HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information.

Transferable points are, simply put, the most valuable type of currency to earn in the points and miles world. This is entirely due to their versatility. Chase, American Express, Capital One and Citi all offer rewards credit cards with points that you can transfer to a wide variety of flight and hotel partners.

This can be especially valuable when you hope to travel in a premium cabin or simply want to minimize the number of points or miles you redeem for an award. Instead of being limited to a single airline (and its partners) or one hotel program, you can leverage your rewards to book the best option available for the lowest possible price.

And if you’ve made a resolution to up your travel game in 2022, learning how to transfer your credit card rewards can be one of the most important steps to take.

Sign-up for the TPG daily newsletter to get points and miles coverage like this delivered to your inbox.Here is a guide on which cards earn transferable points, when you should transfer points, and which airlines and hotels partner with each program.

In This Post

Why are transferable points so valuable?

In short, transferable point currencies offer flexibility when it comes time to use your rewards to book travel. If you have a large stash of American AAdvantage miles, you’re limited to award flights on American and its partners. However, if you have a big balance of Chase Ultimate Rewards points, you have many more options:

Book travel directly on any airline through the Chase travel portal.Transfer points to British Airways or Iberia to book American award flights.Transfer points to Flying Blue to book SkyTeam award flights.Transfer points to Virgin Atlantic to book Delta-operated flights or premium-class ANA flights.Transfer points to United MileagePlus or Air Canada Aeroplan to book Star Alliance award flights.You could also transfer points to the World of Hyatt for luxurious hotel stays or even use your points to cover tours and activities on your trip.

When should you transfer points?

There are a seemingly infinite amount of ways to use your points — from flights, hotels, gift cards, merchandise and more. It can be quite complex. While you shouldn’t think of your loyalty program account balances as long-term investments, you should ensure that you spend your points just like hard-earned money: with strategy and efficiency. This is when it becomes critical to determine when you should transfer points to partners versus redeem them in other ways.

When you want to redeem your transferable points on flights, there are a couple of different ways to go about it. You can purchase them through the travel site specific to the bank (like the Chase Ultimate Rewards portal or Amex Travel), or you can transfer your points to a frequent flyer program and book flights based on that program’s award rates. While your end goal is the same — book a flight using your rewards — the costs can vary widely.

If you need to book a last-minute flight (for a spontaneous trip or due to a family emergency) or are looking at a premium-class ticket with a high cash fare, transferring your points can make for a fantastic redemption.

