HOSTED BY: 1 AIR TRAVEL

I’ll admit it — I’m addicted to premium travel rewards cards. Most people choose just one or two of the most popular top-tier cards — such as The Platinum Card® from American Express, Chase Sapphire Reserve and Capital One Venture X Rewards Credit Card (see rates and fees) — but I have all three.

That being said, the Venture X is the premium card I most often recommend to points-and-miles collectors to get their foot in the premium travel card world.

Here are six reasons why.

$0 effective annual fee

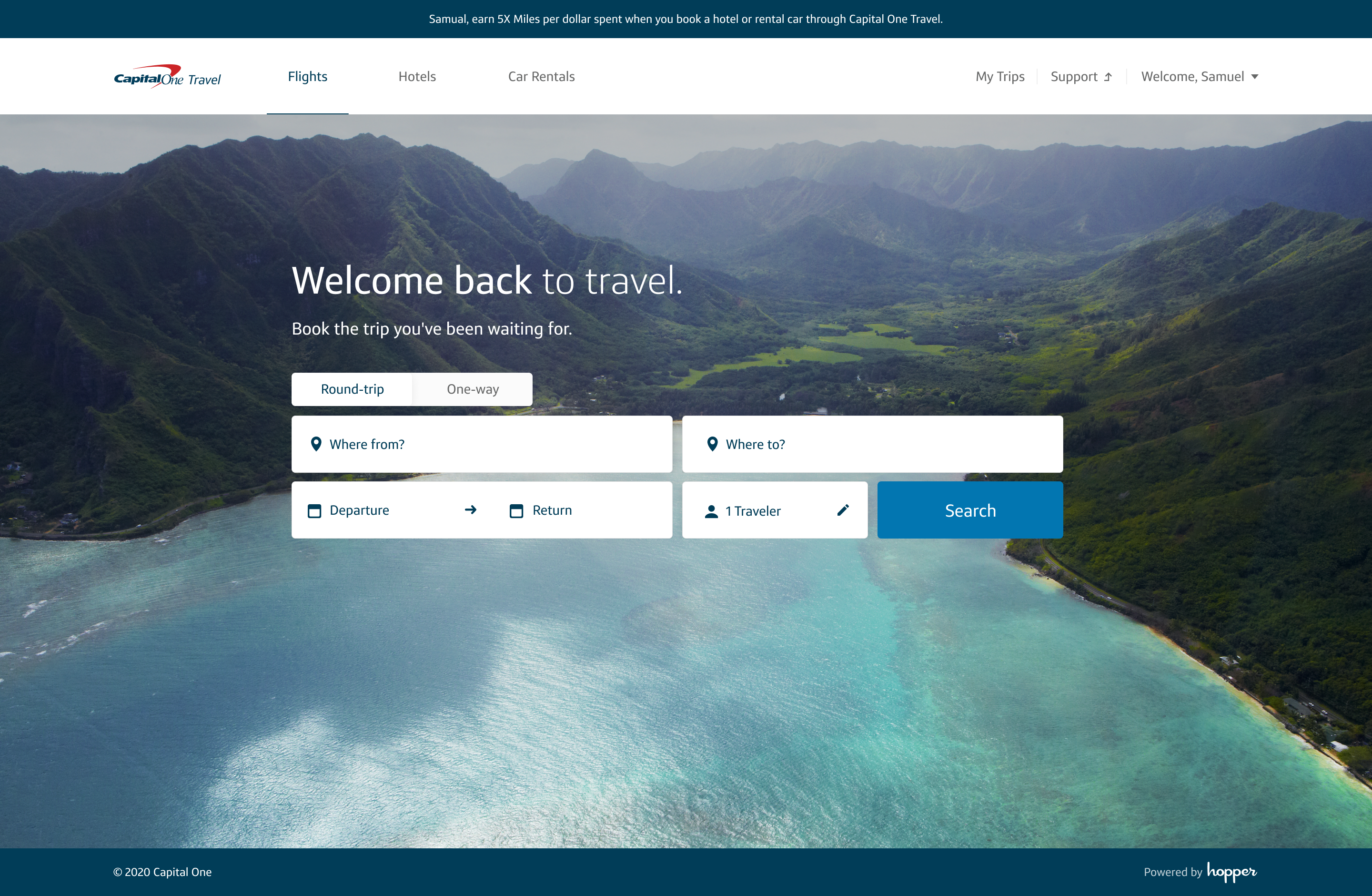

This card has a $395 annual fee, an expense too high to gloss over. However, I partially reduce that annual fee by taking advantage of the up to $300 annual travel credit toward bookings through the Capital One travel portal. That brings the effective annual fee down to $95 — but there’s more.

