HOSTED BY: 1 AIR TRAVEL

Editor’s note: This is a recurring post, regularly updated with new information and offers.

Southwest Rapid Rewards Priority Credit Card overview

The Southwest Rapid Rewards Priority Credit Card is the most rewarding of Southwest Airlines’ personal credit cards, offering a $75 annual Southwest credit and 7,500 anniversary bonus points. With the most benefits of any of the airline’s offerings, this is the card to get if you’re a Southwest loyalist. Card Rating*: ⭐⭐⭐½

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

Southwest Airlines has a legion of fans — largely due to its flexible change/cancellation policies and offering two free checked bags for all passengers. Unlike other airlines, Southwest doesn’t offer lounges, premium cabins or even seating with extra legroom. But it does offer a full suite of cobranded credit cards to help frequent flyers fulfill their Southwest travel goals.

The Southwest Rapid Rewards Priority Credit Card has a recommended credit score of 670 or above and is the most premium personal credit card in the Southwest lineup.

But are its benefits valuable enough to warrant the $149 annual fee? And is now the right time for you to apply? Let’s find out.

Southwest Priority Card pros and cons

ProsCons$75 annual Southwest travel creditFour upgraded boardings every year7,500 points on each cardholder anniversary25% inflight discount on food, drinks and Wi-FiAbility to earn A-List status faster by spending on this cardTravel and purchase protections through Chase$149 annual feeLimited redemption opportunitiesSouthwest Priority Card welcome offer

The Southwest Rapid Rewards Priority Credit Card is currently offering a welcome bonus of a Companion Pass (good through Feb. 28, 2025) plus 30,000 points after you spend $4,000 on purchases in the first three months from account opening.

The Southwest Companion Pass is one of the most valuable benefits of the Rapid Rewards program. It allows you to bring a companion on your flight for free (plus applicable taxes and fees) on an unlimited number of Southwest Airlines flights for the duration of the pass. Typically, you’d need to earn 135,000 tier-qualifying points (by flying Southwest or spending on cobranded credit cards) or complete 100 qualifying flights within a calendar year to qualify for a Companion Pass.

THE POINTS GUY

But with this offer, you can get a Companion Pass good through Feb. 28, 2025, just by meeting the minimum spending requirement. The value you’ll get from this pass will depend on how much you’re able to use it, but you can get some serious value from it during this period. Plus, you’ll also get 30,000 bonus points, which TPG values at $420.

This matches the best offer we’ve seen on this card, so this is one to jump on if you’ve been considering getting the card.

Still, note that Southwest cards are subject to Chase’s 5/24 rule. If you’ve opened five or more credit cards in the past 24 months (from all banks, not just Chase), you may not be approved. Also, you can’t open a new personal Southwest card if you have one open or have earned a sign-up bonus in the past 24 months on any personal Southwest card.

Related: 13 lessons from 13 years’ worth of Southwest Companion Passes

Southwest Priority Card benefits

The Southwest Priority card offers the following benefits:

Anniversary bonus: Each year, on your card-opening anniversary, you’ll receive 7,500 Rapid Rewards points, worth $105, based on TPG’s valuations.Annual Southwest travel credit: During each cardmember year, you’ll receive a $75 travel credit that can be used on most Southwest purchases, including tickets (excluding upgraded boardings and inflight purchases), dropping the card’s effective cost to $74.

ZACH GRIFF/THE POINTS GUY25% inflight savings: Receive 25% back (as a statement credit) after you use your card to purchase inflight drinks, Wi-Fi, messaging and movies.Tier qualifying points boost: Earn 1,500 TQPs that count toward A-List and A-List Preferred status for each $5,000 you spend in a calendar year.

In addition to the Southwest-specific benefits, the card comes with lost luggage reimbursement, baggage delay insurance, extended warranty coverage and purchase protection.

The card has no foreign transaction fees, and the annual fee is $149.

