HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information.

After many years of building a solid portfolio of fixed-value and cash-back credit cards, Capital One took a big step forward by adding airline and hotel transfer partners to its popular lineup of cards under the Venture and Spark brands. This was big news at the time, but it might not have moved the needle much for some rewards-seekers. After all, many of the most valuable transfer partners are already partnered with Chase Ultimate Rewards and American Express Membership Rewards.

However, Capital One’s distinctive achievement was to combine transferable miles and fixed-value redemptions. Then, throughout 2021, Capital One began huge improvements to its program, adding new transfer partners and improving many transfer rates. As it stands, the program has 17 transfer partners in total, one of the largest rosters of loyalty partners of any transferable points program.

In this guide, we’ll go through some strategies for maximizing your return with Capital One miles.

Want more credit card news and advice from TPG? Sign up for our daily newsletter.

In This Post

Earning Capital One miles

Five cards earn Capital One miles rather than just cash back — here’s a look:

Capital One Venture Rewards Credit Card

(Photo by The Points Guy)Current bonus: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.Benefits: 2 miles per dollar on purchases, Global Entry/TSA PreCheck application fee credit (up to $100).Annual fee: $95.

Read our review of the Capital One Venture card.

Capital One Venture X Rewards Credit Card

(Photo by The Points Guy)Current bonus: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.Benefits: 2 miles per dollar on purchases, Global Entry/TSA PreCheck application fee credit (up to $100) every four years, no foreign transaction fees, extended warranty protection, Priority Pass Select membership, Capital One Lounge access and 10,000 annual bonus miles.Annual fee: $395.

Read our review of the Capital One Venture X credit card.

Capital One VentureOne Rewards Credit Card

(Photo by The Points Guy)Current bonus: 20,000 bonus miles after you spend $500 on purchases within the first three months of account opening.Benefits: 1.25 miles per dollar on purchases.Annual fee: $0.

Read our review of the Capital One VentureOne card.

Capital One Spark Miles for Business

(Photo by John Gribben for The Points Guy)Current bonus: 50,000 bonus miles after you spend $4,500 on purchases within the first three months of account opening.Benefits: 2 miles per dollar on all purchases.Annual fee: $0 introductory annual fee the first year, then $95.

Read our review of the Capital One Spark Miles for Business card.

Capital One Spark Miles Select for Business

(Photo by John Gribben for The Points Guy)Current bonus: 20,000 miles after you spend $3,000 on purchases within the first three months of account opening.Benefits: 1.5 miles per dollar on all purchases; free employee cards.Annual fee: $0.

The information for the Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Read our review of the Capital One Spark Miles Select card.