CAPITAL ONE

I also receive 10,000 anniversary bonus miles each year I have the card. Given that TPG values Capital One Venture Miles at 1.85 each, those 10,000 points are worth $185. That means that I’m actually “making” $90 a year by holding the card — and that’s without taking into account all the other benefits below.

Capital One lounge access

While my Amex Platinum takes the cake for lounge privileges — including access to Centurion lounges and Delta Sky Clubs (when flying on Delta-operated or -marketed flights), amongst others — the Venture X is also a great option. It gives you a Priority Pass Select membership plus access to Plaza Premium lounges.

Cardholders also get access to Capital One’s small (but growing) lounge network. Living in Austin, I often connect through Dallas Fort Worth International Airport (DFW), where the first Capital One Lounge opened in November 2021. This was the same month the card launched with a 100,000-point welcome bonus. (Now, the standard offer is 75,000 miles after spending $4,000 in purchases in the first three months, worth $1,388.)

SUMMER HULL/THE POINTS GUY

My favorite part of the lounge is the grab-and-go food and drink options; these options are great when you have a short connection and want to save money by not purchasing overpriced airport food.

SUMMER HULL/THE POINTS GUY

Four free authorized users

This card is the one that keeps on giving. You can add up to four authorized users to your card for free.

I’ve added two family members and two friends as authorized users. They can take advantage of all the lounge benefits I enjoy — most notably the more than 1,300 Priority Pass lounges worldwide. Plus, they can bring in bring up two guest per visit with unlimited complimentary access.

Transferable miles

If there is anything I endeavor to teach a credit card rewards beginner, it’s this: Don’t put all your eggs in one basket by getting a card linked to just one airline or hotel loyalty program. Instead, earn flexible (or transferable) points.

Capital One miles can be transferred to 15 airlines and three hotel partners. I try to take advantage of transfer bonuses to convert my points to Air France-KLM Flying Blue for good-value business-class flights to Europe; Avianca LifeMiles for premium-cabin redemptions on United back home to Sydney; and British Airways Executive Club for nonstop flights within the U.S. and to Latin America on American Airlines.

NICK ELLIS/THE POINTS GUY

Generous earning rate on nonbonus categories

While I use other cards to maximize my bonus earning on categories like groceries, flights and ride-hailing services, the Venture X is my go-to for nonbonus spending such as clothing, online purchases and fitness.

This card earns at least 2 miles per dollar spent on purchases, though it jumps to 5-10 points per dollar spent on bookings through the Capital One travel portal. Although, I prefer to book directly to reduce headaches if I change or cancel a flight or hotel stay.

Car rental elite status

The Venture X offers complimentary Hertz President’s Circle status to the primary cardholder and authorized users (21 years or older). This allows for free upgrades, bonus points and a free additional driver.

SCOTT MAYEROWITZ/THE POINTS GUY

I’ve status matched my top-tier Hertz status to Enterprise and Europcar. I would do so to Avis and National if I didn’t already get complimentary status with them through my Platinum card.

*Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Bottom line

The Capital One Venture X is the most common premium travel rewards card that I recommend frequent travelers get. It has a relatively low annual fee that is easy to cover with an annual travel credit and bonus anniversary miles. You’ll get luxury travel perks like Priority Pass lounge access and elite status with Hertz (and potentially other car rental companies). The ability to add up to four authorized users for free makes it a crowd favorite — and one of the top cards in my wallet.

For a deeper dive into the card’s benefits, check out our full review of the Venture X.

Official application link: Capital One Venture X Rewards Credit Card with a 75,000-mile bonus after spending $4,000 in purchases in the first three months

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Title: Why the Venture X is a mainstay in my wallet

Sourced From: thepointsguy.com/news/why-capital-one-venture-x/

Published Date: Mon, 31 Jul 2023 20:00:39 +0000

No comments:

Post a Comment