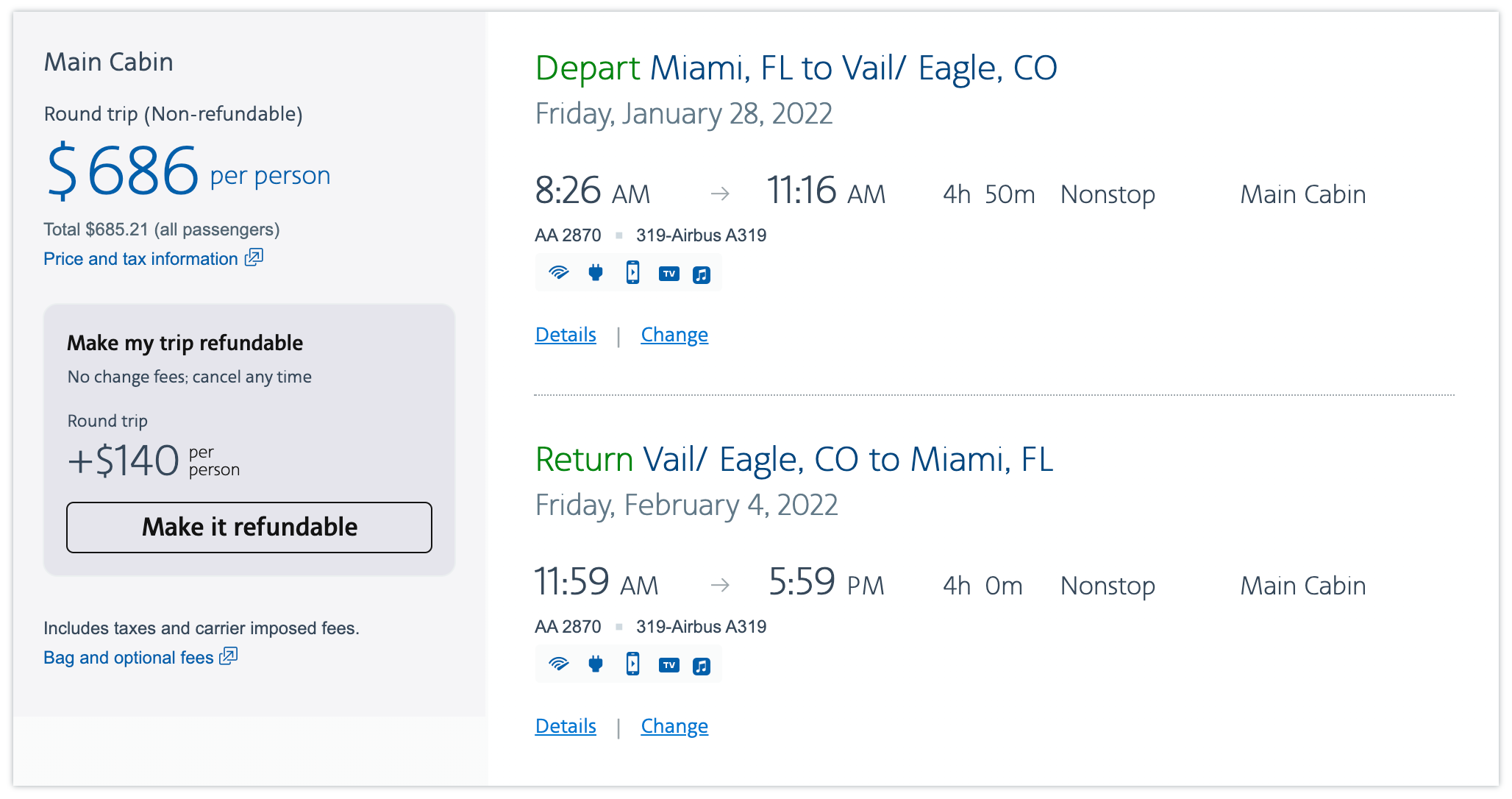

For example, let’s say that you live in the Miami area and want to book a somewhat last-minute getaway to Vail for a ski trip. Not surprisingly, flights on one of the only nonstop flights from South Florida are quite pricey — as in nearly $700 round trip.

(Screen shot courtesy of American Airlines)