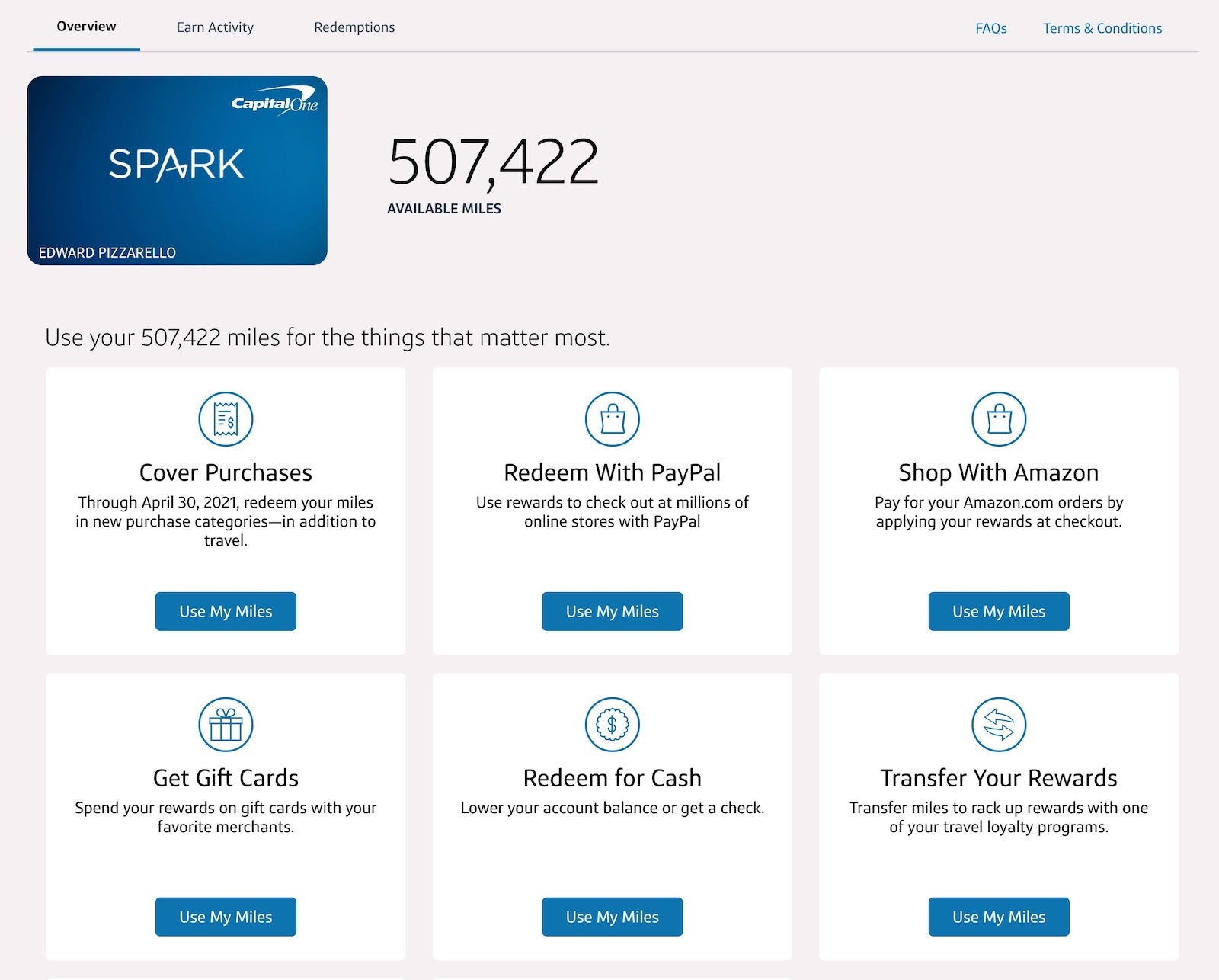

Capital One redemption options

(Photo by Eric Rosen/The Points Guy)

You have two broad options for redeeming your Capital One miles: for a fixed value or transferring them to airline and hotel partners.

Transferring will usually get you a better value. Still, it’s the ability to mix and match redemptions to suit your personal travel needs that gives Capital One a unique edge over the competition.

Let’s take a closer look at these two redemption alternatives.

Related: Should you use cash or miles to book airline tickets?

Fixed-value rewards

Capital One provides a few options for getting a fixed-value return when you redeem your miles. However, not all of these are created equal:

Redeem for recent travel: You can use your miles to redeem for recent eligible travel purchases made in the last 90 days on your Venture or Spark card at a fixed rate of 1 cent each. There’s no minimum redemption amount. You can redeem for purchases made with airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and timeshares.Book new travel: You can book new travel directly through Capital One and redeem your miles at the same value of 1 cent apiece, but this would prevent you from double dipping with any rewards program offered by an online travel agency. Bear in mind that booking hotels through a third-party site (including Capital One) would likely prevent you from earning points or miles and enjoying applicable elite status perks. As a result, you’re likely better off booking travel directly and then redeeming miles for recent travel.Redeem for gift cards: You can use your Capital One miles for gift cards at the same rate of 1 cent per mile, but since gift cards can often be purchased on sale, redeeming miles to cover travel purchases is a better option.Redeem for cash back: You should do everything possible to avoid this option, as it will only provide a redemption value of 0.5 cents per mile.If you aren’t in the mood to search for award availability or you’ve found a screaming deal for cash airfare, redeem your Capital One miles at a fixed value. The process is relatively easy and doesn’t require jumping through any hoops.

Here’s a step-by-step guide showing how to use your Capital One miles at a fixed value.

How to redeem Capital One miles at a fixed value

First, sign in to your Capital One account, click on your mileage balance (located below the card icon) and you’ll be taken to the rewards page. There, you’ll see four fixed-value redemption options — you can use your miles for travel, gift cards or cash, or transfer them to another account.

(Screenshot from capitalone.com)

When it comes to redeeming miles for travel, you can either book new travel or use the miles as a statement credit against previous travel purchases. Regardless of which route you take, the redemption rate when using Venture miles for travel is always 1 cent per mile.

