HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Delta SkyMiles® Reserve American Express Card overview

The Delta SkyMiles® Reserve American Express Card provides a bevy of great perks when flying on Delta, as well as the ability to earn elite status through spending on the card. It’s best suited for frequent flyers who want Delta-specific perks, including lounge access, a boost toward elite status and a domestic companion certificate after each account anniversary. Card rating*: ⭐⭐⭐½

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

While the Delta Reserve has a hefty $650 annual fee (see rates and fees), it offers many helpful benefits to offset that price tag and can offer lots of value to businesses with Delta loyalists.

In February 2024, Delta refreshed its credit card lineup, increasing annual fees, introducing new perks, enhancing existing benefits and restricting lounge access across the board, so there are several changes you’ll want to keep in mind if you were looking at this card previously.

This card has a recommended credit score of at least 670.

Here is a closer look at the Delta Reserve Amex and its benefits so you can decide whether it’s the right card for you.

Delta Reserve Amex pros and cons

ProsConsDelta Sky Club access when flying DeltaAnnual companion ticket for travel on DeltaAbility to earn elite status through spendingHigh annual fee (see rates and feesOther Delta cobranded cards offer superior earning categoriesDelta Reserve Amex welcome offer

The Delta Reserve Amex is currently offering 100,000 bonus miles after you spend $6,000 in purchases on your new card in your first six months of account opening. Offer ends March 27.

TPG’s valuations peg Delta SkyMiles at 1.2 cents each, making 100,000 bonus miles worth $1,200 and matching the best offer we’ve ever seen on this card.

THE POINTS GUY

Some applicants won’t be eligible for this welcome offer. Specifically, due to Amex’s one-bonus-per-card-per-lifetime rule, you typically won’t qualify if you currently have this card or have had previous versions. Amex may also consider the number of American Express cards you’ve opened and closed, as well as other factors, when determining whether to offer you a welcome bonus.

Thankfully, Amex will tell you if you aren’t eligible for the welcome offer after submitting your application but before Amex pulls your credit. So, if you’re hoping to snag the welcome bonus, pay attention to any messages or warnings that show up after you apply.

Related: What credit score do you need to get Delta SkyMiles cards?

Delta Reserve Amex benefits

The Delta Reserve Amex offers several useful perks for frequent Delta flyers.

Lounge access

Currently with the Delta Reserve Amex, primary and additional cardmembers get unlimited access to Delta Sky Club lounges when traveling on a same-day, Delta-marketed or Delta-operated flight.

Starting in February 2025, that will change to 15 free annual visits, with unlimited annual visits after spending $75,000 in a year. Cardmembers can also pay a fee of $50 per person per location for Sky Club access when traveling on a Delta partner airline flight not marketed or operated by Delta.

ALBERTO RIVA/THE POINTS GUY

The Delta Reserve Amex will also get you into American Express Centurion Lounges for free when flying Delta with a ticket purchased on a U.S.-issued American Express card. You can bring up to two guests into the Centurion Lounge with you for a fee of $50 per person per location.

Cardmembers also get four one-time Sky Club guest passes upon account opening and each year upon account renewal. You can pay $50 per person per location to bring up to two guests or immediate family (spouse or domestic partner and children under 21 years of age) with you into the Sky Club.

nnual companion certificateAnother major benefit of the Delta Reserve Amex is the companion certificate cardmembers receive each year after their account anniversary. The companion certificate is valid for one round-trip ticket in first class, Premium Select, Delta Comfort+ & Main Cabin for a companion when you purchase one adult round-trip ticket.

ERIC ROSEN/THE POINTS GUY

It can be used for travel to all 50 U.S. states (including Hawaii and Alaska), Mexico, Central America and the Caribbean.

Depending on what you redeem your companion ticket for, you could use it to save hundreds or even thousands of dollars each year, especially if you fly first class.

Elite status qualification

Delta recently overhauled how its credit cards help cardmembers earn elite status with one metric: Medallion Qualification Dollars (MQD). Delta Reserve Amex cardholders earn 1 MQD for every $10 spent with no limit on how many MQDs can be earned through credit card spending.

They also receive an MQD boost of 2,500 MQDs each year.

Related: The ultimate guide to getting upgraded on Delta

Other perks

The Delta Reserve Amex extends several other great travel-related perks, including complimentary Hertz President’s Circle status, an annual up to $240 Resy credit ($20 monthly), an annual up to $120 ride-hailing credit ($10 annually), an up to $200 annual Delta Stays credit, a first checked bag free for you and up to eight companions, Main Cabin 1 priority boarding, 15% off award redemptions for Delta flights, 20% back as a statement credit on inflight purchases, up to $100 statement credit for Global Entry every 4 years or up to $85 for TSA PreCheck every 4.5 years, and no foreign transaction fees (see rates and fees).

