll earn rewards when you use your card for a Hotels.com purchase. In my case, I opted to use my Citi Prestige Card since it earns 5 Citi ThankYou points per dollar spent with travel agencies and was targeted for the Citi Merchant and SimplyMiles offers discussed above.

I earned 3,584 Citi ThankYou points on my $738 purchase using my Citi Prestige Card. Based on TPG’s valuation of Citi points at 1.8 cents each, these points are worth about $65.

CITI.COM

Only select Citi-issued cards are eligible for Citi Merchant Offers, and only Mastercards are eligible for SimplyMiles offers. So, choose your card wisely based on its expected earning rate and the other offers you plan to use.

I recommend checking which of your cards are targeted for the associated SimplyMiles and Citi Merchant offers. The Citi® Double Cash Card may be a good choice. You may want to use a Citi Mastercard targeted for the Hotels.com offers mentioned above, even if it doesn’t earn more than 1 point or mile per dollar spent on the purchase.

Related: 8 of the best credit cards for general travel purchases

Earning through a shopping portal

WERA RODSAWANG/GETTY IMAGES

Before booking my stay through Hotels.com, I clicked through Rakuten to earn 2 Amex Membership Rewards points per dollar spent.

In my Rakuten account, I see my visit on the shopping trips page but not on my earning balance page. When I researched this, the help page on Rakuten told me, “Hotels.com will confirm your cash back within six weeks after travel has been completed.”

I expect to earn 1,434 Membership Rewards points on my purchase, but this won’t be confirmed until after my stay next summer. TPG’s valuations peg the value of 1,434 Membership Rewards points at about $29. So, this is the least valuable part of my five-way stack.

Although I frequently use Rakuten when making online purchases, there are many other online shopping portals. I recommend comparing your options once you’re ready to book using a shopping portal aggregator such as Cashback Monitor.

Related: Your guide to maximizing shopping portals for your online purchases

Earning through Hotels.com Rewards

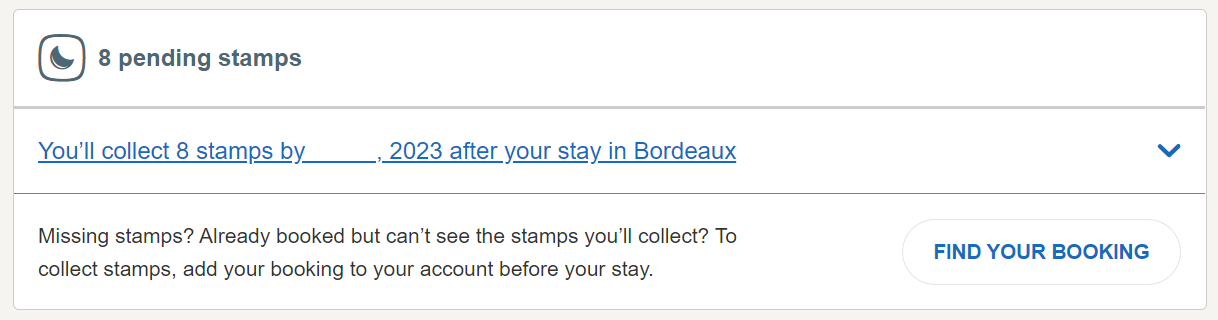

Finally, I’ll earn through Hotels.com Rewards on my stay since I booked through Hotels.com and am a Hotels.com Rewards member. Hotels.com Rewards members earn a stamp for each eligible night they book and stay. Each time you collect 10 stamps, you earn a reward night worth the average price of the 10 stamps.

I’ll earn eight stamps at an average of $81.46 per night from my eight-night stay. If I stay two more nights with a similar average per-night cost, I’ll earn a reward night worth about $81.

HOTELS.COM

Hotels.com Rewards stamps don’t expire as long as you keep your account active at least once every 12 months. So, by staying with Hotels.com at least once each year, I ensure my stamps don’t expire.

Related: Why I think Hotels.com reward nights are the easiest to use

Bottom line

I rarely book hotels through online travel agencies such as Hotels.com, as I’m usually looking to use (and work toward requalifying for) hotel elite status. But I want to stay within walking distance of the Parc des Expositions de Bordeaux for the RoboCup robot soccer competition next summer in France. Unfortunately, this eliminated any hotels in the loyalty programs I prefer from consideration for this stay.

Of course, paying now for a stay next summer means you’ll be out the money long before your stay. But you could also book a stay for next week or next month and benefit from stacking as described in this story. The key aspects are that you understand how to use each part of the stack, book eligible stays by the end of Oct. 2022 and choose to pay at the time of booking.

Title: Expert stacking: How I’m earning rewards 5 different ways on a Hotels.com booking

Sourced From: thepointsguy.com/guide/hotels-rewards-stack/

Published Date: Thu, 13 Oct 2022 14:30:15 +0000

No comments:

Post a Comment