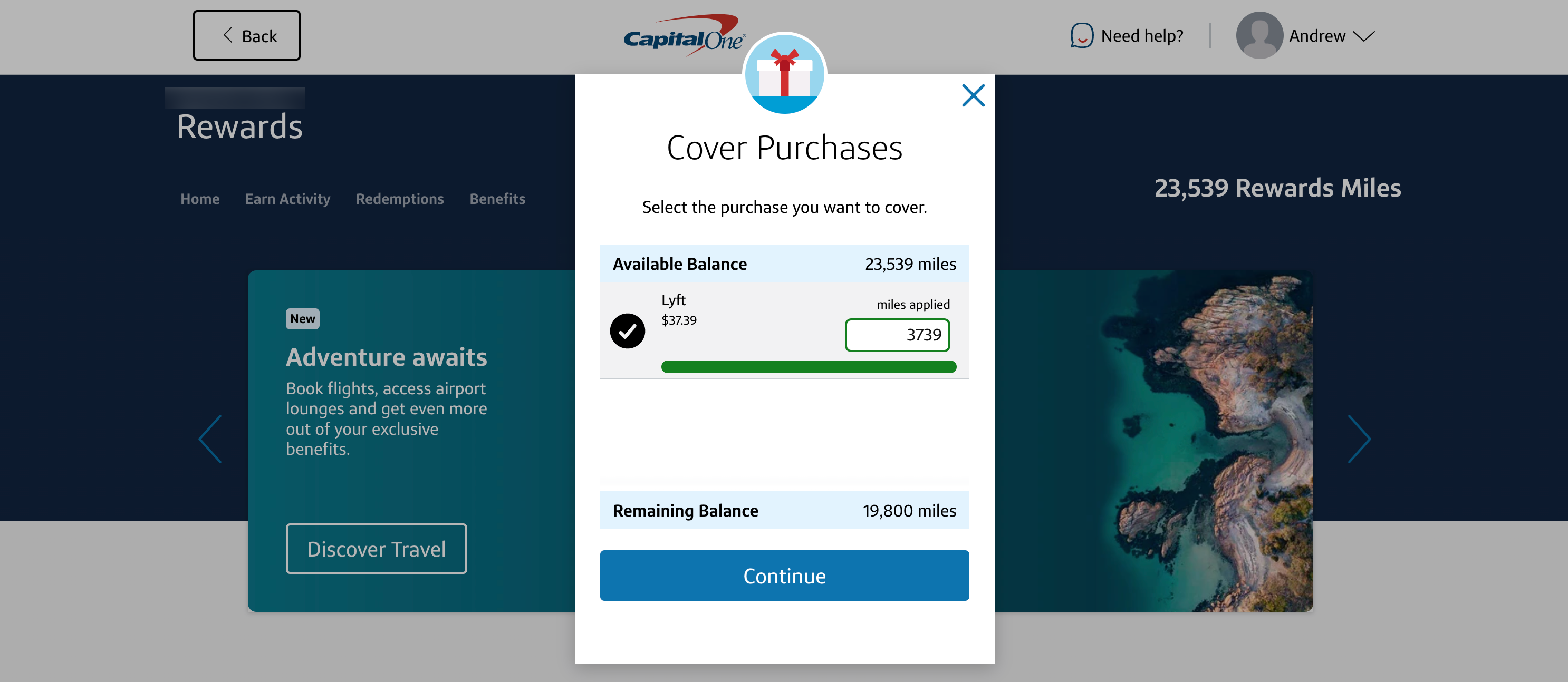

Option 1: Redeem a previously made travel purchase

Clicking “Redeem Travel Purchases” will bring you to a screen with all your eligible travel purchases made with the card in the last 90 days. The term “travel” is used quite broadly and includes everything from flight and hotel bookings to Uber and Airbnb purchases. From there, you’re just two clicks away from essentially erasing travel expenses from your statement.

(Screenshot from capitalone.com)

After selecting the purchase you would like to redeem to cover, you can either approve the redemption outright or edit the number of miles used for a partial credit of the charge. Note that there is no minimum redemption amount unless you’re redeeming for partial credit, in which case you’ll need to use at least 2,500 miles.