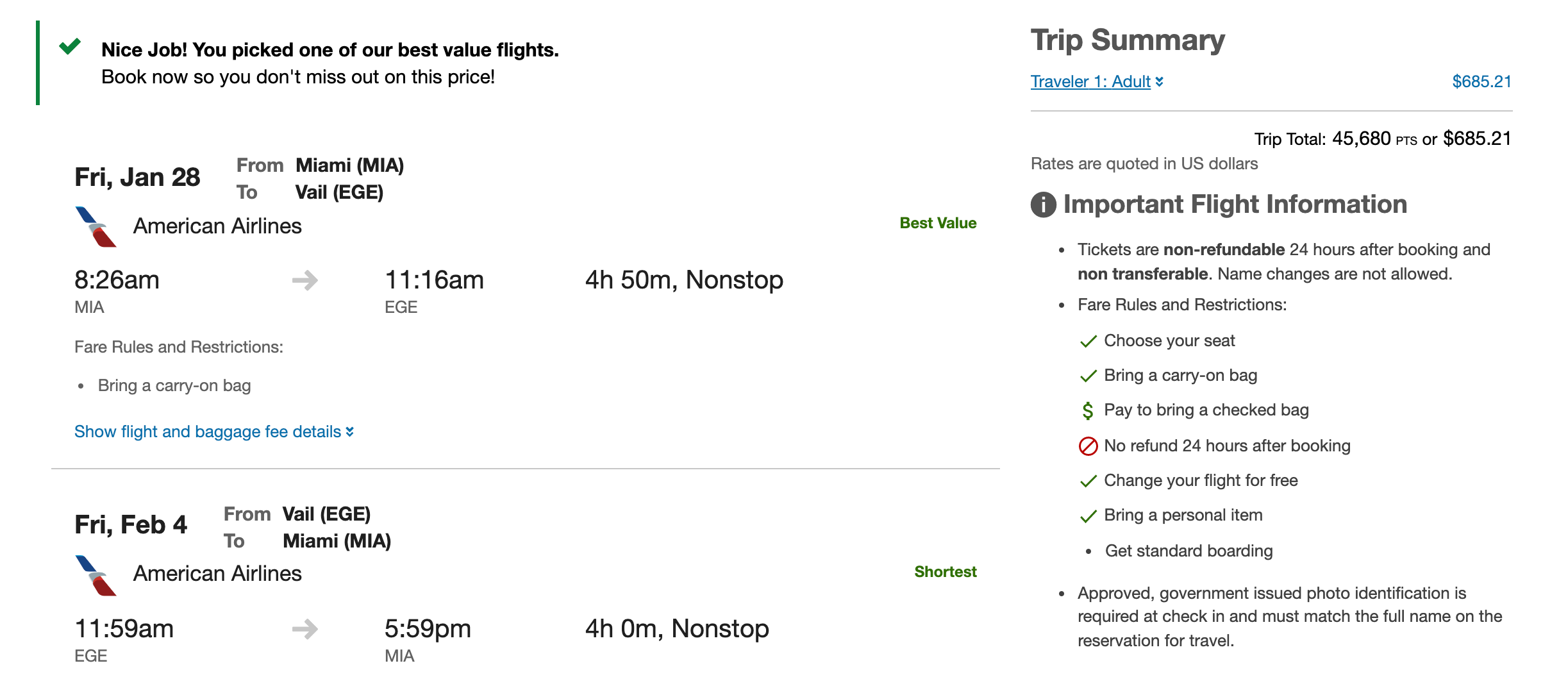

If you have the Chase Sapphire Reserve card, you can use your Ultimate Rewards points directly for travel at a rate of 1.5 cents apiece toward travel, so you could redeem 45,680 points for those flights:

(Screen shot courtesy of Chase)