Earning points with the Southwest Priority Card

Here’s what you’ll earn with the Southwest Priority card:

3 points per dollar on Southwest purchases2 points per dollar spent with Rapid Rewards hotel and car rental partners2 points per dollar on local transit and commuting, including ride-hailing apps2 points per dollar on internet, cable and phone services; select streaming1 point per dollar on all other purchases

ANCHIY/GETTY IMAGES

This is a wide variety of bonus categories compared to other airline credit cards, though top travel cards are typically even more lucrative.

Related: The best rewards credit cards for each bonus category

Redeeming points with the Southwest Priority Card

Redeeming points with the Southwest Rapid Rewards Priority Credit Card is very straightforward. Southwest award prices are directly tied to the cash value of the ticket, meaning the number of points you need for a flight will fluctuate, but you’ll rarely encounter times when you can’t use your points. Plus, you can redeposit your award without penalty if your plans change.

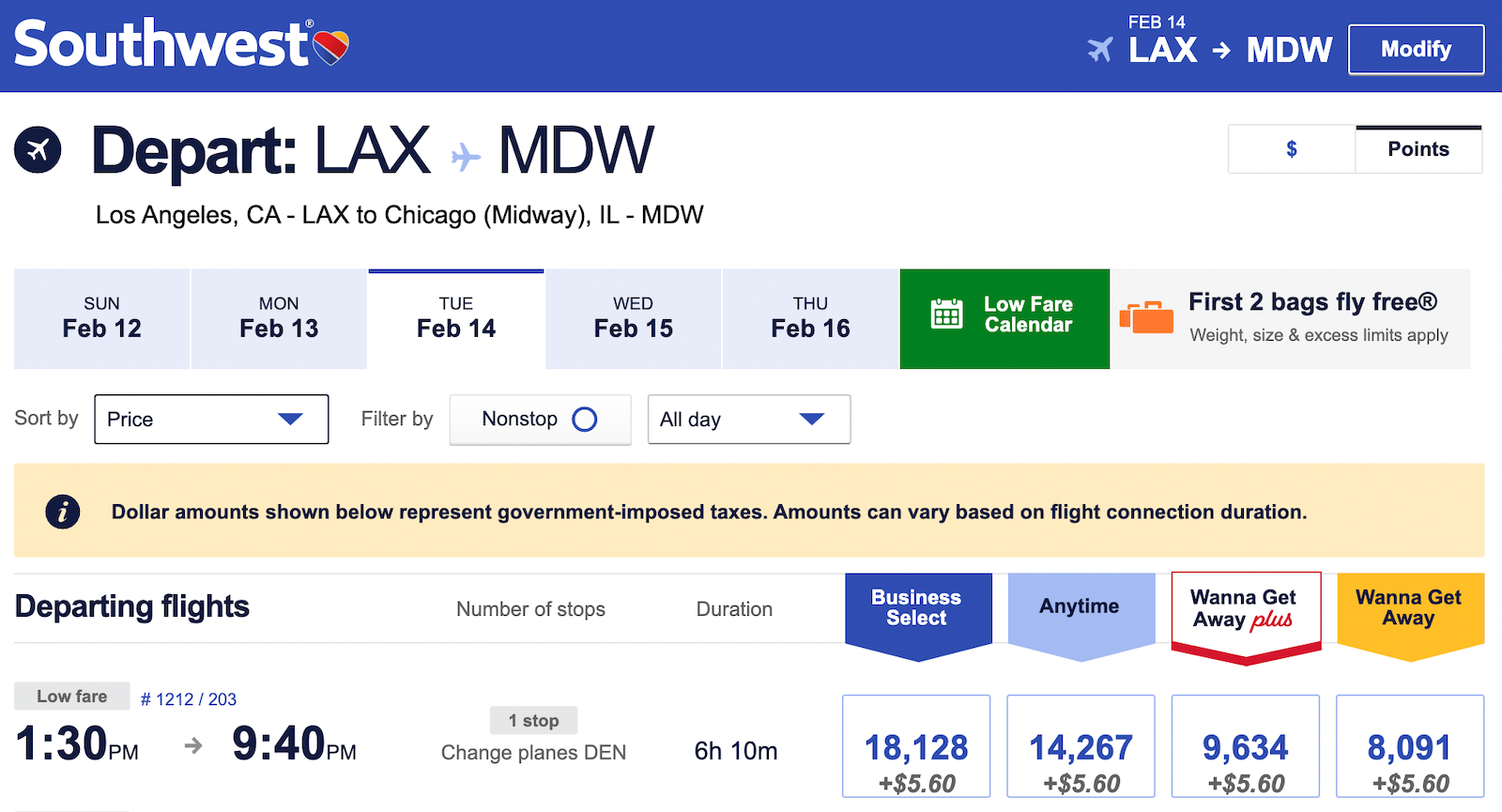

While Southwest’s Rapid Rewards points won’t help you fly in first-class suites, they can provide great value. For instance, you can fly from Los Angeles (LAX) to Chicago-Midway (MDW) for just 8,091 points one-way, depending on the time of year. Meanwhile, other airlines often charge 10,000 miles or even more (assuming you can find availability).

SOUTHWEST.COM

If you book during one of Southwest’s flash sales, you could score awards for less than 2,500 points one-way. You can even fly to fun faraway destinations like Hawaii, Costa Rica and Mexico with your Southwest points.

For instance, TPG credit cards writer Emily Thompson recently took advantage of one of these sales to book a round-trip ticket between Nashville (BNA) and San Jose, California (SJC) for under 25,000 points. If you’re flying to one of Southwest’s destinations, you can find a great deal on points.

Related: Why I choose Southwest every time

Which cards compete with the Southwest Priority Card?

Southwest Airlines offers three personal cards, so you can choose the one that fits you best.