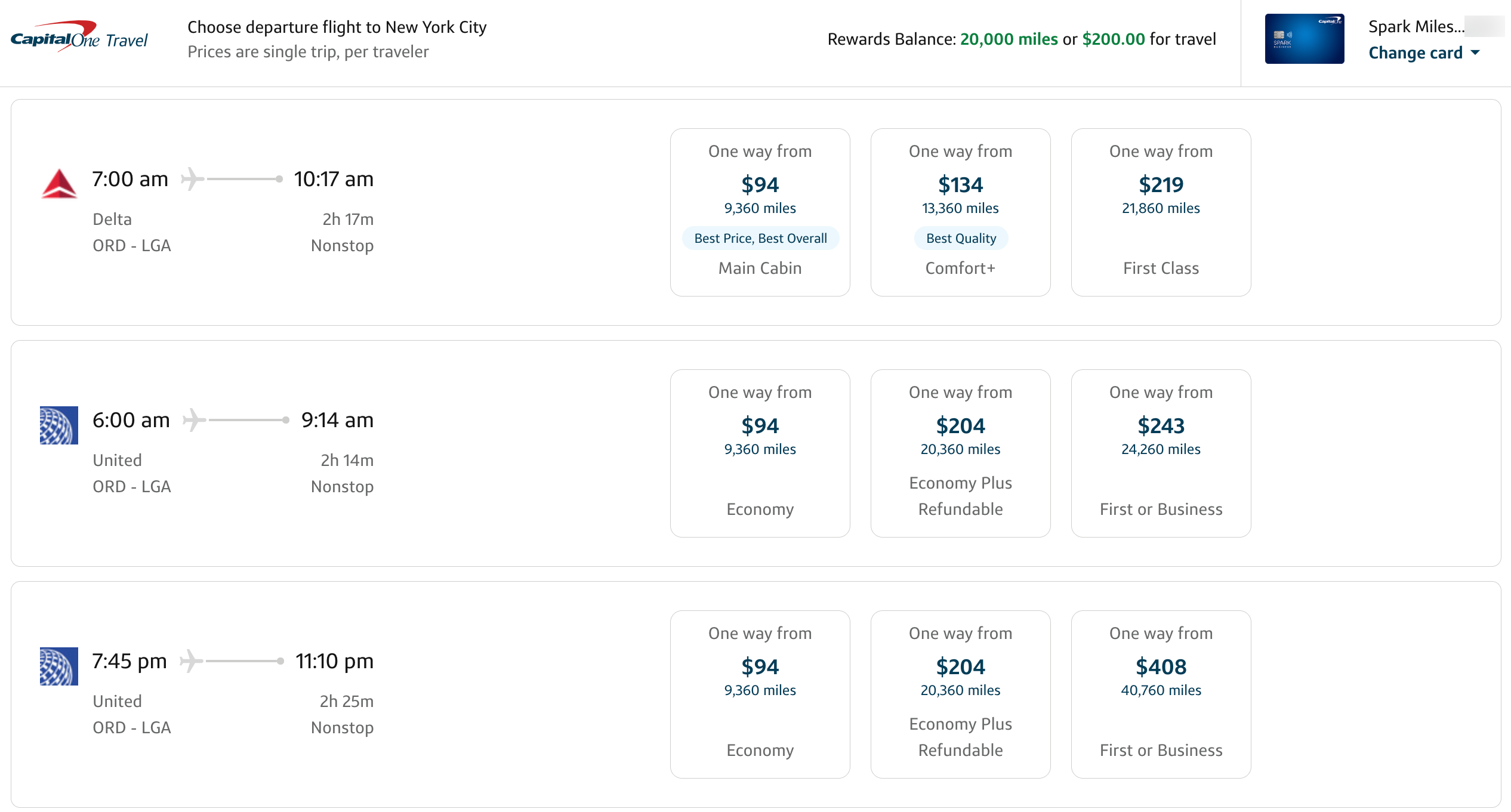

Option 2: Book new travel through Capital One

Alternatively, you can use your miles to book new travel directly through Capital One. The portal looks like any other booking site, and since the miles have a fixed value, you’ll never need to worry about blackout dates or award restrictions.

However, you’ll probably be better off booking your travel using an online travel agency such as Orbitz or Hotels.com and then offsetting the purchase using the method previously described. This is because many OTAs have their own rewards programs and appear on cash-back shopping portals, so you can double or triple dip and get even more cash back.

Again, remember that booking through Capital One or another OTA means you won’t be able to earn hotel points or use elite status perks on your booking. In most cases, you have to book directly in order to use these benefits. On the other hand, you can use your airline elite status benefits when you book through an OTA.

(Screenshot from capitalone.com)