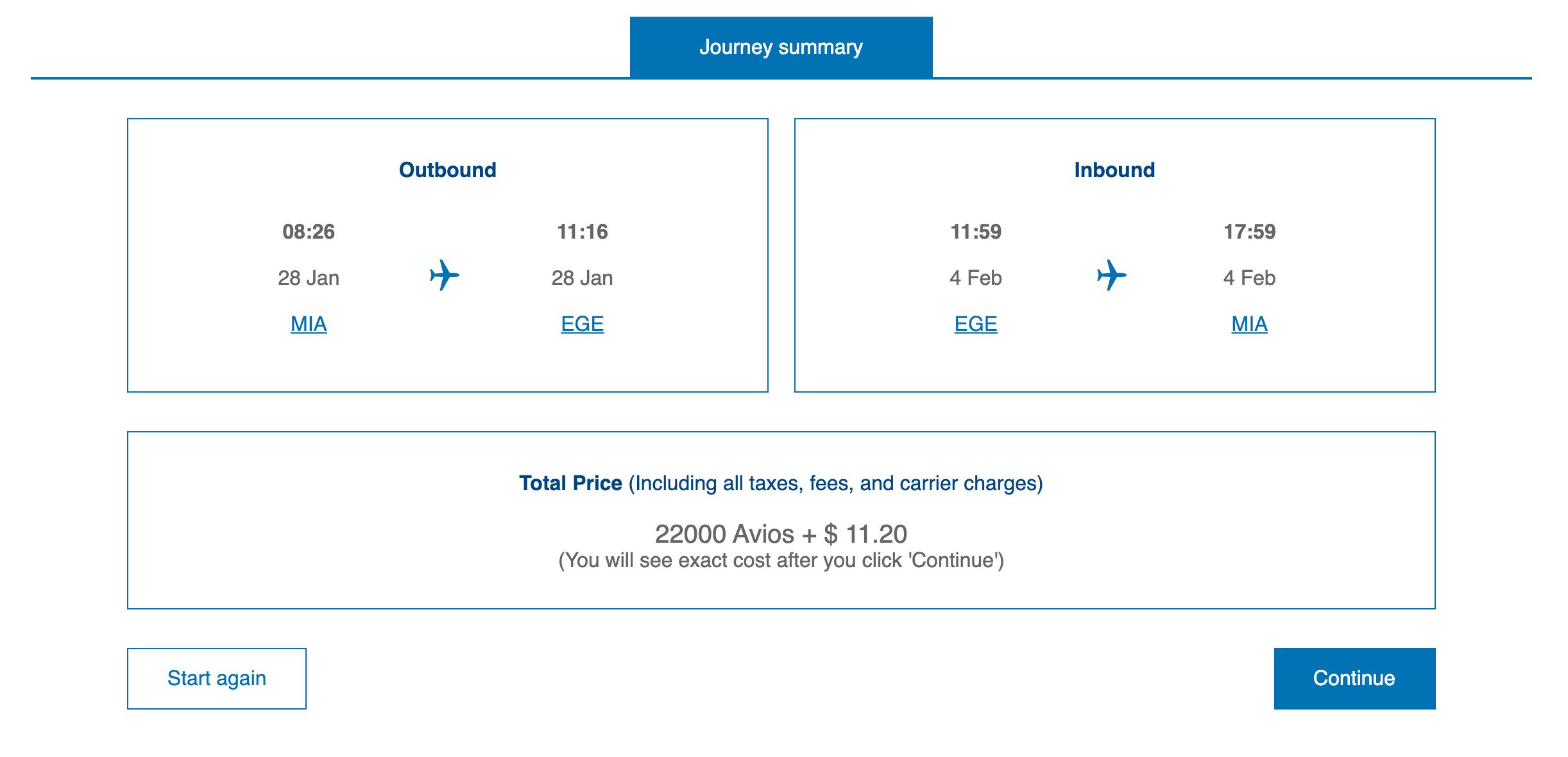

However, since these flights are available as saver-level award tickets with American, you could instead transfer just 22,000 Ultimate Rewards points to your British Airways Executive Club account to book the exact same itinerary:

(Screen shot courtesy of British Airways)