The Delta Reserve also includes extensive shopping protections and travel coverage when you use your card for certain purchases.

Earning miles on the Delta Reserve Amex

As you might assume from its name, the Delta Reserve Amex earns Delta SkyMiles as follows when you make eligible purchases with the card:

3 miles per dollar on eligible purchases made directly with Delta1 mile per dollar on all other eligible purchases

MY AGENCY/SHUTTERSHOCK

But even with 3 miles per dollar on airfare, you may not want to spend much on the Delta Reserve Amex after you’ve earned the welcome bonus because, based on TPG’s valuation of Delta miles at 1.2 cents each, you’ll get about a 3.6% return on Delta purchases and a 1.2% return on everything else.

You can do better, especially if you consider other American Express cards that earn Membership Rewards points that you can transfer to Delta.

Related: 4 reasons why the Amex Platinum might be the ideal credit card for Delta flyers

Redeeming miles on the Delta Reserve Amex

Delta’s dynamic pricing can make it frustrating to redeem Delta SkyMiles. The effects of variable pricing can be mild in some cases, like this month of round-trip flights between New York (JFK) and Chicago-O’Hare (ORD). Delta highlights the lowest economy class fare of 15,000 miles in this example, but many other dates have significantly higher pricing.

ZACH GRIFF/THE POINTS GUY

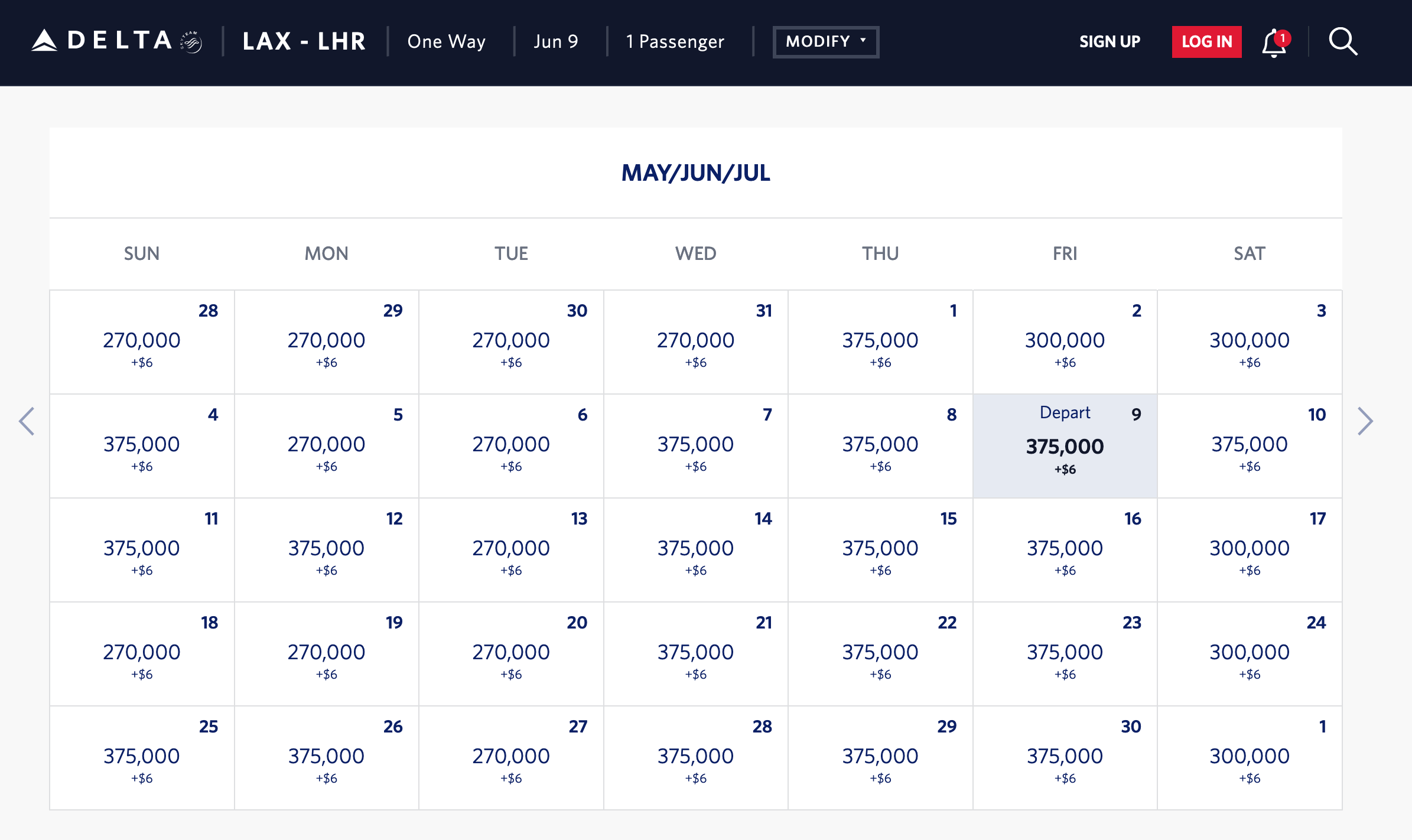

And when you start talking about premium-cabin awards, prices can skyrocket. When booking through other loyalty programs, You can do better than these one-way awards between LAX and London Heathrow (LHR).

DELTA.COM

If you have the flexibility to do so, you’d be better off saving your Delta miles for one of the carrier’s frequent flash award sales. In the past, we’ve seen deals for domestic awards from 2,000 SkyMiles each way and New York to Bogota, Colombia, in business class from 12,000 SkyMiles each way.

You can also use your SkyMiles to fly on international SkyTeam partner airlines such as Air France and Korean Air, as well as select non-alliance partners like Virgin Atlantic and WestJet.

You can redeem Delta SkyMiles for many things other than flights, too — including premium alcoholic beverages in Sky Clubs as well as hotels and rental cars. However, note that some redemption options provide relatively low value.

TPG’s Hannah Streck often uses her Delta SkyMiles to book award tickets and utilizes the 15% off Delta flights to stretch her stash of miles.

Related: 9 Delta SkyMiles sweet spots worth saving up for

Which cards compete with the Delta Reserve Amex?