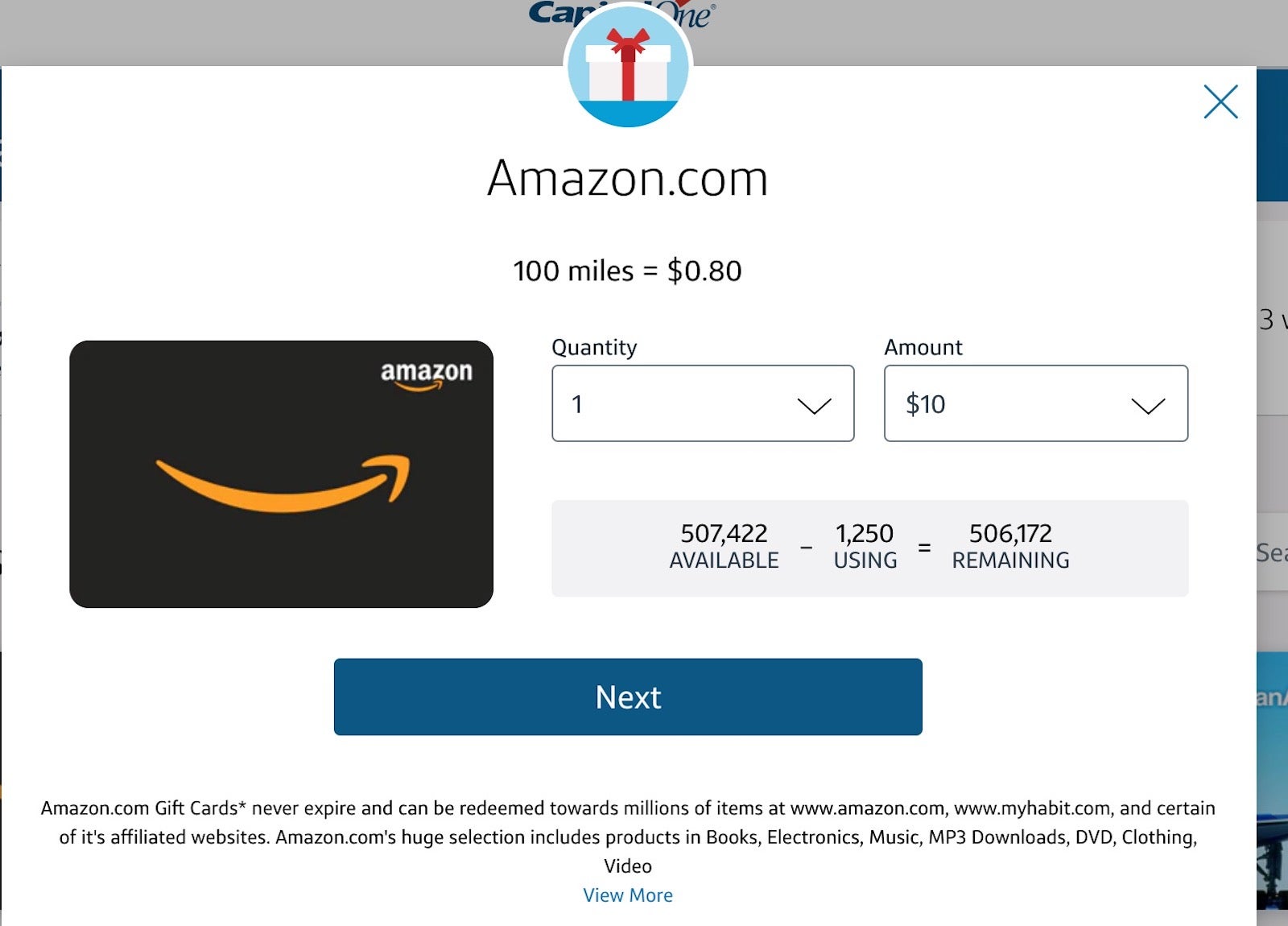

Option 3: Redeem miles for gift cards

Miles typically maintain the same fixed value of 1 cent apiece when redeeming gift cards. The one major exception is Amazon gift cards, in which case miles are only worth 0.8 cents each. You can often buy gift cards with a discount or cash back, so you’re better off using your miles to offset travel expenses first.

(Screenshot from capitalone.com)

Option 4: Shop online

Another option is to redeem miles directly when shopping online and checking out through PayPal or Amazon. However, you’ll only get 0.8 cents in value this way, too. As such, you should probably avoid this redemption option.

Option 5: Redeem for cash back

The least valuable redemption option is cash in the form of an account credit or a check by mail. You’d probably want to avoid this option because the miles’ value is cut in half when using this method and clocks in at a mere half-cent per mile.

Option 6: Transfer miles to another account

The final way to redeem your miles is by transferring your miles to another account. There is no cost associated with this and as long as the other person holds a miles-earning card, there are no restrictions as to whom you can send them to.

Transfer to airline partners

If you’re looking to get higher value for your miles, transferring to airline partners may be your best bet.