If you want Southwest benefits with a more modest fee: The Southwest Rapid Rewards Premier Credit Card is the mid-tier card in the Southwest lineup, with a $99 annual fee. These include 6,000 anniversary bonus points, two EarlyBird Check-ins per year and 25% back on inflight purchases. For more details, read our full review of the Southwest Premier card.If you want a Southwest card with an even lower annual fee: The Southwest Rapid Rewards Plus Credit Card has a $69 annual fee and an anniversary bonus of 3,000 points. You’ll also receive two EarlyBird Check-ins every card anniversary. For more information, read our full review of the Southwest Plus card.If you want points you can use with Southwest and other airlines: The Chase Sapphire Preferred Card earns Chase Ultimate Rewards points, which you can transfer 1:1 to Southwest — as well as a wide range of airlines — for making flight redemptions. You’ll get numerous travel protections, a $50 annual hotel credit and robust earning categories, and the card has a $95 annual fee. For more information, read our full review of the Sapphire Preferred.For more options, check out our full list of travel credit cards.

Related: Comparing the Southwest Rapid Rewards Priority, Premier, and Plus Credit Cards

Is the Southwest Rapid Rewards Priority Card worth it?

If you fly Southwest at least a few times each year, you will come out ahead with the Southwest Priority Credit Card. The card’s everyday earning rates aren’t the most lucrative, but impressive built-in perks like upgraded boardings, a $75 annual travel credit and a 7,500-point anniversary bonus easily make up for it.

Bottom line

The Southwest Rapid Rewards Priority Credit Card is the most rewarding of Southwest Airlines’ personal credit cards, allowing you to earn a good stash of points and get the most benefits of any of the airline’s offerings. If you fly Southwest often, this is the card for you.

Apply here: Southwest Rapid Rewards Priority Credit Card

Title: Southwest Priority credit card review: Valuable perks for frequent Southwest travelers

Sourced From: thepointsguy.com/guide/southwest-priority-credit-card-review/

Published Date: Wed, 07 Feb 2024 14:30:38 +0000

No comments:

Post a Comment