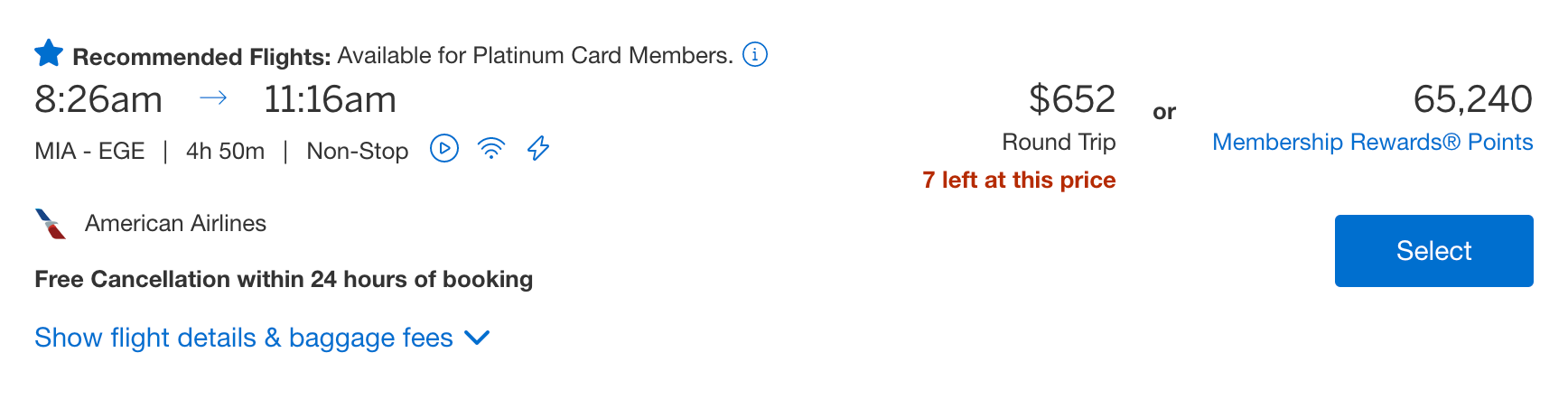

The savings are even more significant if you only have American Express Membership Rewards points. Points earned from cards like The Platinum Card® from American Express or the American Express® Gold Card are worth 1 cent each when redeemed directly for travel. For these flights, Amex Travel is actually offering a special, discounted fare: either $652 or 65,240 points:

(Screen shot courtesy of American Express)

However, you could again transfer just 22,000 Membership Rewards points to British Airways to book this same flight.

In either case, transferring points instead of using them directly results in massive point savings. You’re using roughly half of the points with Chase and nearly two-thirds fewer points for Amex.

Now, it’s worth noting that the above calculations do ignore the fact that you’d earn miles on this flight if you booked directly using points rather than transferring them. However, they wouldn’t come close to the value you’d save by transferring points from Chase or Amex to book this flight.

READ MORE: Amex Membership Rewards vs. Chase Ultimate Rewards

So what kind of points can you earn to eventually transfer to your favorite airline program? Let’s dive into the four most well-known credit card rewards currencies so you know exactly what your options are.

merican Express Membership Rewards

The Amex Gold card is just one option for earning Membership Rewards points. (Photo by Eden Batki/The Points Guy.)

American Express Membership Rewards is a favorite transferable points currency, with a value of 2 cents per point according to TPG’s latest valuations. These points can get you some incredible awards. Here are the various partners to which you can transfer your points, all with ratios of 1:1 unless otherwise noted:

Aer Lingus AerClubAeromexico Club Premier (1:1.6)Air Canada AeroplanAir France-KLM Flying BlueAll Nippon AirwaysAsia Miles (loyalty program for Cathay Pacific)Avianca LifeMilesBritish Airways Executive ClubDelta SkyMilesEmirates SkywardsEtihad GuestHawaiian Airlines Hawaiian MilesIberia PlusJetBlue TrueBlue (250:200)Qantas Frequent FlyerSingapore Airlines KrisFlyerVirgin Atlantic Flying ClubAmex also has three hotel programs as 1:1 transfer partners:

Choice PrivilegesHilton Honors (1:2) Marriott BonvoyIt’s also worth noting that American Express offers frequent transfer bonuses to these partners; the last 12 months alone have seen a variety of individual offers from the likes of Avianca and Singapore Airlines — plus a record 10 simultaneous offers that launched in Sept. 2021.

Note that these are sometimes targeted, so keep your eye on your account for these offers to pop up.