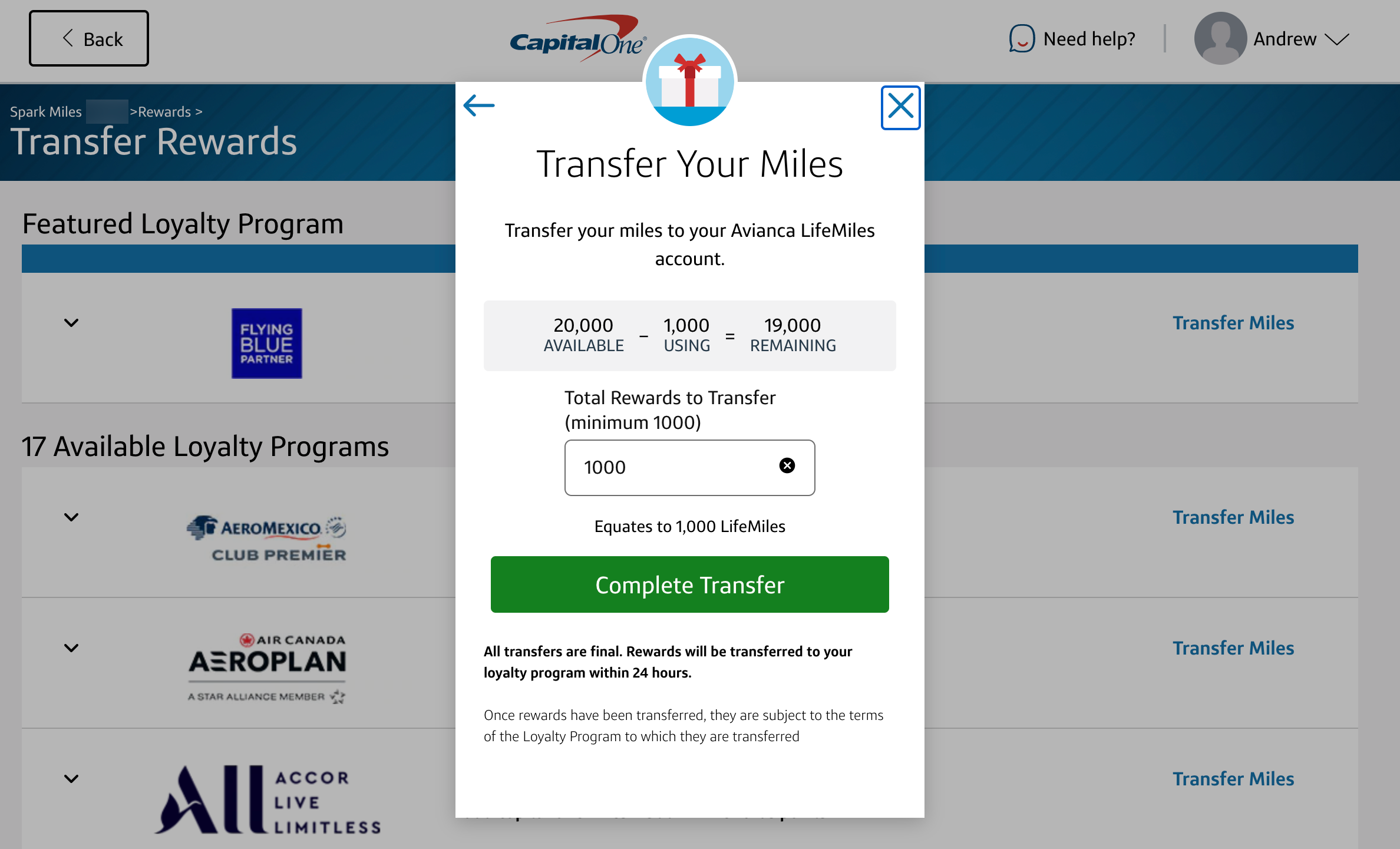

(Screenshot from capitalone.com)

Here’s a high-level overview of the program’s airline transfer partners, most of which are now converted on a 1:1 basis from Capital One miles, and some sample redemption values.

ProgramMiles needed for a one-way domestic flightCapital One miles needed Transfer ratioOnline booking?Aeromexico Club Premier40,000-44,000 / 80,000-88,000*40,000-44,000 / 80,000-88,0001:1YesAir Canada Aeroplan12,500 / 25,00012,500 / 25,0001:1YesAir France-KLM Flying BlueDynamicDynamic1:1YesAvianca LifeMiles7,500 – 12,500 / 25,0007,500 – 12,500 / 25,0001:1YesBritish Airways Avios9,000 – 25,750 / 16,500 – 77,2509,000 – 25,750 / 16,500 – 77,2501:1YesCathay Pacific Asia Miles15,000 / 45,00015,000 / 45,0001:1YesEmirates SkywardsVaries based on carrier and routeVaries based on carrier and route1:1YesEtihad Guest12,500 / 25,00012,500 / 25,0001:1NoEVA Infinity MileageLands39,000 / 58,00052,000 / 77,3332:1.5YesFinnair Plus27,000 / 51,00027,000 / 51,0001:1NoQantas Frequent Flyer18,000 / 36,00018,000 / 36,0001:1YesSingapore Airlines KrisFlyer (United)25,000 / 40,00025,000 / 40,0001:1YesSingapore Airlines KrisFlyer (Alaska)7,500-12,500 / 17,500-47,0007,500-12,500 / 17,500-47,0001:1NoTAP Air Portugal Miles&Go30,000 / 45,00030,000 / 45,0001:1YesTurkish Airlines Miles&Smiles7,500 / 12,5007,500 / 12,5001:1Yes* Uses dynamic pricing and is often higher than award charts.

Given the earning rate of 2 miles per dollar on the Spark and Venture cards, you can effectively think of them as earning 1.5 or 2 partner airline miles per dollar spent on every purchase, depending on the partner. Just keep in mind that these partners have variable transfer times, so check out our guide to Capital One transfer times so you know how long you’ll have to wait for your miles to post.

Redeeming miles for travel vs. transferring to airlines

If you’re redeeming miles for recent travel with Capital One, you have your pick of airlines. (Photo by Alberto Riva/The Points Guy)

Capital One’s Venture and Spark Miles cards have always allowed cardholders to redeem miles for travel, which lets you redeem your miles for 1 cent each as statement credits toward any travel purchase that you’ve made within the last 90 days. So how do you decide when to transfer miles and when to redeem for travel to book a domestic flight, for instance?

1. Cost

The easiest way to get started looking for a flight is to search Google Flights for your desired itinerary. As noted above, the least expensive domestic round-trip awards require you to transfer 15,000 Capital One miles to Turkish Miles&Smiles. As a result, if you find any highly discounted fares for $150 round-trip or less, it’s probably best to redeem miles for travel.

If the flights are more expensive than $150, it’s still critical to know the cost in dollars since that price will translate to the number of Capital One miles required. Just add two zeros to the end; a $500 ticket, for example, will cost 50,000 Capital One miles if you redeem miles for travel. This information comes in handy if there’s no award space available.

2. Award availability

Next, look for award availability at the lowest mileage levels using the major domestic carriers’ websites (American, Delta and United) or ExpertFlyer (owned by TPG’s parent company, Red Ventures). When you find saver-level award space, you can use the chart above to see how many airline miles it will require.

3. Factor in mileage earning and upgrade opportunities

When you redeem miles for travel, you can book tickets the way you normally do. That means you can earn miles from the flight and credit toward elite status. If you currently hold elite status, you should still enjoy all of your elite status benefits, including being eligible for upgrades.

That said, you may not receive those benefits when you transfer your Capital One miles to a partner. Generally, you won’t earn miles or elite qualifying credit on award tickets. However, you may be able to use some elite status benefits on award tickets — even if you’re booking with a partner.

For example, a United Gold member booking a Lufthansa flight through Turkish Miles&Smiles may receive their Star Alliance Gold benefits like free checked bags and lounge access. In order to access these benefits, however, you must call the airline and have them replace your Turkish frequent flyer number with your United frequent flyer number.