Most Delta Reserve Amex cardmembers carry it for two reasons: Delta Sky Club access and an extra boost toward earning Delta elite status. When it comes to these perks, the Delta Reserve Amex has three primary competitors:

If you want stronger earnings rates: The Platinum Card® from American Express offers 5 Membership Rewards points per dollar on airfare (on up to $500,000 per calendar year) purchased through American Express Travel or directly with the airline (a 10% return based on TPG’s valuations) compared to the Delta Reserve Amex’s 3 miles per dollar spent on eligible Delta purchases (a 3.6% return). And you can still transfer Membership Rewards points to Delta SkyMiles at a 1:1 ratio. For more information, read our full review of the Amex Platinum.If you want a lower annual fee: Try the Delta SkyMiles® Platinum American Express Card, offering a first checked bag free and priority boarding. It also has a lower annual fee of $350 (see rates and fees), which may be easier to justify for some consumers. For more information, read our full review of the Delta Platinum Amex.If you’re eligible for a business card: You might prefer the Delta SkyMiles® Reserve Business American Express Card. It has a lot of similarities to the consumer version but with the option to (obviously) put your business expenses on the card and potentially rack up more miles. For more information, read our full review of the Delta Reserve Business Amex card.For additional options, check out our full list of the best travel cards.

Read more: Delta elite status match offered to targeted Amex cardholders

Is the Delta Reserve Amex worth it?

This card is best for Delta loyalists who want complimentary Delta Sky Club access and elitelike benefits when flying Delta or redeeming miles. If you fit that bill, this card could be worth it. However, to maximize your frequent flyer miles earnings, you’re better off with a card that earns transferable points, like the Amex Platinum.

Bottom line

If you don’t need a ton of Delta-specific perks, another card might be better for you. If you fly often, however, and if you’re a Delta loyalist, then the Reserve is a tough proposition to beat. Just ensure you can maximize the benefits enough to justify the hefty annual fee.

Apply here: Delta SkyMiles Reserve American Express Card

For rates and fees of the Delta Reserve Amex, click here. For rates and fees of the Amex Platinum, click here. For rates and fees of the Delta Platinum Amex, click here. For rates and fees of the Delta Reserve Business Amex, click here.

Title: Delta SkyMiles Reserve Amex card review: Delta’s top-tier credit card

Sourced From: thepointsguy.com/guide/delta-reserve-amex-credit-card-review/

Published Date: Fri, 02 Feb 2024 20:00:59 +0000

No comments:

Post a Comment