HOSTED BY: 1 AIR TRAVEL

Editor’s note: This guide has been updated with the latest information.

Cellphone protection can be an extremely valuable benefit, and it’s available on increasingly more credit cards, with the Capital One Venture X Rewards Credit Card as the latest to add this protection.

Personally, I use the Ink Business Preferred Credit Card from Chase to pay my cellphone bill, as it now covers up to $1,000 per claim for repairs or replacement (up to three claims in a 12-month period) after a $100 deductible per claim.

Damaged or stolen phones are covered, but lost phones are not. For stolen phones, a police report must be filed within 48 hours of the incident.

On my tour of the Pacific islands several years ago, my iPhone was no match for the mighty Pacific. Water damage was not covered by my iPhone warranty, so I was looking at a $549 fee for an out-of-warranty replacement. Luckily, my Chase Ink Business Preferred had me covered, and I was able to submit this expense for reimbursement, minus the $100 deductible.

To be eligible for cellphone protection, you only need to have paid the bill preceding the incident with your Ink Business Preferred card. You don’t need to have purchased the cellphone or paid for the repair with the card.

I’ll take you through the step-by-step process of submitting an insurance claim for the Ink Business Preferred in case you find yourself in the unenviable position of needing it. You can submit a claim over the phone, but it’s much easier to do online.

Before you start, be sure to have the following information available, including the documents in digital form ready to upload.

Ink Business Preferred credit card number.Cellphone purchase date.Bill pay date (prior to incident).Cellphone make, model and serial number.Claim amount.Description of incident.Document: Credit card statement prior to incident.Document: Cellphone statement prior to incident.Document: Police report (if phone was stolen).Document: Device summary that shows serial/IMEI number and link to wireless account.Document: Diagnosis and service summary (if applicable).Document: Receipt for repair/replacement.Your first step is going to cardbenefitservices.com. If you don’t already have an account, you will need to create one.

(Screenshot courtesy of Asurion)

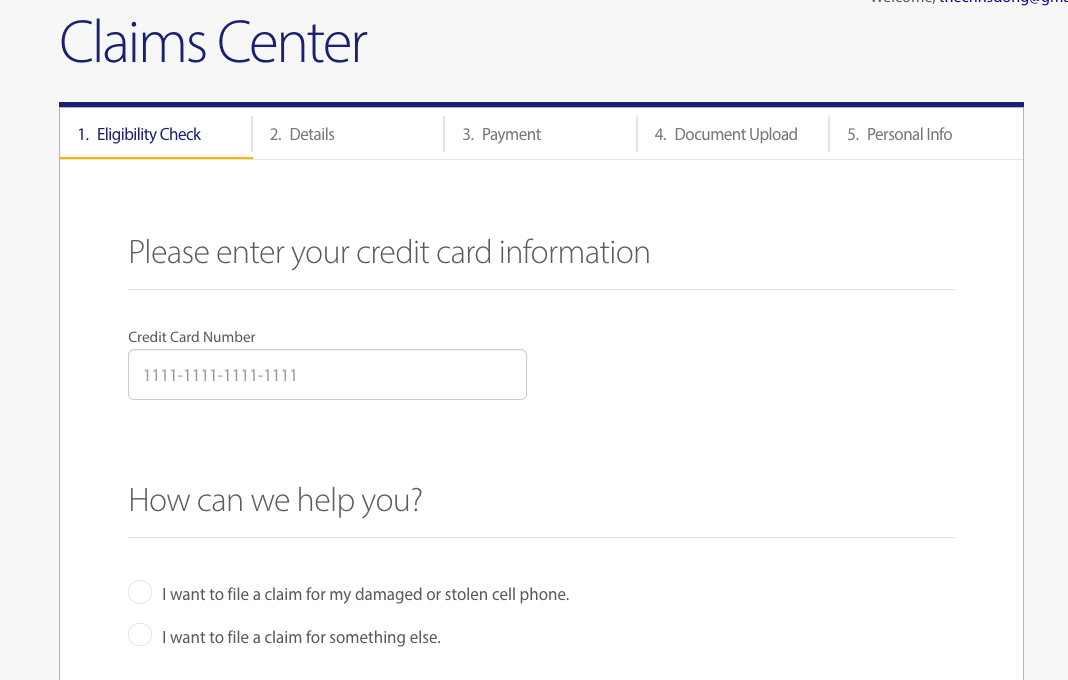

Once you’re logged in, you’ll be taken to the Claims Center, from which you can submit or manage claims and products.

(Screenshot courtesy of Asurion)

Select “File a claim” and you’ll be taken through five straightforward steps to submit the claim.

(Screenshot courtesy of Asurion)

The reimbursement method gives you the choice of a mailed check or a payment to your card. For the latter, a card benefits representative will call you for your card information.

Four documents are required (five if the phone was stolen), but I added three more on my own to expedite the processing.

This is what I submitted for each document:

Cellular wireless telephone account (required): Full PDF of most recent cellphone bill.Service provider billing statement (required): Full PDF of most recent phone bill.Device summary page (required): Photo of receipt from AT&T store of my cellphone purchase, which listed device IMEI number.Credit card statement (required): Full PDF of most recent credit card statement.Apple service confirmation (my add): Diagnostic report from Apple Genius Bar confirming phone damage.Apple service receipt (my add): Shows the amount I paid for the repair.Credit card line item for cellphone payment (my add): The most recent cellphone bill was paid after my most recent credit card statement, so I included this.Rather than wait for a benefits administrator to approve the claim and ask for diagnostic information and a replacement receipt, I added those initially. I didn’t know if the credit card line item would be needed, but I wanted to eliminate any back and forth and give them everything they could possibly need to approve the claim.

When I finished the steps and returned to the Claims Center, I could select “Manage claims” and see that my claim was under review.

The next day, I received notice the claim had moved to adjudication, and the following day I was told a check was in the mail. Five business days later, a letter arrived and inside was a check for $449, which equaled the pretax cost of the phone replacement minus the $100 deductible.

In all, it took seven business days from when I filed my claim until I received my check. Presumably, it would have been even faster if I had chosen payment directly to my card.

I’d highly recommend ditching handset protection fees from a cellphone provider and paying your monthly bill with a credit card that offers handset protection, like the Ink Business Preferred.

Related: Credit cards that offer cellphone protection

Additional reporting by Chris Dong.

Featured photo by John Gribben for The Points Guy.

Title: How to submit a cellphone insurance claim for the Ink Business Preferred

Sourced From: thepointsguy.com/guide/how-to-submit-cell-phone-insurance-claim-ink-business-preferred/

Published Date: Tue, 11 Jan 2022 20:59:16 +0000

No comments:

Post a Comment