4. Consider taxes and fees

All frequent flyer programs will add Transportation Security Administration taxes at a minimum, which will be $5.60 each way on nonstop flights. However, some programs tack on hefty surcharges on top of that. This is worth remembering before transferring Capital One miles.

5. Think about the risks and hassle factor

When you are faced with the choice of redeeming miles for recent travel or transferring miles to frequent flyer programs, consider the time it could cost you, especially if the airline doesn’t offer online booking for partner award tickets. You may have to create a new account and spend time calling the airline.

There’s also the risk that the airline won’t be able to see the award you want or that the award could disappear before you receive your airline miles. For these reasons, you should probably redeem miles for travel if you’re not going to save a lot of miles by transferring them. That’s especially true when you aren’t familiar with the frequent flyer program or don’t want to spend too much time on the booking process. As with other transferable points programs, all transfers are irreversible.

Related: Capital One Venture Rewards Card: When to redeem miles vs. transferring to airline partners

Maximizing airline transfer partners

TPG values Capital One miles at 1.85 cents apiece, thanks to the value you can get by transferring to a handful of partner programs. To keep things simple, I’m going to split the list of transfer options into three groups:

Those you should avoid.Those you should use only in specific circumstances.Those that consistently offer high value.Because of the wide variety of transfer partners, you can use Capital One miles to fly all three major alliances: SkyTeam, Star Alliance and Oneworld.

Bad transfer options

EVA, Finnair and TAP Air Portugal don’t offer enough value in their loyalty programs to consider transferring your Capital One miles to them. Although there might be a specific route or redemption that gives you a good return, the overall process will be plagued by some combination of high fuel surcharges, difficult websites and customer service, and limited award availability. It isn’t worth the time.

Aeromexico also appears on the “avoid” list despite a few decent SkyTeam redemption options (like round-the-world tickets). This is because the carrier uses kilometers instead of miles, thus boosting award rates by roughly 60% over “standard” mileage charts. If you find value in Aeromexico’s Club Premier program, you should transfer points from Amex Membership Rewards at a 1:1.6 ratio instead to compensate for this inflated award pricing.

Under the right circumstances, you can get some solid value from Flying Blue. (Photo by Emily McNutt/The Points Guy) verage transfer options

Air France-KLM Flying Blue: Flying Blue can be a good option, especially if you’re able to take advantage of one of the carrier’s monthly promo awards that offer discounts of 25%-50% on select routes. However, dynamic pricing makes it impossible to talk about Flying Blue redemptions in general terms because award rates can vary significantly from one day to the next. Also, keep in mind that Flying Blue adds additional surcharges to Delta awards.

Cathay Pacific Asia Miles: Asia Miles uses a distance-based award chart, so Cathay Pacific flights from the U.S. to Asia end up being expensive due to their length. Still, it might be worth paying up for one of the world’s best first-class products or nonstop flights to Asia from cities like Boston and Washington, D.C. You can also find good values on some shorter domestic American and Alaska flights and Oneworld awards from the East Coast to Europe. However, you’ll need to contend with the carrier’s challenging award booking engine.

British Airways Avios: British Airways is another Oneworld carrier that uses a distance-based award chart. There are some sweet spots, such as short- and medium-haul domestic flights. You can sometimes get more value by converting these points to other Avios programs, such as Iberia Plus.

Emirates Skywards: Although Emirates’ fuel surcharges aren’t as high as they once were, the award rates still aren’t necessarily amazing. Emirates also doesn’t have many partner airlines you can book awards on.

Singapore Airlines KrisFlyer: KrisFlyer is useful for those looking to fly long-haul business or first class on Singapore as the airline doesn’t release awards to partner airlines. There are also some good deals like domestic U.S. business-class awards for 23,000 miles each way, but you’ll likely be better off booking these awards through Turkish Miles&Smiles as it charges fewer miles.

Qantas Frequent Flyer: Qantas is another program that uses a distance-based award chart for Oneworld flights, but it generally isn’t the most rewarding. One advantage of using the Frequent Flyer program is that you might have access to additional premium-class Qantas award space that other partners can’t book.

Qantas also partners with Israeli flag carrier El Al. You can get a good value redeeming Qantas miles to Israel, especially for business-class flights on El Al’s new 787 Dreamliner between Newark and Tel Aviv.

High-value options

Most of the value of Capital One miles comes from four transfer partners. Aside from Turkish Miles&Smiles, all of them are also 1:1 transfer partners of American Express Membership Rewards.

Air Canada Aeroplan: Air Canada’s loyalty program, Aeroplan, has long been one of the most popular options for booking Star Alliance awards, especially in premium cabins. With United’s switch to dynamic award pricing, it’s more important than ever to leverage foreign partners with award charts that set fixed mileage prices, and Aeroplan is a great option.

The program’s award chart recently underwent a major overhaul and it eliminated fuel surcharges for partner redemptions, bringing mostly positive changes to the program. Sweet spots include short-haul economy flights under 500 miles for just 6,000 Aeroplan miles. Or, you can book transcontinental business-class awards for just 25,000 miles each way — well below what United would charge if you booked directly through its MileagePlus program.