RELATED: Redeeming American Express Membership Rewards points for maximum value

With the large variety of options to use these points, it can be simple to maximize Membership Rewards for incredible travel, though you’d first need to earn them. Here are the most popular cards that earn American Express Membership Rewards points:

The Platinum Card® from American ExpressThe Business Platinum Card® from American ExpressAmerican Express® Gold CardAmerican Express® Business Gold CardThe Blue Business® Plus Credit Card from American ExpressAmerican Express® Green CardWhile many of these have lucrative welcome offers, you could be targeted for an even higher bonus through the CardMatch Tool (offer subject to change at any time). If you want to earn the maximum amount of points, consider the Amex Trifecta, and once you have one (or more) of these cards set up for online account management, don’t forget that the Amex Offers program can earn you thousands of additional bonus points.

The information for the Amex Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

RELATED: Choosing the best American Express card for you

Finally, you can also use Rakuten to earn bonus points when you buy items online. This online shopping portal partners with thousands of retailers to award you bonus cash-back for your purchases. However, you can elect to earn Membership Rewards points instead. It’s even offering a promotion for new members through March 31, 2022. You can sign-up here and earn a one-time bonus of $30 — or 3,000 Membership Rewards points — by spending at least $30 at a participating merchant in the first 90 days of joining.

READ MORE: How to use Rakuten to earn cash-back or Amex points

Chase Ultimate Rewards

You can use Chase points to book Hyatt Zilara Rose Hall in Jamaica, an all-inclusive resort. (Photo by Benji Stawski/The Points Guy)

Chase doesn’t have as many cards or transfer partners as American Express, but Ultimate Rewards points are still quite valuable. While many travelers can’t open new Chase cards due to the issuer’s 5/24 rule, many feel that Ultimate Rewards is arguably the best transferable program out there. You can transfer these points to 11 airline partners, all at a 1:1 ratio:

Aer Lingus AerClubAir Canada AeroplanAir France-KLM Flying BlueBritish Airways Executive ClubEmirates SkywardsIberia PlusJetBlue TrueBlueSouthwest Airlines Rapid RewardsUnited Airlines MileagePlusSingapore Airlines KrisFlyerVirgin Atlantic Flying ClubYou also have three hotel loyalty programs from which to choose:

World of HyattIHG Rewards ClubMarriott BonvoyRELATED: Redeeming Chase Ultimate Rewards points for maximum value

Here are the cards that earn fully-transferable Ultimate Rewards points:

Chase Sapphire Preferred CardChase Sapphire ReserveInk Business Preferred Credit CardHowever, it’s worth noting that there are two additional personal cards (the Chase Freedom Flex and Chase Freedom Unlimited) along with two small business cards (the Ink Business Cash Credit Card and Ink Business Unlimited Credit Card) that participate in the Ultimate Rewards program. However, in order to transfer points earned from those cards to partners, you must have one of the three “premium” cards linked above and then combine your Ultimate Rewards points into that account.

RELATED: The best Chase credit cards for 2022

Citi Thank You Rewards

Citi also has a transferable currency with its ThankYou Rewards program. While most of Citi’s transfer partners are international carriers, you can still get tremendous value from your points by leveraging alliances and partnerships. One TPG writer even believes it’s the most underappreciated flexible currency out there.

Here’s a list of the program’s airline transfer partners, all with a 1:1 transfer ratio.

Aeromexico Club PremierAir France-KLM Flying BlueAsia Miles (loyalty program for Cathay Pacific)Avianca LifeMilesBritish Airways Executive ClubEmirates SkywardsEtihad GuestEVA Air Infinity MileageLandsJetBlue TrueBlueMalaysia Airlines Enrich (though transfers are not currently available)Qantas Frequent FlyerQatar Airways Privilege ClubSingapore Airlines KrisFlyerThai Airways Royal Orchid PlusTurkish Airlines Miles & SmilesVirgin Atlantic Flying ClubIt also has a pair of hotel partners, though one offers a better transfer ratio than the other:

Choice Privileges (1:2)Wyndham RewardsLike Amex, Citi has offered transfer bonuses for a handful of the above programs, including Avianca and Virgin Atlantic.