Related: The best ways to maximize Air Canada’s Aeroplan program

Aeroplan is great for booking short-haul domestic flights. (Photo by Zach Honig / The Points Guy)

Avianca LifeMiles: Avianca LifeMiles once was a relatively obscure program that only the points pros knew about, but Capital One and Amex have helped bring it into the limelight. One of its biggest advantages is that it doesn’t pass on fuel surcharges from partner airlines, so you can book Lufthansa first-class awards for 87,000 miles and just $5.60 in taxes.

(Screenshot from lifemiles.com)

LifeMiles also has the odd but consumer-friendly policy of discounting mixed-cabin awards, such as the one-way first-class award on ANA below from Chicago to Okinawa, Japan. The LifeMiles award chart says that this flight should cost 90,000 miles, but because your connection from Tokyo to Okinawa is in economy, you end up saving about 6,800 miles.

(Screenshot from lifemiles.com)

Etihad Guest: Despite not being a member of one of the three major alliances, Etihad has a partnership with American Airlines that allows for reciprocal mileage redemptions.

The best news is that Etihad’s pricing for American awards matches what AAdvantage used to charge before its large-scale devaluation in 2016. This means that — if you can find saver-level award space — you can fly from the U.S. to Europe for only 50,000 miles each way in business class.

(Screenshot from etihadguest.com)

American is also the last of the U.S. airlines to offer a true first-class cabin, which you can find flying to select European, Asian and South American destinations. Award space is tough to come by, but you can fly from Miami to London for only 62,500 Etihad Guest miles each way if you do find it.

Etihad has several other niche partners as well, and its currency continues to be one of the most underrated out there. Another great redemption option is using 44,000 miles to fly business class in Royal Air Maroc’s 787 from New York to Casablanca, Morocco. Etihad devalued Royal Air Maroc redemptions by pricing awards by segment, but nonstop routes from the U.S. are still an incredible deal.

Turkish Miles&Smiles: Turkish offers several sweet spots for Star Alliance-operated flights and has gotten more user-friendly with the addition of an online booking tool.

The program prices award flights on region-based award charts. Since Hawaii is included in the North America region, you can book United flights to the Aloha State for the same amount as any other domestic flight — just 7,500 miles each way in economy or 12,500 miles each way in business class. Alternatively, you could fly on United’s premium transcontinental routes at the same prices. These rates are a fraction of what United normally charges for these flights if you were to book your awards directly.

Other gems include flights from the U.S. to Mexico on United for 10,000 Turkish miles one-way in economy and 15,000 in business class. Or, you can head to Europe in business class for just 45,000 miles one-way on Star Alliance airlines. Turkish doesn’t charge any fuel surcharges on United flights, though they can be high on other partners like Austrian and Lufthansa.

Related: Turkish Miles&Smiles: Why you should care about the hottest frequent flyer program of the year

Use Turkish Miles&Smiles to fly to Hawaii for cheap. (Photo by James R.D. Scott/Getty Images)

Transferring miles to hotels

Capital One has continued to grow its transfer partner list. You can now transfer Capital One miles to the following hotel loyalty programs:

Wyndham Rewards: 1:1 (1,000 Capital One miles = 1,000 Wyndham Rewards points).Accor Live Limitless: 2:1 (1,000 Capital One miles = 500 ALL points).Choice Privileges: 1:1 (1,000 Capital One miles = 1,000 Choice Privileges points.If you plan on staying at an Accor property, including one of its higher-end Fairmont hotels, this can be a decent deal. The program uses a fixed-value redemption scheme, where you can redeem 2,000 points for a 40-euro discount on your hotel stay (about $42). Since you’d need to transfer 4,000 Capital One miles to get 2,000 ALL points, transferring is guaranteed to give you a better value than redeeming miles for travel.

Wyndham redemptions also recently got more valuable now that the transfer ratio is 1:1, as opposed to 2:1.5. Our valuations here at TPG peg Wyndham points at 1.1 cents apiece, though it’s not impossible to get a higher value.

Meanwhile, Choice Privileges can provide solid value as well. The program generally charges between 6,000 and 35,000 points for a free night. The two exceptions to this are hotels in the Asia Pacific region, which can cost up to 75,000 points per night. You usually won’t get great value for your points when redeeming at these high points costs. Just note that you can only reserve a room using points within 100 days of your stay.

Bottom line

Capital One miles have become much more valuable over the last few years thanks to the introduction of new transfer partners, improved transfer ratios and elevated welcome bonuses on its credit cards. Almost all airline partners now transfer at a 1:1 ratio, which is phenomenal considering the Capital One Venture Rewards Credit Card earns 2 miles per dollar on everyday purchases.

With 17 transfer partners, Capital One offers one of the most diverse transferable points programs out there. The beauty of Capital One miles comes from the ability to combine transfer partner redemptions with fixed-value redemptions to suit your travel needs.

Additional reporting by Ethan Steinberg and Joseph Hostetler.

Featured photo by Zach Griff/The Points Guy.

Title: Tips and tricks to get maximum value from your Capital One miles

Sourced From: thepointsguy.com/guide/redeeming-capital-one-miles-maximum-value/

Published Date: Wed, 18 May 2022 16:00:20 +0000

No comments:

Post a Comment