Unfortunately, there is currently just a single card available that allows all of these transfers: the Citi Premier® Card. (Note that if you’re still holding into the Citi Prestige® Card — which is no longer open to new applicants — you also have the full transfer benefits.)

That said, like Ultimate Rewards, you have the ability to combine your Citi ThankYou Rewards points into a single account for select products, allowing you to effectively “convert” your fixed-value earnings from cards like the Citi Rewards+® Card or the Citi Rewards+℠ Student Card into fully transferable ThankYou points. This was even extended to the Citi® Double Cash Card in late 2019.

The information for the Citi Prestige and Citi Rewards+ Student Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

RELATED: Redeeming Citi ThankYou points for maximum value

Capital One

The newest premium card on the market earns you valuable transferable miles with Capital One. (Photo by John Gribben for The Points Guy)

The final program on this list got into the transferable points arena in late 2018. While Capital One cards had long been known for their simple, fixed-value award options, the issuer upped its game with the addition of over a dozen transfer partners to some of its most popular cards.

And 2021 was a banner year for the issuer’s portfolio, as it moved some programs to a 1:1 tier in the spring — and then moved almost all of them to this level in the fall. It also launched a brand-new credit card and opened the first-ever Capital One Lounge at Dallas-Fort Worth (DFW).

Here’s a list of the airlines that are currently available as transfer partners, with all transfers now at a 1:1 ratio unless otherwise noted:

Aeromexico Club PremierAir Canada AeroplanAir France-KLM Flying BlueAvianca LifeMilesBritish Airways Executive ClubCathay Pacific Asia MilesEmirates SkywardsEtihad GuestEVA Air Infinity MileageLandsFinnair PlusQantas Frequent FlyerSingapore Airlines KrisFlyerTAP Portugal Miles&GOTurkish Airlines Miles&SmilesThe issuer then added two hotel programs as new partners in early 2020 and another in the first week of 2022:

Accor Live Limitless (2:1)Choice PrivilegesWyndham RewardsEarly on, Capital One launched transfer bonuses to Emirates, JetBlue and Flying Blue — though this was all prior to shifting these partners to a standard, 1:1 ratio. Only time will tell if we see these return.

Here are the cards that currently earn transferable Capital One miles:

Capital One Venture X Rewards Credit CardCapital One Venture Rewards Credit CardCapital One VentureOne Rewards Credit CardCapital One Spark Miles for BusinessCapital One Spark Miles Select for BusinessThe information Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

RELATED: Best ways to maximize Capital One miles

If you’re sitting on a stash of Capital One miles, transferring them to airline partners can unlock some great awards. For full details on these options, be sure to check out our guides on how to transfer Capital One miles and when it makes sense to transfer instead of redeeming at a fixed value.

Bottom line

Earning and burning points can prove to be a bit of effort, and that’s certainly the case with transferable point currencies from Amex, Chase, Citi and Capital One. However, making the shift from using your points directly for travel to transferring them to airline or hotel partners is one of the most critical steps to take when you want to extend the value of your rewards. It also provides immense flexibility when you need to book something last minute, as you’re not locked into a single rewards program.

It may take some time to do so, but when you are able to take trips on Singapore Airlines’ new A380 suite or British Airways’ 777 first class, it makes all of the effort worth it!

Just be aware that, once you transfer your points to a given loyalty program, it’s not refundable. If you wind up canceling your trip, your points or miles will be refunded to the airline or hotel program, not the credit card currency.

Check out our best travel credit cards for more of our top choices of cards that offer transferable rewards.

Featured photo by Zach Honig/The Points Guy.

Jasmin Baron contributed to this post.

Title: How (and why) you should earn transferable points in 2022

Sourced From: thepointsguy.com/guide/a-guide-to-earning-transferable-points/

Published Date: Wed, 12 Jan 2022 22:14:41 +0000

No comments:

Post a Comment